Senate's Push for Cryptocurrency Legislation: A Critical Moment

The recent developments in the U.S. Senate concerning cryptocurrency legislation mark a pivotal moment for the future of digital assets and their inherent market structures. As articulated by Senate Agriculture Committee Chairman John Boozman, the anticipated bipartisan agreement on a regulatory framework could occur as early as this year. This signals a growing recognition among lawmakers of the need for a coherent regulatory environment, particularly as cryptocurrency continues to gain traction among both institutional and individual investors. Such legislation aims to bring clarity and security to an industry that has often been characterized by uncertainty and volatility.

The proposed legislation revolves around enhancing the regulatory authority of the Commodity Futures Trading Commission (CFTC) over cryptocurrency markets. This move is significant as it aligns with broader economic trends reflecting an increasing demand for regulatory oversight, especially in light of past market upheavals reminiscent of the dot-com bubble and the 2008 financial crisis. The last decade saw cryptocurrencies soar in popularity, yet the lack of regulatory clarity has often left investors vulnerable to significant risks. The recent bipartisan efforts to establish a well-structured regulatory environment, including robust consumer protections, may help stabilize a market that has experienced both significant peaks and disheartening troughs.

However, challenges persist, particularly regarding the contentious debate surrounding stablecoin rewards. Banks have raised concerns that allowing these rewards could unintentionally parallel banned interest payments, thus complicating compliance efforts. As stakeholders engage in negotiations, the potential for unintended consequences looms large: whereas efforts to regulate could protect consumers, they may also stifle innovation within the cryptocurrency sector. This is particularly concerning within a fast-evolving landscape where agility and adaptability are crucial for survival. The Senate's approach may necessitate balancing the interests of diverse stakeholders—including regulators, investors, and cryptocurrency firms—to foster a competitive yet safe market environment.

Critically, the urgency of striking a deal cannot be overstated, especially as the market continues to evolve at a breakneck pace. For institutional investors, clarity around these regulations is key to their participation and could influence investment strategies significantly. A well-defined regulatory framework could not only enhance investor confidence but also catalyze a greater influx of institutional capital into the cryptocurrency space. Yet, the question remains: will the legislation achieve a delicate balance between safeguarding consumers and fostering a conducive environment for innovation? As the Senate embarks on this legislative journey, the consequences of these decisions will likely resonate across various market dynamics, shaping the future trajectory of cryptocurrency as both a financial asset and a transformative technology.

Read These Next

Chengdu Qinchuan's Leadership Changes: Opportunities and Risks

The commentary analyzes the recent corporate governance changes at Chengdu Qinchuan Internet of Things Technology Co., highlighting the potential strategic shifts and associated risks involved. It examines the broader implications of leadership transitions in the context of the IoT sector, compliance with regulatory expectations, and historical precedents in corporate leadership changes.

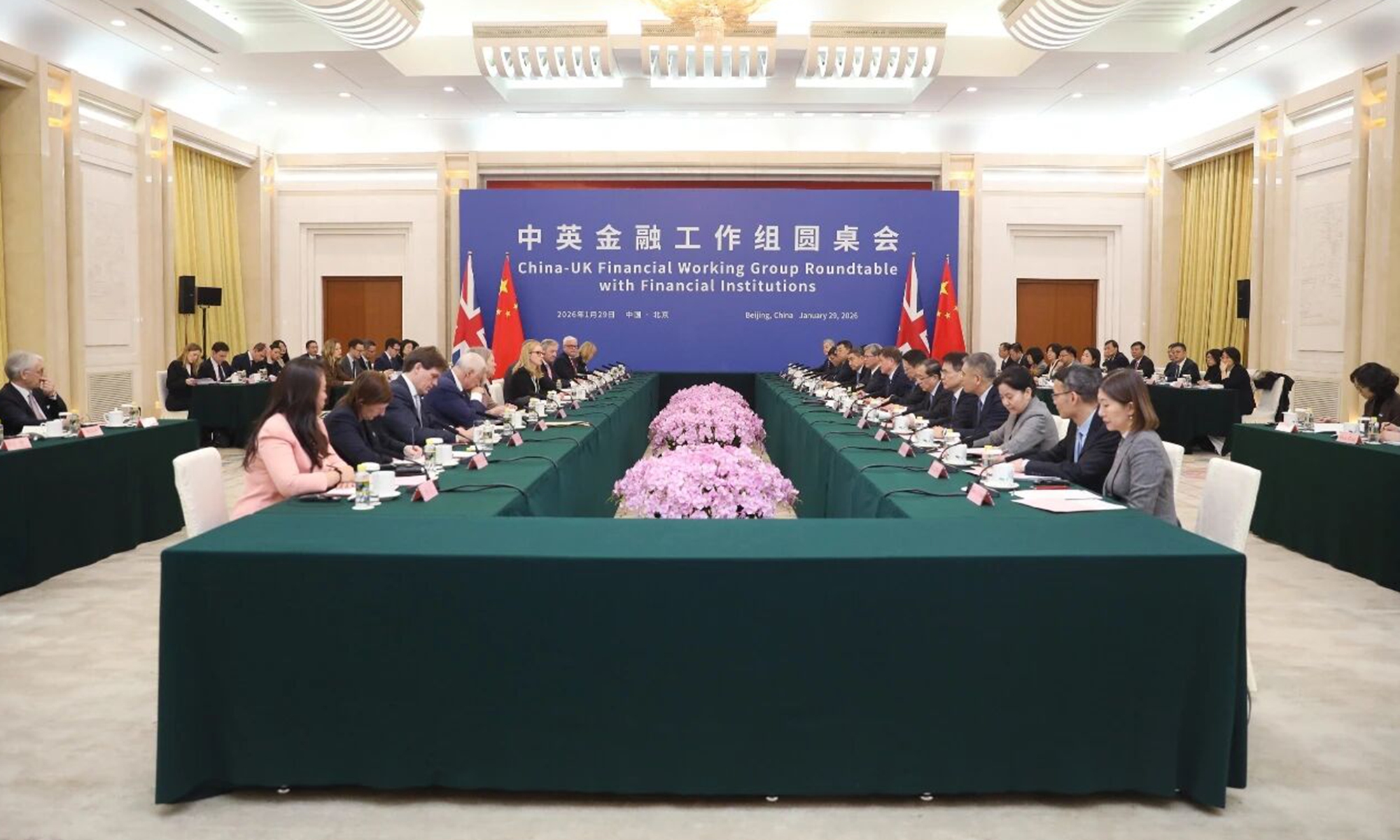

China UK Financial Working Group Inaugural Meeting in Beijing

The China-UK Financial Working Group meeting focused on cooperation, financial stability, and market development between the two nations.

H Silicon Subsidiary to Sign 3.045 Billion Yuan Polysilicon Deal

Hui Silicon Industry plans to sign a procurement agreement for electronic-grade polysilicon, boosting its semiconductor sector.