Fallout from Trump's Meme Coin Gala: Political Implications and Market Volatility

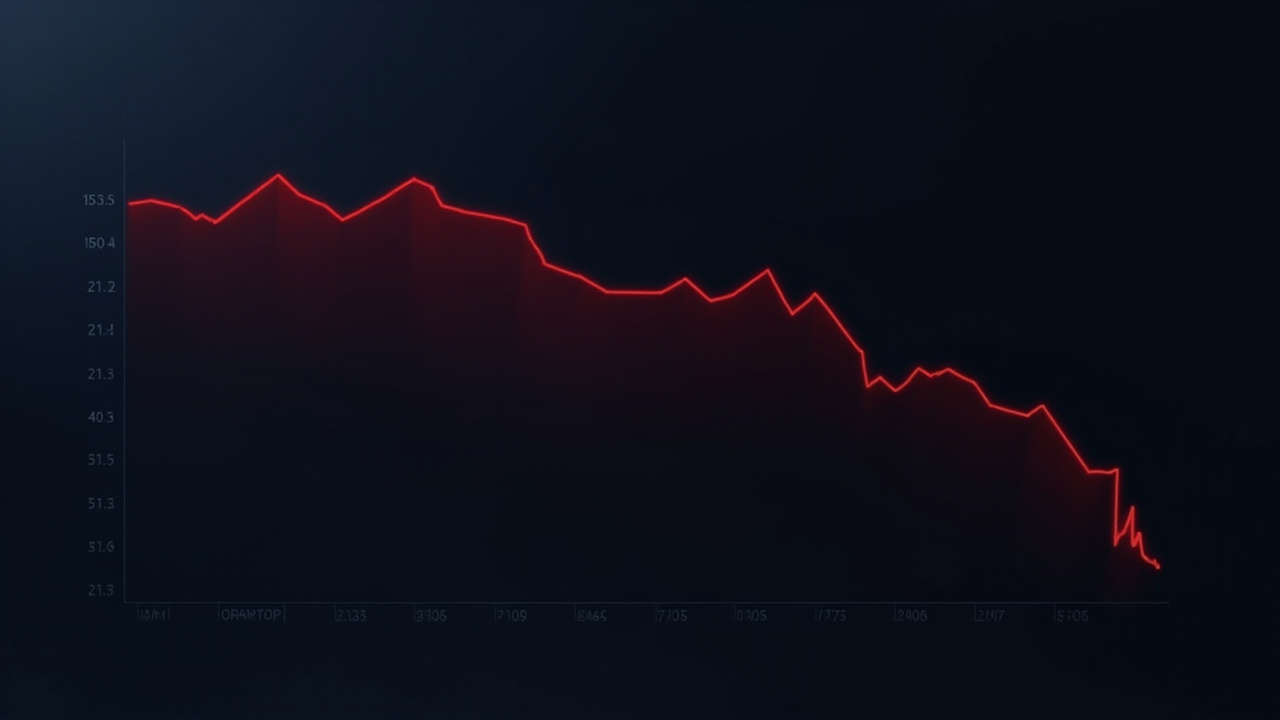

In a mixing pot of politics and financial speculation, the recent gala held by former President Donald Trump for the $TRUMP meme coin has ignited discussions on the frail nature of cryptocurrencies. The gala, attended by crypto elites and influencers, amassed a staggering $148 million in token purchases, only to see the coin’s value plummet by 16% shortly after. This juxtaposition between a high-profile event and the reflecting volatility underscores the precarious intersection of political engagement and the thriving yet tumultuous crypto market.

The aftermath of the dinner not only reveals the precariousness of meme coins but also highlights the implications for investor sentiment and regulatory scrutiny towards stablecoins. With crypto moguls like Justin Sun at the forefront, holding substantial stakes in the $TRUMP token while simultaneously facing SEC scrutiny, the entire episode raises legitimate questions about credibility and governance in the crypto landscape. Trump’s brief and somewhat lackluster appearance stood in stark contrast to the event’s extravagant billing as the "most exclusive invitation in the world," leading to disappointment among attendees. This sentiment likely ripples through the broader investor community, possibly engendering wariness in a market already sensitive to sentiment shifts in the wake of historic economic pressures.

The political implications are equally significant, as this event was a catalyst for renewed discussions on stablecoin legislation amidst bipartisan squabbles. The proposed GENIUS Act, aimed at regulating stablecoins, faces potential derailment not only from political distractions related to Trump’s ventures but also from controversial amendments that could alienate key stakeholders in the banking sector. The irony is palpable—while institutions like JPMorgan and Bank of America seem poised to issue a unified digital dollar, the opportunity could slip through their fingers should legislative clarity falter due to political infighting. Will Congress be able to disentangle itself from the implications of political figures profiting from cryptocurrency during their terms?

As we evaluate the potential trajectories for the crypto market in light of this gala and its aftermath, a critical assessment points to several risks and opportunities. The swift fall in the value of the $TRUMP token is not just indicative of speculative pressures but serves as a cautionary tale for potential investors. With headlines now linking political figures to crypto's speculative nature, the confidence of both retail and institutional investors could wane, further endangering an already volatile market. However, there exists a promising horizon—should stablecoin regulations take form and establish safeguards, it could pave the way for a more structured and trustworthy environment where digital assets can thrive. Economically, this could not only stabilize the crypto market but also integrate innovative financial products with traditional financial systems.

In conclusion, the post-dinner fallout from Trump’s $TRUMP coin gathering underscores a critical junction in the evolution of cryptocurrencies vis-à-vis political maneuvering. As regulatory bodies monitor these developments, investors should remain vigilant to the intertwining narratives of risk and regulation. Furthermore, the call for clarity in stablecoin legislation signals to various stakeholders that the momentum for change is building, despite the distractions. As we look forward, one must ask: can crypto learn from its tumultuous past, or are we witnessing the beginning of a new volatility fueled by political ambitions?

Read These Next

Navigating Changes in 华夏黄金主题证券投资基金 (LOF): Operational Updates and Investor Considerations

Analysis of the announcement regarding operational changes in 华夏黄金主题证券投资基金 (LOF) and its implications for investors.

China Accelerates High-Quality Development in National Development Zones

China's Ministry of Commerce launched a plan to enhance economic zones for high-quality growth and foreign investment, promoting green and digital economies.

Bitcoin dips below $107,000, down 1.7% on the day.

Bitcoin's price drop sparks discussions on regulatory policies in China's cryptocurrency market, affecting venture capital. Investors advised to stay alert.