Quantum Computing: A New Tailwind for Real Estate

The integration of quantum computing into the commercial real estate market represents a significant evolution in technology and investment strategy. As artificial intelligence has transformed data centers into lucrative assets, quantum computing is poised to catalyze a similar revolution across various real estate sectors. Driven by advancements in quantum technology, the need for specialized infrastructure will grow, creating unique opportunities for investors and developers alike. This trend presents a compelling narrative that is set to attract substantial capital inflows, promising a paradigm shift in how real estate is perceived and valued.

According to a report from JLL, quantum computing is projected to undergo a rapid commercialization process within the next five years, with investments potentially skyrocketing from its current $750 million revenue base to a predicted $100 billion by 2035. As major players like Microsoft, IBM, and Google intensify their investments, the magnitude of transformation in commercial real estate becomes evident. The anticipated quantum advantage breakthroughs could mirror the momentum created by AI technologies, with projections suggesting an influx of $50 billion reminiscent of prior tech funding booms. Historically, the tech landscape has shown that the advent of groundbreaking technologies tends to create robust demand for specialized infrastructure. During the 2008 financial crisis, for instance, the rapid evolution of the internet transitioned commercial real estate valuations, as businesses began prioritizing modern office spaces equipped with advanced tech capabilities. Now, the question for investors is: can they leverage this emerging trend before it fully materializes?

There are, however, inherent risks and opportunities that must be scrutinized. On one hand, the coupling of quantum computing with existing data center infrastructures will be essential, as traditional facilities will not be rendered obsolete but will require adaptation to accommodate quantum needs. In contrast, the ongoing demand for quantum-specific real estate could inadvertently create hyperlocalized investment bubbles around leading research hubs, much like the dot-com bubble. While the majority of current quantum developments are situated near academic institutions, the potential for a decentralized distribution presents both risks and unparalleled opportunities for those willing to venture beyond traditional markets. Investors must remain vigilant of market fluctuations and technological evolution as they strategize their approaches.

Read These Next

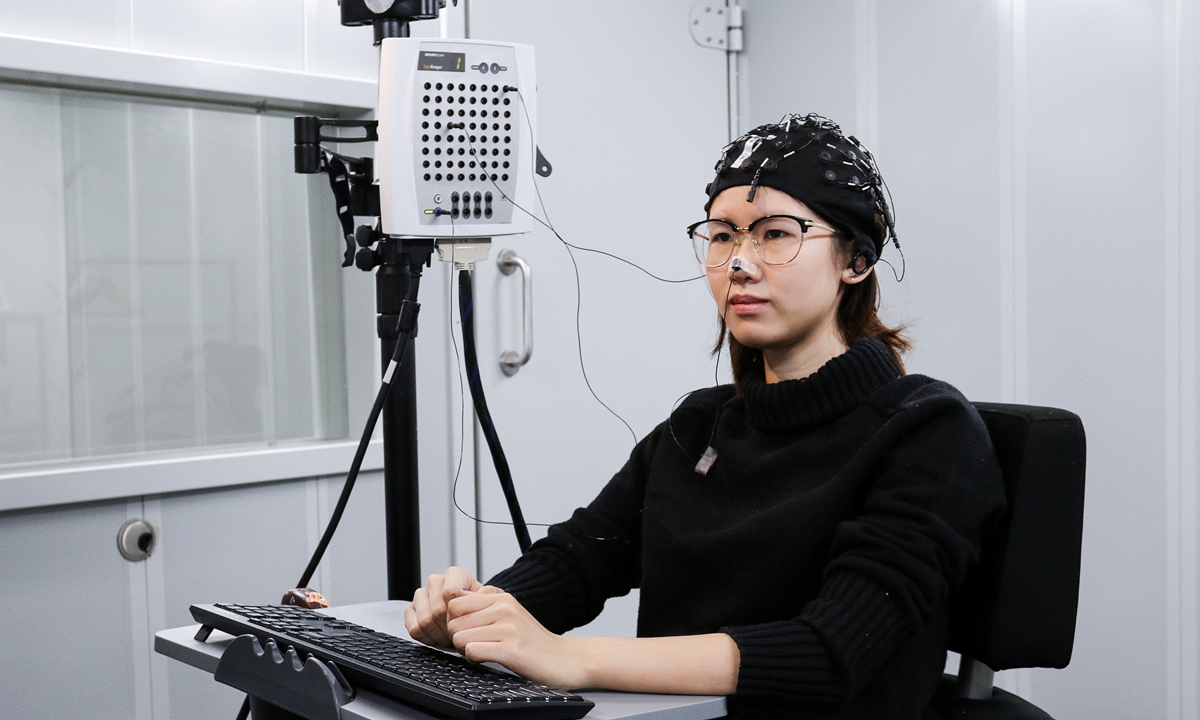

Chinese Researchers Boost Development of Brain Computer Technology

China's BCI tech advances with a semi-invasive system, promising breakthroughs for neurological impairments and industry impact.

Zuckerberg Announces META THREADS Reaches 400 Million Users

Meta's CEO Mark Zuckerberg announced THREADS has 400M monthly users, reflecting its growing influence amid TikTok's competition.

Implications of Terminating Bond Issuance in Corporate Finance

A critical commentary on the termination of a company's convertible bond issuance and its implications for funding, regulatory scrutiny, and investor sentiment.