Zhejiang Sanhua Intelligent Control Co., Ltd.: Preparing for H Share Issuance on the Hong Kong Stock Exchange

Overview: Zhejiang Sanhua Intelligent Control Co., Ltd., a leading provider of intelligent control solutions and components, is currently pursuing an exciting opportunity by issuing H shares for listing on the Hong Kong Stock Exchange. This move aims to enhance its visibility and accessibility to international investors, further solidifying its market position. The report outlines key milestones in the share issuance process, including regulatory approvals and proposed timelines.

Key Financials: The company plans to issue a total of 360,330,000 H shares, with an initial pricing range set between HKD 21.21 and HKD 22.53. The allocation includes 25,223,100 shares earmarked for public sale in Hong Kong, while the majority of 335,106,900 shares will be offered internationally. This strategic move is anticipated to bolster the company’s financial position and assist in funding its growth initiatives.

Management Commentary: Management has expressed a positive outlook on the upcoming share issuance, highlighting the critical nature of expanding the company’s capital base to support its growth trajectory. The confirmation from the China Securities Regulatory Commission (CSRC) regarding the overseas issuance signifies a vote of confidence in the company's strategy and operational robustness.

Trends and Drivers: The driving force behind this issuance is the increasing demand for advanced intelligent control technologies across various industries. Moreover, the application for the listing aligns with broader macroeconomic trends favoring overseas market expansion for Chinese enterprises. The positive feedback from regulatory bodies indicates a conducive environment for such initiatives.

Risks and Outlook: While the issuance presents substantial opportunities, it is accompanied by inherent risks tied to market conditions and investor sentiment. The demand for shares may fluctuate, impacting the final pricing and overall take-up. Additionally, regulatory compliance is critical, with potential discrepancies between documents prepared in Hong Kong versus China necessitating careful navigation. Investors should monitor market responses closely, as share adjustment provisions could lead to volatility.

Conclusion: Zhejiang Sanhua Intelligent Control Co., Ltd. is strategically positioning itself for an international presence through its H share issuance in Hong Kong. With regulatory backing and positive management sentiment, the company is poised for enhanced growth, albeit with vigilance required regarding market dynamics and compliance considerations.

Read These Next

Paramount to cut 3% of U.S. workforce amid deeper cost-cutting measures

Paramount Global announces a 3.5% layoff of U.S. employees amid challenges in the traditional media landscape, as the company seeks to adapt to shifting consumer preferences and macroeconomic pressures, paralleling similar moves by competitors like Disney and Warner Bros. Discovery.

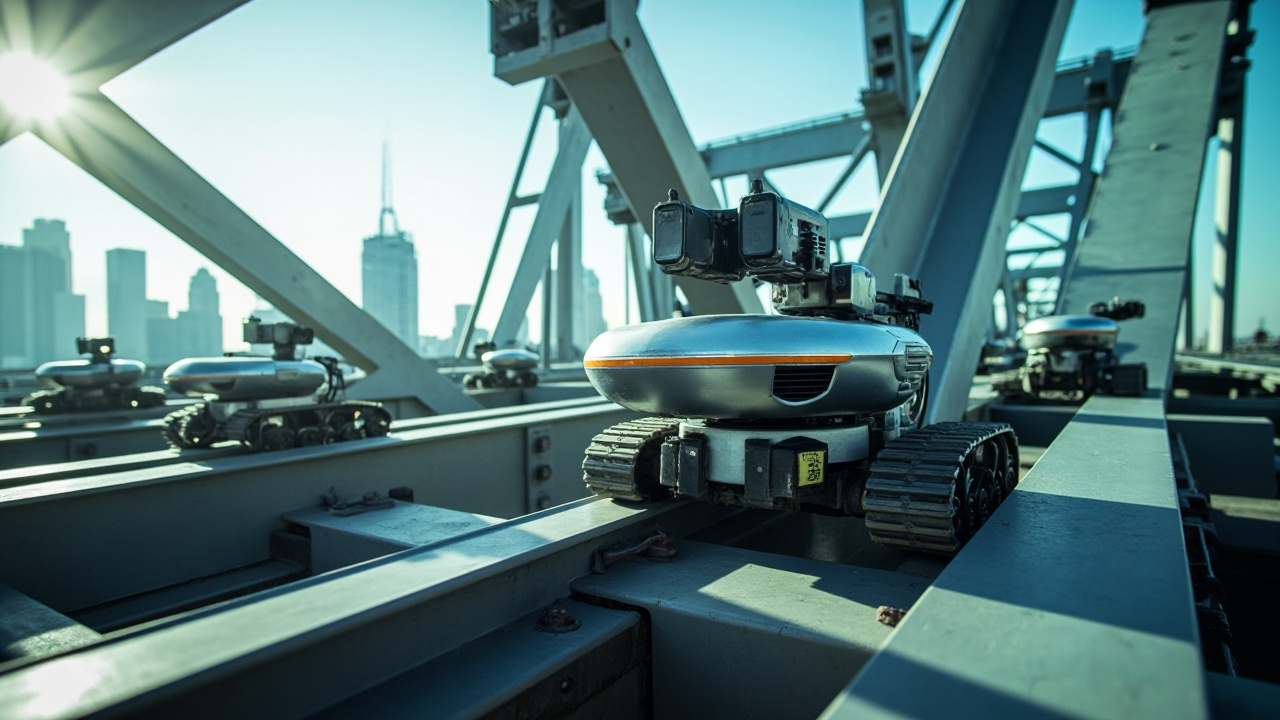

Gecko Robotics raises $125M, valuing infrastructure startup over $1B.

Gecko Robotics raises $125 million in a funding round, valuing the AI-driven infrastructure startup at $1.25 billion, marking significant investor interest in automation and AI solutions for critical infrastructure.

First Intelligent Robot 4S Store to Open in Beijing E-Town This August

In August, Beijing will open the first 4S store for intelligent robots, revolutionizing robotics with sales, service, and parts.