Navigating Stock Incentive Plans for Compliance and Engagement

In a significant move reflecting a blend of strategic foresight and compliance diligence, the company has made noteworthy adjustments to its 2025 restricted stock incentive plan. Reducing the number of eligible participants from 136 to 129 not only underscores the growing complexities of regulatory frameworks surrounding insider trading but also serves as a litmus test for corporate governance and employee engagement in an era of heightened scrutiny. Such adjustments invite a deeper examination of corporate strategies related to stock-based compensation amidst evolving market dynamics.

The board's recent approval of 3.24 million shares of restricted stock for the newly eligible participants, set at a valuation of 17.54 yuan per share, illustrates the company's commitment to aligning employee incentives with shareholder interests. Historically, incentive plans have garnered mixed results, often seen during pivotal periods such as the 2008 financial crisis when stock-based compensation faced criticism for promoting short-termism over sustainable growth. By providing a substantial number of shares, the company seeks to enhance shareholder value while simultaneously fostering a culture of accountability among key personnel. However, will this strategy effectively curb the potential pitfalls associated with previously disqualified participants and their consequent morale issues?

Despite the positive outlook, the cancellation of 11,829 stock options from the 2020 incentive plan underscores underlying compliance challenges and potential risks impacting employee retention and engagement. Such cancellations, particularly due to compliance breaches, reveal a critical tension faced by the company—a challenge to maintain strict adherence to regulatory practices while cultivating a motivated workforce. As the corporate landscape evolves, will the drive for compliance overshadow the necessary agility to adjust to employee sentiments fostered by incentive structures? The risk of diminished morale among employees who might feel unjustly penalized could prove detrimental to overall productivity.

Looking ahead, it is vital for the company to proactively address these compliance challenges while simultaneously reinforcing employee confidence through transparent communication about changes in incentive structures. With a robust mechanism to monitor insider trading and clear pathways for understanding the rationale behind adjustments, the company can mitigate risks associated with employee disenfranchisement. Engaging multiple stakeholders—namely investors, regulators, and employees—will be central to navigating this landscape. Ultimately, the success of these incentive plans will hinge not only on their design but on their perceived fairness and the company’s ability to adapt to an increasingly complex regulatory environment.

Read These Next

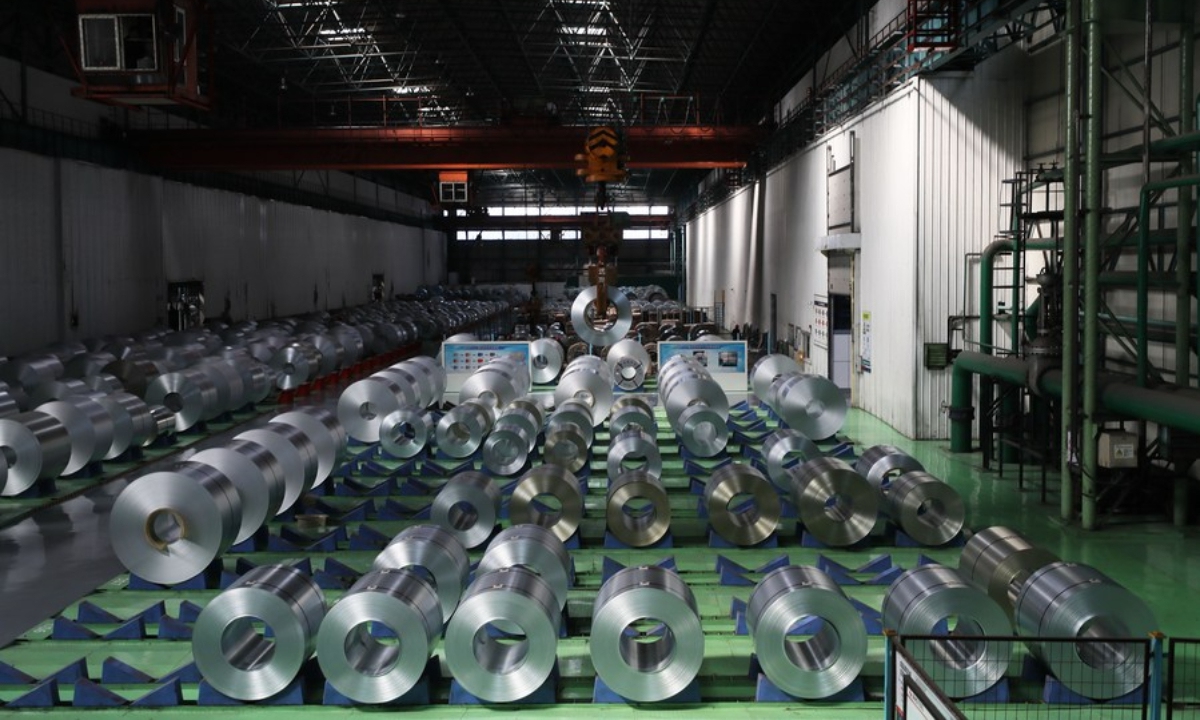

Chinese Expert Warns US EU Metals Alliance Could Disrupt Global Markets

A Chinese trade expert criticized US-EU plans for a metals alliance targeting China, warning it could disrupt global supply-demand balance.

Chuangyao Tech's Share Transfer: Market Sentiment & Risks

Chuangyao Technology announces a tentative share transfer price of 38.01 CNY, reflecting investor interest and corporate strategies amidst potential risks.

Huaxi Cattle Market Share Surpasses 20% in China

Huaxi cattle now hold over 20% of China's beef market, highlighting 40 years of breeding and boosting local agriculture.