RISECOMM GROUP's Strategic Capital Restructuring

The recent annual report from RISECOMM GROUP HOLDINGS LIMITED unveils a series of strategic decisions aimed at bolstering the company’s financial foundations. The unanimous support for key proposals concerning share consolidation and an increase in authorized share capital signals a deliberate maneuver to enhance the company's capital structure. Additionally, the approval of a rights issue and placement agreement highlights the company’s intention to fortify its liquidity position amidst potential market fluctuations. In a climate marked by economic unpredictability, such proactive measures are fundamental, as they reflect a management team that is responsive to shareholder interests and the broader market dynamics.

The financial trends revealed in the report are particularly worth noting. The complete consensus among shareholders suggests a robust confidence in the company's strategic initiatives considering no resolution faced opposition—an indicator that management's foresight resonates with investor interests. This overwhelming support can be interpreted as a foundational strength that may enable the company to weather potential headwinds, such as shifts in consumer spending or regulatory changes. Moreover, the timing of these approvals—set against a backdrop of global economic uncertainties, including fluctuating GDP growth rates and evolving consumer price index (CPI) measures—shows a keen awareness of the external environment.

However, the announced share consolidation and rights issue might signal more profound operational challenges. The need for capital-raising initiatives does suggest that RISECOMM GROUP HOLDINGS LIMITED could be facing financial constraints, potentially driven by declining revenues or increased operational costs, which warrants scrutiny from investors. Could this move imply vulnerabilities in the company's operational efficiency or market position? Additionally, the uncertainty surrounding shareholder sentiments raises the possibility of a future backlash if economic conditions deteriorate or if the company's performance fails to meet investor expectations. As such, while the current shareholder alignment paints a positive picture, potential market risks loom on the horizon.

In conclusion, RISECOMM GROUP HOLDINGS LIMITED is strategically positioning itself to navigate a potentially turbulent financial landscape by pursuing shareholder-approved measures that bolster capital flexibility. Investors and stakeholders should remain vigilant, considering not only the proactive steps being taken but also the external economic indicators that might impact these strategies. The interplay between micro-level corporate decisions and macroeconomic conditions could create both significant risks and opportunities. As we move forward, will the company's proactive strategies match operational realities, or will unforeseen challenges surface, testing the resilience of its current investment strategy?

Read These Next

SpaceX's Mars Express: Investing in Space Travel

Italy's partnership with SpaceX for Mars missions signifies a pivotal moment in commercial space exploration, illustrating investment trends and technological challenges.

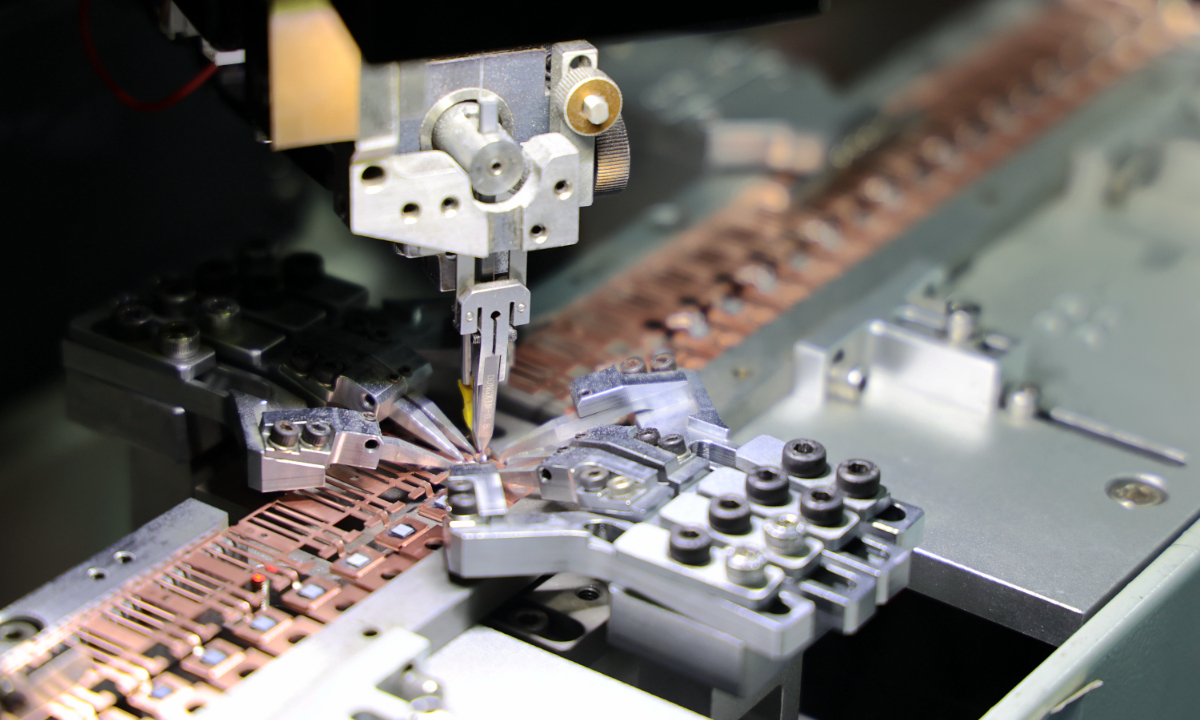

China's A-share Semiconductor Stocks Surge on AI Demand

China's A-share semiconductor sector grows due to rising demand, AI integration, and a recovering consumer electronics market.

Non-Bank Financial Sector Surges with Great Wall and Tianfeng Hitting Limits

Non-bank financial sector thrived in afternoon trading; Great Wall & Tianfeng hit limits, Dongfang up 8%, signaling investor confidence.