Boeing Cuts Losses, CEO Calls It 'Turnaround Year'

In a notable shift for Boeing, the aerospace giant recently reported slashed losses, signaling a potential turning point as CEO Kelly Ortberg heralds 2025 as "our turnaround year." The announcement reflects a concerted effort by Ortberg and his team to navigate Boeing’s longstanding crises, culminating in improved performance metrics and heightened sales activity. Such developments are significant not only for the company but for the entire aerospace sector, which has been under immense pressure from both market dynamics and regulatory scrutiny arising from past safety failures.

Boeing's reported loss of $176 million in Q2 2025, a drastic reduction from the staggering $1.09 billion loss in the previous year, signals a pivotal recovery phase. Revenue surged by 35%, reaching $22.75 billion, and the all-important segment of airplane deliveries witnessed an upswing, with 150 airplanes handed over—the highest delivery count for a second quarter since 2018. Particularly, the commercial airplane unit saw an impressive 81% revenue increase year-over-year, highlighting a renewed demand for its jets amidst global air travel recovery. However, as Ortberg pointedly noted, achieving stability at the current production rate of 38 737 Max aircraft per month is crucial before any scale increases can be sought, underscoring the delicate balance between rapid expansion and regulatory compliance.

Yet despite these optimistic figures, it is critical to savor the cherry-picked data in the context of larger economic trends. While the rebound in airplane deliveries aligns with an overall recovery in global air travel, it also provokes questions about Boeing’s vulnerability to future crises, as seen with the $445 million charge linked to its settlement with the Justice Department over the 737 Max incidents. Could this reliance on a single aircraft line—a flagship product—expose Boeing to a potentially catastrophic revenue shock if regulatory hurdles or market shifts occur? Moreover, the recent vote down of a labor deal by employees in the defense unit indicates impending labor tensions that could further destabilize Boeing's operations.

In comparison to historical instances, such as the aftermath of the 2008 financial crisis or the dot-com bubble burst, Boeing’s struggles encapsulate more than just corporate mismanagement; they reflect how macroeconomic conditions can severely impact large industrial players. Fly-by-night companies collapsed during the dot-com boom due to speculative valuation; similarly, Boeing's future hinges on its ability to restore customer confidence, meet regulatory demands, and proactively manage labor relations. Labor disputes and the specter of further regulatory scrutiny can dampen any rebound. For stakeholders—investors keen on recovery, regulators focused on consumer safety, and analysts gauging future profitability—these elements must remain at the forefront in analyzing Boeing's trajectory.

In conclusion, while the recent performances indicate that Boeing can take significant strides towards recovery, it is essential to remain vigilant about the unpredictable winds of change in the aviation industry. What lessons from past crises should the company heed to ensure sustainable growth, rather than a fleeting resurgence? The path ahead involves navigating both operational improvements and external pressures, a balancing act that will require astute strategic oversight if Boeing wishes to truly redefine its narrative in the competitive aerospace landscape.

Read These Next

IMF Boosts 2025 Global Growth Forecast to 30 Percent

IMF raises 2025 global growth forecast to 3.0%, citing resilience in major economies, especially China, amid trade dynamics.

Navigating Stock Incentive Plans for Compliance and Engagement

The company has made pivotal changes to its stock incentive plan in light of compliance issues, seeking both to align employee interests with those of shareholders and to address potential morale concerns. These adjustments highlight the intricate balance between meeting regulatory standards and fostering an engaged workforce.

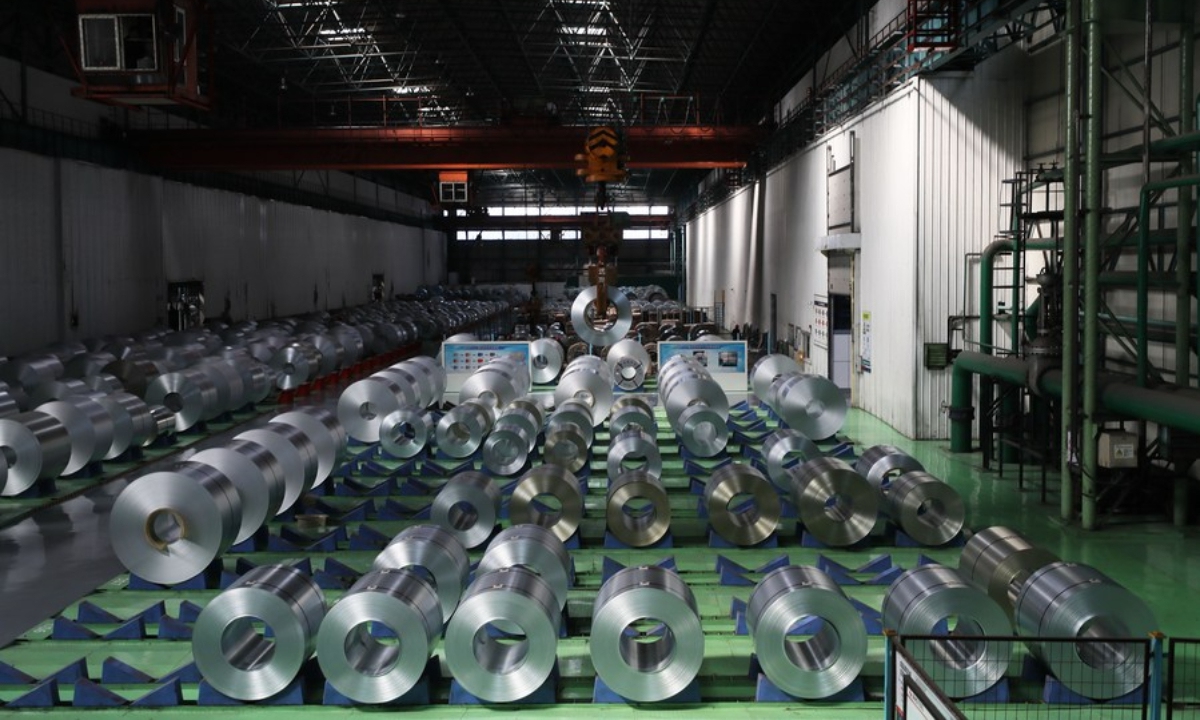

Chinese Expert Warns US EU Metals Alliance Could Disrupt Global Markets

A Chinese trade expert criticized US-EU plans for a metals alliance targeting China, warning it could disrupt global supply-demand balance.