TBEA's Strategy: Balancing Growth and Governance Risks

In the dynamic landscape of global finance, TBEA Co., Ltd. recently accomplished significant milestones during its first extraordinary general meeting on February 6, 2026, in Xinjiang. The approval of guarantees for its subsidiary TBEA Energy India and the ambitious issuance of corporate bonds totaling 5 billion Yuan are indicative of the company's proactive growth strategy amidst today's economic volatility. Shareholder engagement was robust, with 10,898 participants (approximately 25.1% of voting shares), reflecting a strong confidence in the board's vision. However, while these developments mark potential for enhanced capital flow and operational expansion, they equally raise questions around inherent risks that warrant a closer examination.

The approval of the guarantee for TBEA Energy India with 98.95% shareholder backing underscores a significant vote of confidence in the subsidiary's capacity to generate returns. The corporate bond issuance, receiving a remarkable 99.50% approval, signals the shareholders’ optimism regarding leveraging debt for strategic investment opportunities. This alignment with shareholder interests indicates not only financial support but also a collective belief in the anticipated operational efficiency and profitability of TBEA Energy India. However, the crucial point to consider is whether these approvals are merely a reflection of current optimistic market sentiments or an essential strategy in anticipation of future challenges. After all, corporate bonds, while vital for capital enhancement, impose a fiduciary responsibility to deliver on promised returns, which requires astute operational management.

The lack of special resolutions raises a potential red flag for TBEA’s corporate governance apparatus. While the overwhelming support indicates strong shareholder trust, the absence of more aggressive, forward-looking proposals might suggest a cautious approach by the board—potentially foreshadowing hesitancy in capital deployment amidst uncertain global market conditions. The company's strong dependence on TBEA Energy India, coupled with its obligation to guarantee its performance, encapsulates a profound risk. If the subsidiary falters, it could place significant pressure on TBEA's balance sheet, potentially undermining investor confidence. In light of historical precedents such as the 2008 financial crisis, where over-reliance on subsidiaries led several companies to the brink, one must contemplate whether the board's strategies are sufficiently robust to mitigate such risks.

In conclusion, TBEA Co., Ltd. has taken commendable steps toward expanding its financial and operational horizon through shareholder engagement and strategic decisions. Nonetheless, it remains critical for the board to navigate these waters with caution, balancing ambition with prudent oversight. As the company positions itself amidst an evolving economic backdrop, stakeholders must remain vigilant, ensuring that growth strategies do not compromise the financial stability that could quickly be eroded during downturns. The future of TBEA relies not only on thriving subsidiaries but also on robust governance that evaluates both opportunities and the precarious nature of financial dependencies.

Read These Next

Chengdu Qinchuan's Leadership Changes: Opportunities and Risks

The commentary analyzes the recent corporate governance changes at Chengdu Qinchuan Internet of Things Technology Co., highlighting the potential strategic shifts and associated risks involved. It examines the broader implications of leadership transitions in the context of the IoT sector, compliance with regulatory expectations, and historical precedents in corporate leadership changes.

Senate's Push for Cryptocurrency Legislation: A Critical Moment

This commentary analyzes significant developments regarding cryptocurrency legislation in the U.S. Senate, discussing the bipartisan efforts led by John Boozman and the potential implications for the digital asset market.

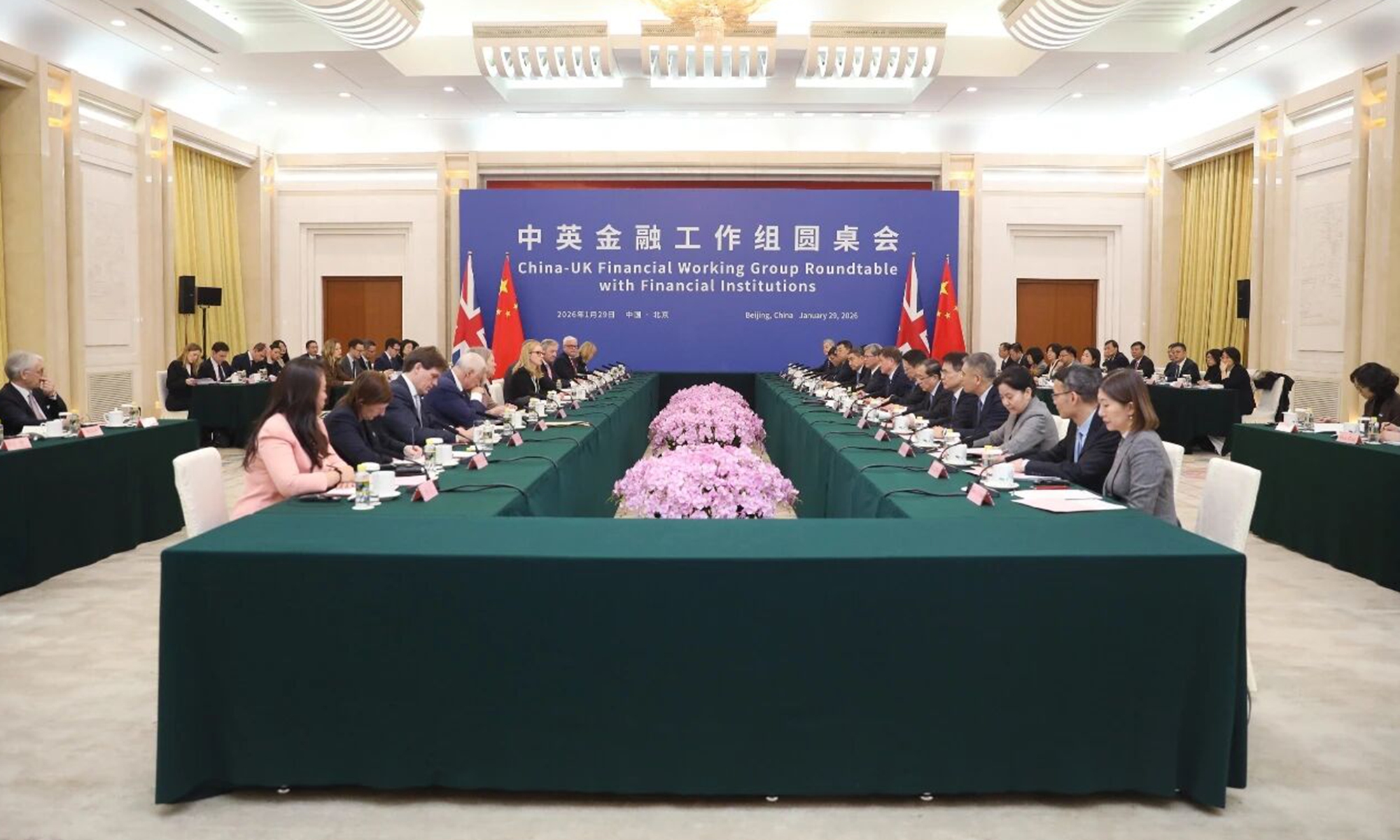

China UK Financial Working Group Inaugural Meeting in Beijing

The China-UK Financial Working Group meeting focused on cooperation, financial stability, and market development between the two nations.