IMF Boosts 2025 Global Growth Forecast to 30 Percent

The International Monetary Fund (IMF) has announced an increase in its global growth forecast for 2025 to 3.0 percent, attributing this optimistic revision to the unexpected resilience observed in major economies, notably China. This update highlights the ongoing adjustments in international relations, particularly in the context of trade dynamics.

In its recent World Economic Outlook update, the IMF confirmed a 0.2 percentage point increase from its previous forecast made in April, projecting a slight further increase in 2026 to 3.1 percent. This improvement underscores several positive trends influencing global economic activity.

The revision is underpinned by a series of favorable developments, including anticipatory economic activity aimed at mitigating the effects of anticipated higher trade tariffs, along with the relatively low average effective tariff rate in the United States. Additionally, enhanced financial conditions and fiscal expansion in key markets have contributed to this more promising outlook.

Although the United States experienced a contraction in real GDP during the first quarter, the IMF has adjusted its growth forecast upward to 1.9 percent for 2025, marking an increase of 0.1 percentage point. The euro area is also projected to see growth of 1.0 percent, aided by robust investment and net export performance.

China has registered the most significant upward revision, with growth expectations for 2025 now at 4.8 percent, representing a notable increase of 0.8 percentage point. The Chinese economy demonstrated remarkable performance, expanding at an annualized rate of 6.0 percent in the first quarter, benefiting from strong international demand despite a decline in exports to the United States.

As global economic indicators improve, headline inflation is expected to decline to 4.2 percent in 2025 and further to 3.6 percent in 2026. However, inflationary pressures show considerable disparity, with forecasts suggesting that inflation in the United States will remain above target levels, while other significant economies are likely to experience more muted price growth.

The IMF's chief economist, Pierre-Olivier Gourinchas, remarked on the better-than-expected resilience of the global economy but cautioned that persistent trade tensions continue to pose substantial challenges. He noted that while the effects of trade shocks might be less severe than initially feared, they still exert significant pressure on global economic conditions.

Given the current market volatility, the IMF has highlighted the urgent need to stabilize global trade policies. It calls for collective efforts to reduce uncertainty and to rebuild trust within the multilateral trading system to foster a more resilient economic environment.

Furthermore, the IMF report emphasized the necessity of maintaining central bank independence, which Gourinchas described as crucial for restoring price stability. He advocated that the capacity of central banks to make independent decisions free from political influences is vital for effective economic governance.

While the overall outlook has improved, the IMF cautioned that risks persist, particularly in the context of potential deepening of trade fragmentation and more enduring inflation. The organization's findings suggest that these factors could weigh on future economic performance, underscoring the need for vigilance in economic policy.

Read These Next

Navigating Stock Incentive Plans for Compliance and Engagement

The company has made pivotal changes to its stock incentive plan in light of compliance issues, seeking both to align employee interests with those of shareholders and to address potential morale concerns. These adjustments highlight the intricate balance between meeting regulatory standards and fostering an engaged workforce.

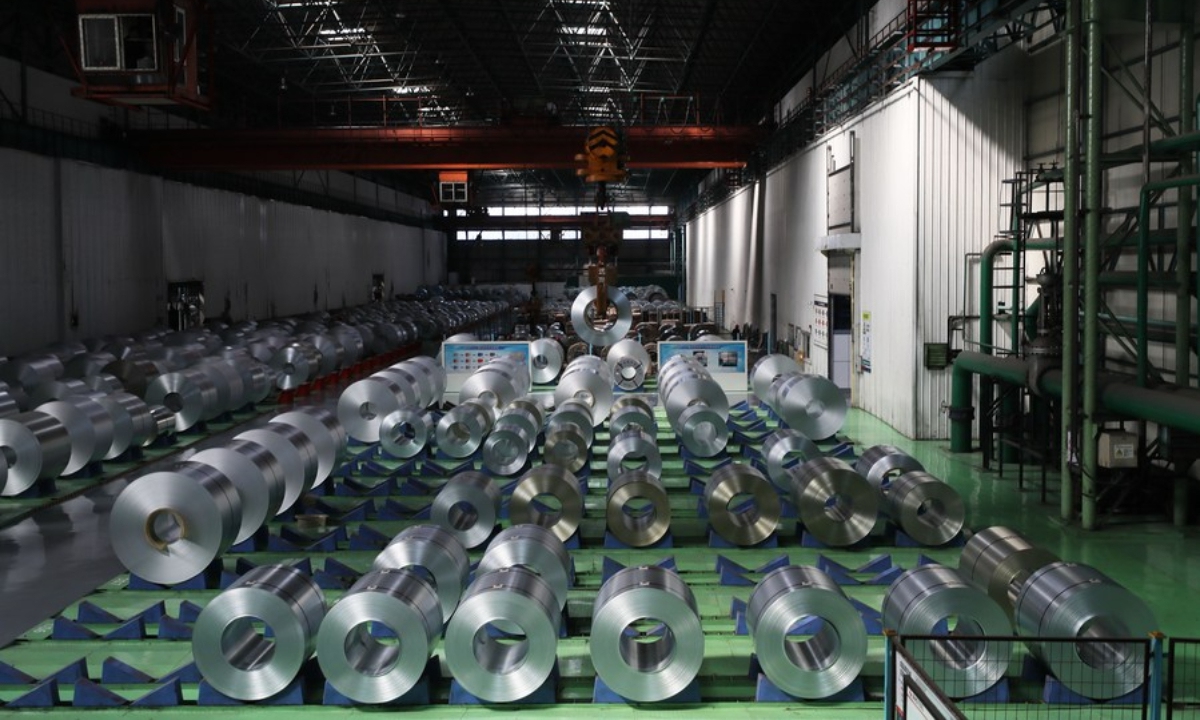

Chinese Expert Warns US EU Metals Alliance Could Disrupt Global Markets

A Chinese trade expert criticized US-EU plans for a metals alliance targeting China, warning it could disrupt global supply-demand balance.

Chuangyao Tech's Share Transfer: Market Sentiment & Risks

Chuangyao Technology announces a tentative share transfer price of 38.01 CNY, reflecting investor interest and corporate strategies amidst potential risks.