Paramount to cut 3% of U.S. workforce amid deeper cost-cutting measures

Paramount Global’s recent decision to implement a 3.5% reduction in its U.S. workforce marks a pivotal moment in the ongoing evolution of the media landscape. This strategic move, communicated through an internal memo from its leadership, underscores the pressing challenges that major corporations like Paramount face as the traditional pay-TV model continues to falter, exacerbated by broader macroeconomic challenges. Investors must discern whether these cost-cutting measures will genuinely lead to enhanced profitability or are merely a reactionary step in a tempestuous market.

This workforce reduction is not occurring in isolation; rather, it is part of a broader trend within the media industry. Paramount is not the only player making drastic personnel changes. Following similar trajectories, companies like Disney and Warner Bros. Discovery have also reported significant layoffs, reflecting a systematic realignment as corporations pivot towards streaming and on-demand content consumption. The decline of linear television and the associated erosion of the traditional revenue models are critically reshaping corporate strategies across the sector. How effectively these corporations can transform their business models amidst these disruptions will ultimately define their futures. Paramount's past measures, including a previous 15% workforce reduction last year, signal a concerted effort to streamline operations; however, with these significant cuts come questions of sustainability and operational efficiency against an increasingly competitive backdrop.

As Paramount pursues its merger with Skydance Media, its strategy will require scrutiny not just for its immediate financial implications, but also in light of potential regulatory hurdles. The battle over the merger illustrates the intricate dance between corporate growth aspirations and the realities of regulatory oversight. What could be the unintended consequences of these layoffs? If not managed carefully, these reductions may lead to a talent drain that could hinder creative output at a time when unique content is more crucial than ever. Ultimately, stakeholders—including investors, employees, and consumers—will be keenly aware of how these shifts impact the content quality, brand loyalty, and financial health of the organization. If Paramount can successfully navigate these waters and emerge with a revitalized strategy, it could unlock opportunities that directly impact EBITDA margins and longer-term growth.

Read These Next

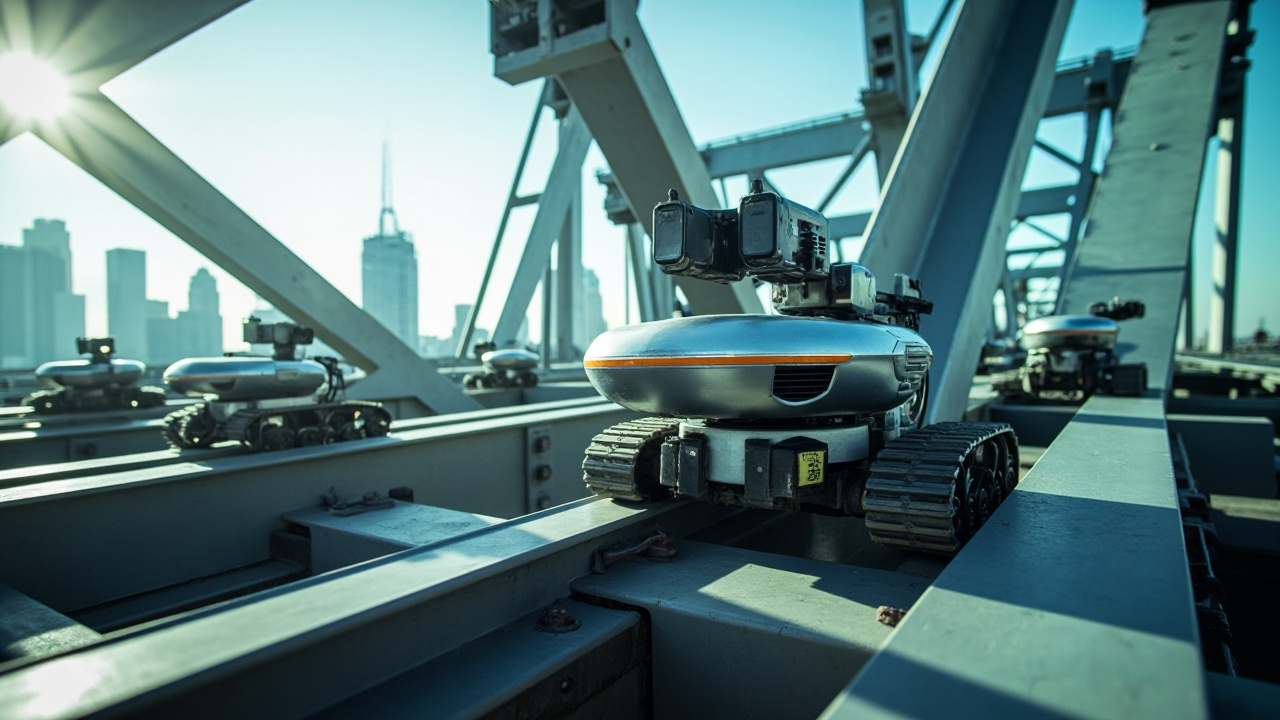

Gecko Robotics raises $125M, valuing infrastructure startup over $1B.

Gecko Robotics raises $125 million in a funding round, valuing the AI-driven infrastructure startup at $1.25 billion, marking significant investor interest in automation and AI solutions for critical infrastructure.

First Intelligent Robot 4S Store to Open in Beijing E-Town This August

In August, Beijing will open the first 4S store for intelligent robots, revolutionizing robotics with sales, service, and parts.

Beiji Tech & Stardom Era Forge Strategic Humanoid Robot Partnership

Beiji Technology and Star Era have partnered to enhance humanoid robots in logistics, boosting efficiency and customer experience.