Jin Feng Reduces Stake in Shangwei: Strategic Shift or Worry?

In a significant shift within the institutional investment landscape, Jin Feng Investment Holding Co. Ltd. has reduced its stake in Shangwei New Materials Technology Co., Ltd. to below 5%. This development comes at a time when investors are scrutinizing not only the performance trajectories of key players but also the overarching strategies that guide holding patterns in volatile markets. The ramifications of such a reduction are manifold, and they bear implications not only for the companies involved but also for shareholders and potential investors who are closely monitoring governance and financial health.

The equity cut reflects Jin Feng's changing investment strategies and perhaps expresses unspoken concerns regarding Shangwei’s future performance. As Jin Feng divested approximately 1.58 million shares, translating to a 0.39% drop in ownership, one cannot help but question: what underlying factors drive such decisions at a time when many sectors are braving headwinds from global macroeconomic trends? As we examine the backdrop of rising inflation rates and the tightening monetary policies enacted globally—where central banks are engaged in far-reaching quantitative tightening—investors must gauge how these factors resonate with a company's operational health. The reduction in holdings might indicate a more cautious stance alongside a fundamental reevaluation of the company’s prospects that could stem from potential headwinds in production or demand.

Moreover, the implications of this divestment could extend beyond mere percentage points in shareholding. Historically, similar strategic pivots have precipitated volatility in stock prices, raising alarms akin to those witnessed during the 2008 financial crisis and the dot-com bubble. In these episodes, large-scale sell-offs by major stakeholders often foreshadowed not only a lack of confidence from within but also inspired panic among retail investors. Here, Jin Feng Investment's decision to undergo a ‘centralized bidding process’ for the share divestment could either be seen as a prudent navigation of regulatory waters or as a signal of deeper uncertainties clouding Shangwei’s outlook. Furthermore, the need for regulatory compliance is paramount, and pending approvals from the Shanghai Stock Exchange only add layers of risk concerning potential delays in transaction finalization.

Looking ahead, the ramifications of Jin Feng Investment’s actions provide a fertile ground for reflection among various stakeholders. Investors may want to dissect the motives behind Jin Feng’s divestiture—are they merely consolidating their wealth or reacting to shifts in market dynamics? Furthermore, stakeholders need to remain vigilant for potential future reductions or increases in holdings, as the report vaguely suggests. The need for thorough due diligence cannot be overstated; it is imperative that investors assess not only the technical fundamentals of Shangwei but also the larger context of compliance and shareholder integrity that governs its upcoming decisions. Unintended consequences for the corporate governance structure might emerge if the market perceives this reduction as a loss of managerial confidence that could impact operational decision-making.

Read These Next

Quantum Computing: A New Tailwind for Real Estate

Analyzing the intersection of quantum computing and commercial real estate, highlighting investment trends, technology implications, and risks.

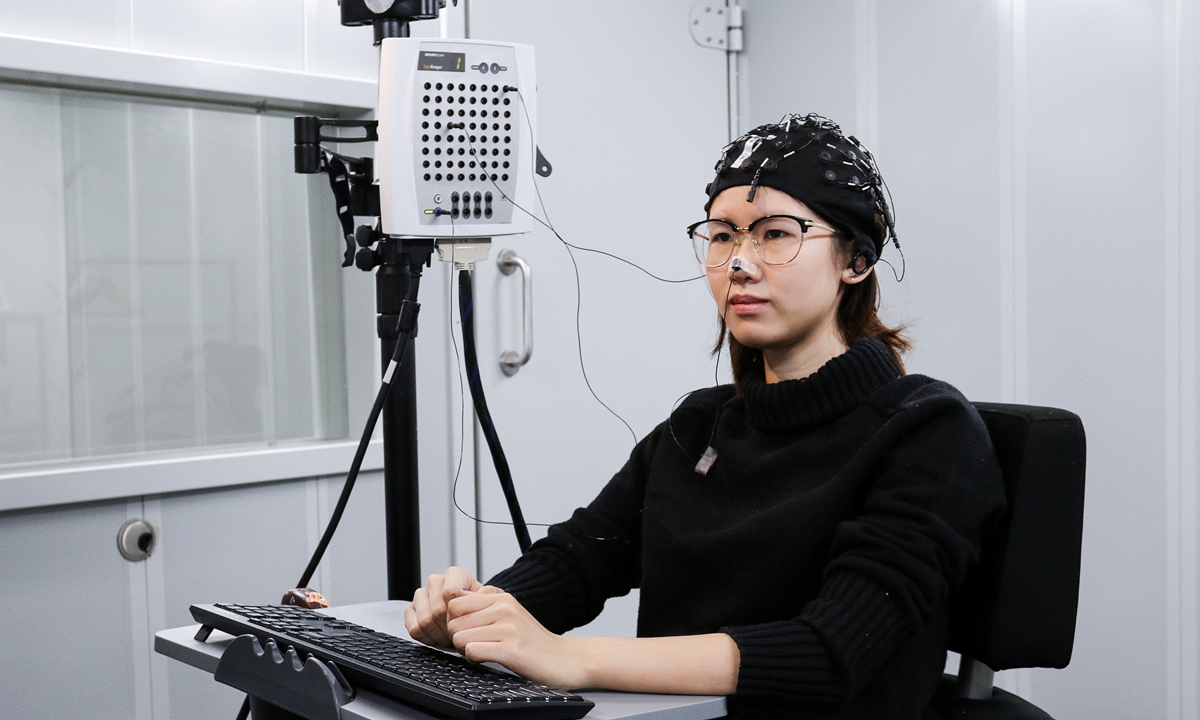

Chinese Researchers Boost Development of Brain Computer Technology

China's BCI tech advances with a semi-invasive system, promising breakthroughs for neurological impairments and industry impact.

Zuckerberg Announces META THREADS Reaches 400 Million Users

Meta's CEO Mark Zuckerberg announced THREADS has 400M monthly users, reflecting its growing influence amid TikTok's competition.