Growth and Risks: China Eastern Airlines' Recent Developments

In a climate where aviation markets are progressively recalibrating towards a post-pandemic normality, China Eastern Airlines has unveiled notable operational changes that signal its robust recovery trajectory. As of July 2025, the airline reported a 7.39% increase in passenger capacity, alongside the resumption of several domestic routes, and the introduction of new international connections, notably between Shanghai and Copenhagen. These developments are not merely incremental; they underscore a strategic pivot to capture burgeoning travel demands, reflecting a broader trend seen across the airline industry working to regain pre-pandemic levels of operation. However, while these figures paint an optimistic picture, they demand thoughtful scrutiny as they may mask underlying vulnerabilities driven by global geopolitical instabilities and fluctuating economic conditions.

Delving into the financial metrics, China Eastern Airlines has experienced a commendable increase in both passenger turnover and cargo growth, with Revenue Passenger Kilometers (RPK) rising by 9.42% year-on-year in July 2025. The airline’s fleet strategy, characterized by the addition of two new aircraft and the retirement of four, aligns with a composite load factor surge by over two percentage points—a pivotal indicator for profitability in commercial aviation. Nevertheless, the divergence in regional route performance, which recorded an 11.22% drop in RTKs, poses a considerable question: could this signal an impending saturation in certain markets? Such mixed signals warrant a nuanced understanding of shifting consumer preferences amid changing travel regulations.

While the growth in international passenger traffic has been a significant revenue driver for China Eastern Airlines, the heavy reliance on international routes may present challenges in a world fraught with geopolitical uncertainties. The ongoing possibility of regulatory changes and economic headwinds raises critical questions about the sustainability of this growth. Moreover, with a notable percentage of the airline's fleet—241 out of 814—being leased, potential lease renegotiations or rises in interest rates could exert considerable pressure on operational costs. Investors should be particularly vigilant about unverified operational figures, as preliminary data might diverge significantly from final audit outcomes, thus necessitating prudent decision-making moving forward.

In conclusion, while China Eastern Airlines showcases commendable growth which aligns with broader industry rebounds, stakeholders must remain cognizant of the numerous risks that lie beneath the surface. A prudent strategy involves not just capitalizing on current successes but preparing adequately for potential pitfalls stemming from market fluctuations and unverified data disclosures. As we gaze ahead, the airline stands at a crucial junction where robust growth must be tempered with strategic caution—how effectively will it navigate these waters will ultimately define its trajectory in the years to come.

Read These Next

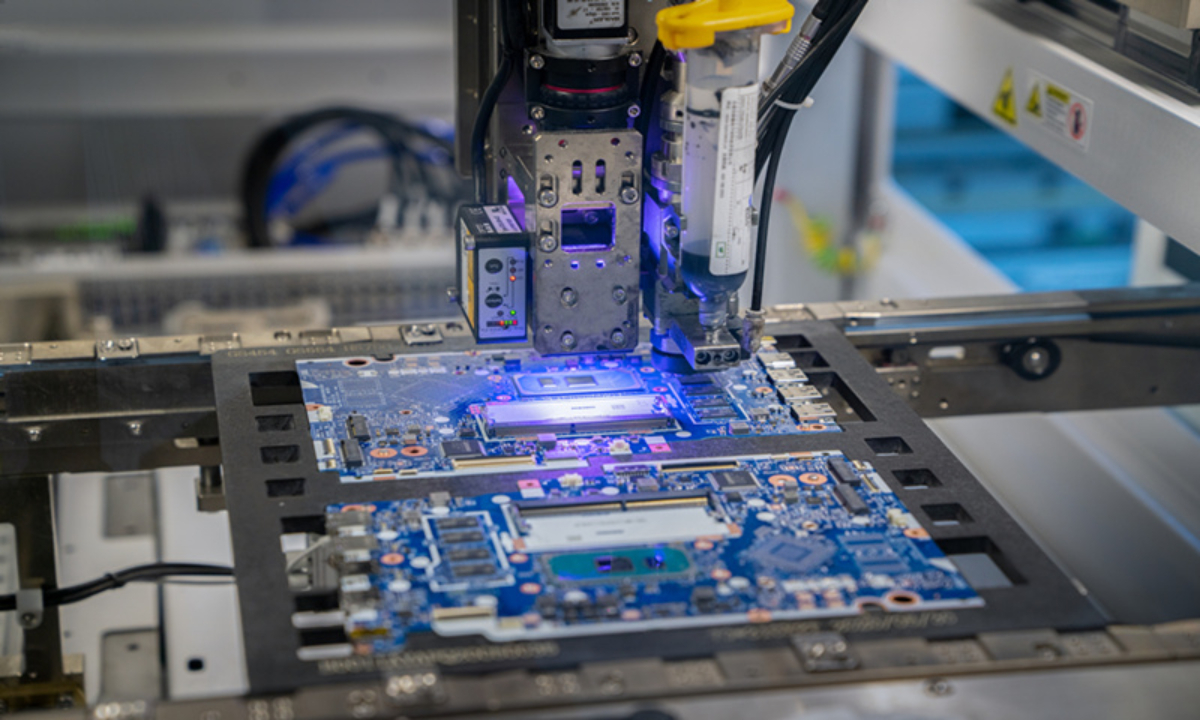

14 Ex HiSilicon Staff Sentenced for Stealing Huawei Chip Tech

A landmark case sees 14 convicted for stealing Huawei's chip tech, highlighting IP protection issues in China's semiconductor industry.

Jinhui Co to Acquire 51% of Haosen Mining for 380 Million Yuan

Jin Hui Co. plans to acquire 51% of Haosen Mining for 380M yuan to boost control and support its exploration phase.

RISECOMM GROUP's Strategic Capital Restructuring

Analysis of RISECOMM GROUP HOLDINGS LIMITED's recent annual report reveals strategic capital restructuring through shareholder-approved initiatives, reflecting strong confidence among investors. However, financial risks stemming from operational challenges warrant close observation.