Cramer on Nvidia's record market cap and AI impact

In a notable milestone for technology and finance, Nvidia has achieved a record market capitalization of $4 trillion. This remarkable feat not only cements Nvidia's position as the world’s most valuable company but also underscores the escalating role of artificial intelligence (AI) in reshaping industries. Jim Cramer’s reflections on this occasion provide an insightful lens through which to gauge Nvidia’s impact, representing both a significant investment opportunity and a critical component of the evolving tech landscape.

Nvidia's ascent is particularly striking when contextualized against historical precedents. The company's rapid growth parallels the dot-com bubble in the late 1990s and the housing bubble of the mid-2000s, both of which were driven by overzealous investor sentiment. However, unlike those eras, Nvidia operates in a fundamentally transformative sector. As the go-to provider for AI-related hardware, Nvidia is not merely riding a wave but effectively surfing the crest of an industrial revolution. The tech giant has amassed an impressive growth trajectory, having surpassed a $2 trillion market cap in February last year, and reaching $3 trillion mere months later. Its products are critical for leading companies engaged in the AI arms race, which suggests sustained demand and potential for long-term EPS growth rates.

However, the growing reliance on Nvidia’s technology introduces both opportunities and risks. On one hand, the company's GPUs have become irreplaceable for firms seeking to deploy AI models and drive efficiencies. Cramer’s assertion that any computer lacking an Nvidia GPU is "obsolete" is indicative of the technological dependency being crafted. Yet, as Nvidia continues to dominate, regulatory scrutiny and potential antitrust action could stifle growth or lead to increased competition, perhaps drawing parallels to the past struggles of tech giants during heightened scrutiny periods. Moreover, the geopolitical landscape complicates matters, given Nvidia's significance in US-China relations, which raises the stakes further. Is Nvidia merely a game-changing entity, or could it become a tactical pawn in broader economic conflicts?

As we look toward the future, Cramer’s advice to "own it, don’t trade it" conveys a critical insight for investors. The substantial leaps in technology underpinning AI allow us to envision a market where Nvidia not only continues to scale but must also grapple with some considerable obstacles. Over the long term, stakeholders including consumers, regulators, and investors must remain vigilant to the multifaceted dynamics at play. Unforeseen consequences, such as job displacement due to automation or volatility stemming from an increasingly competitive digital landscape, could reshape market perceptions fast. Thus, while Nvidia represents a beacon of opportunity, the broader economic consequences could be profound and necessitate both awareness and prudence from all stakeholders.

Read These Next

US to Levy 35 Percent Tariff on Canada Reports Say

US tariffs on imports from Canada raise concerns about retaliatory measures and calls for negotiations to avoid a trade war.

Malaysia Issues Positive Anti-Dumping Ruling on Chinese Sheets

Malaysia announced anti-dumping duties on galvanized sheets from China, S. Korea, and Vietnam, effective July 7, 2025.

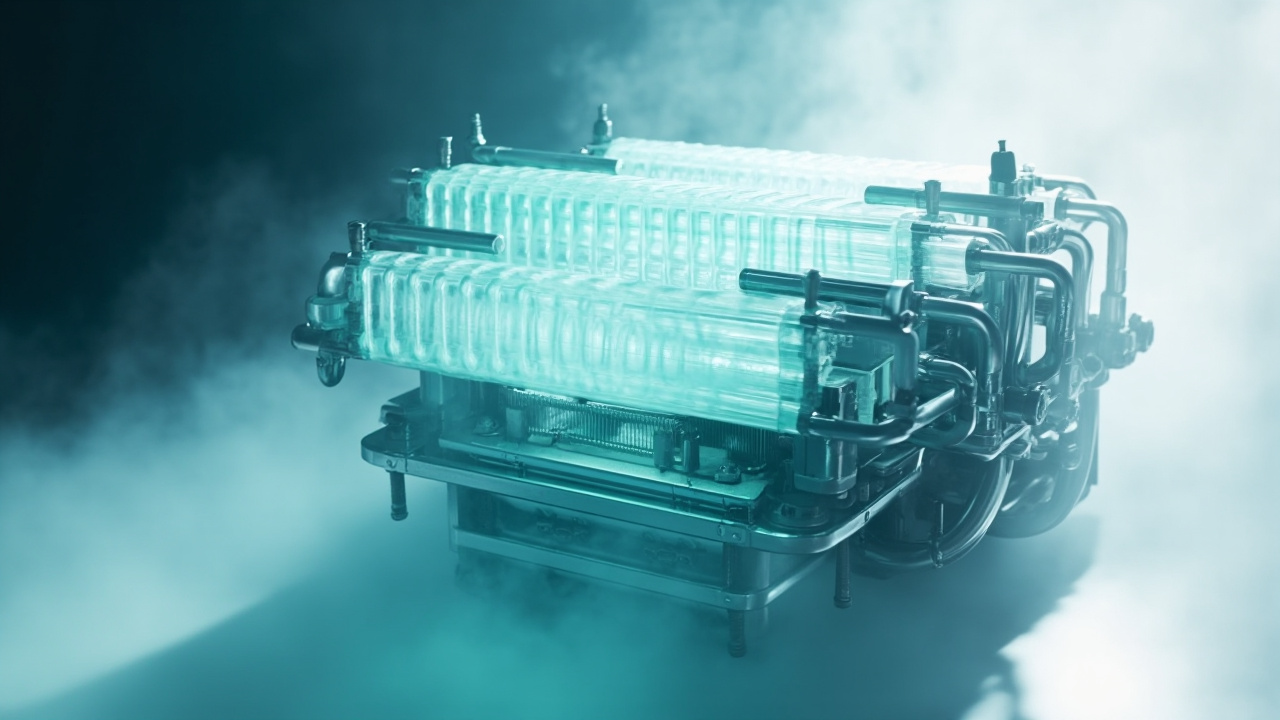

AWS develops cooling tech for Nvidia GPUs amid AI surge

Amazon Web Services has announced the development of new cooling equipment for Nvidia GPUs to support AI workloads, addressing the increasing demand for efficient data center technology amidst the AI boom.