Chengdu Qinchuan's Leadership Changes: Opportunities and Risks

The recent annual report of Chengdu Qinchuan Internet of Things Technology Co., Ltd. marks a pivotal juncture for the company as it undergoes significant restructuring within its governance framework. The election of a new board on February 6, 2026, not only represents a shift in leadership but also underscores a possible transformation in the company’s strategic direction. Given that the Internet of Things (IoT) sector is becoming increasingly competitive and demanding, these changes could be critical for the company’s future growth trajectory and operational efficiency.

The election of seven directors, including four independent directors, is indicative of a strategic move toward strengthening corporate governance. This dual emphasis on independence and inclusivity—by including a director representing employees—suggests that the company is mindful of stakeholder interests. How might these changes impact the firm's EBITDA margins as they pursue new strategies and innovations? A more diverse board may lead to more comprehensive decision-making and risk assessment in alignment with current economic trends, which is essential as companies navigate the complexities of a post-pandemic recovery.

Despite the optimistic rhetoric surrounding the elections and management appointments, one must ponder the potential risks posed by such upheavals. Historically, similar transitions—like those witnessed during the 2008 financial crisis—can lead to uncertain trajectories for corporate performance. The inherent risk of leadership changes, particularly involving the abrupt departure of key individuals such as the former deputy general manager, reflects a reality that investors and stakeholders cannot overlook. The success of this new governance framework rests on the ability of the leadership to maintain strategic continuity while also adapting to market demands with agility.

Furthermore, the report emphasizes the importance of ongoing compliance with regulatory requirements, a factor that cannot be understated given the scrutiny governments place on tech companies today. While the current board and management team meet the necessary qualifications, the shifting landscape of IoT regulations may present unforeseen compliance challenges. This involves adaptation not only in operational practices but also in ensuring transparent communication with shareholders and stakeholders alike, capitalizing on the aligned interests of management holding shares in the company.

In conclusion, Chengdu Qinchuan's proactive restructuring presents an opportunity for the company to solidify its position within the rapidly evolving IoT market. However, as it embarks on this fresh chapter, balancing robust governance with innovative strategy execution will be essential. Stakeholders must remain vigilant, monitoring how these leadership changes manifest in operational performance and ultimately, shareholder return. As we progress further into 2026, will the new leadership be a catalyst for renewed growth, or merely a transitional phase fraught with challenges?

Read These Next

Senate's Push for Cryptocurrency Legislation: A Critical Moment

This commentary analyzes significant developments regarding cryptocurrency legislation in the U.S. Senate, discussing the bipartisan efforts led by John Boozman and the potential implications for the digital asset market.

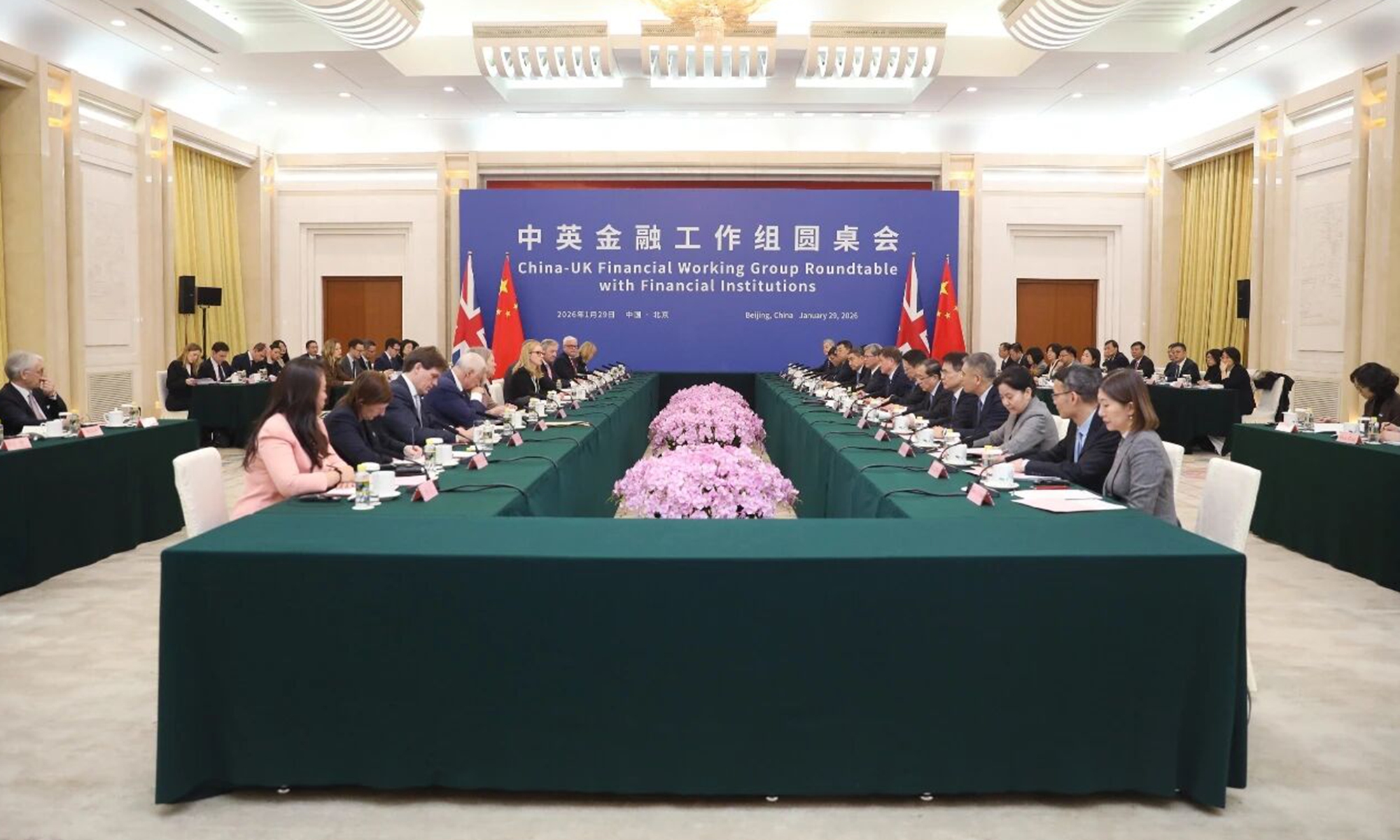

China UK Financial Working Group Inaugural Meeting in Beijing

The China-UK Financial Working Group meeting focused on cooperation, financial stability, and market development between the two nations.

H Silicon Subsidiary to Sign 3.045 Billion Yuan Polysilicon Deal

Hui Silicon Industry plans to sign a procurement agreement for electronic-grade polysilicon, boosting its semiconductor sector.