China's A-share Semiconductor Stocks Surge on AI Demand

China's A-share semiconductor stocks experienced a notable surge on Thursday, driven by a confluence of rising market demand, an increased focus on domestic substitution, and an accelerated integration of artificial intelligence (AI) technologies within the industry. The robust performance underscores the semiconductor sector's critical role in supporting advancements in technology.

Among the key players in the market, AI chipmaker Cambricon Technologies Corp saw its shares close at 949 yuan, reflecting a significant increase of 10.35 percent. Meanwhile, ShenZhen Longtu Photomask Co, known for its independent mask production, reported an impressive rise of 12.98 percent, closing at 53.72 yuan. In addition, Hua Hong Semiconductor's shares closed up by 3.62 percent at 70.50 yuan, while Semiconductor Manufacturing International Corp saw a smaller gain of 0.9 percent, reaching 89.46 yuan.

Experts attribute the upswing in semiconductor stocks to heightened market demand and expectations of rising product prices, which are positively influencing corporate revenue and profit forecasts. Wang Peng, an associate research fellow at the Beijing Academy of Social Sciences, highlighted these dynamics as key factors attracting more capital inflows into the sector.

The resurgence of the semiconductor market is not solely linked to advancements in AI. There is an evident recovery within the consumer electronics sector, which is anticipated to further bolster demand for semiconductor products, as noted by Chen Jing, vice president of the Technology and Strategy Research Institute.

The shift towards domestic substitution in semiconductors is gaining momentum in the current global landscape, positioning Chinese firms to reap substantial benefits from the growing AI industry. According to Wang, this trend is creating significant market opportunities that are drawing the attention of investors.

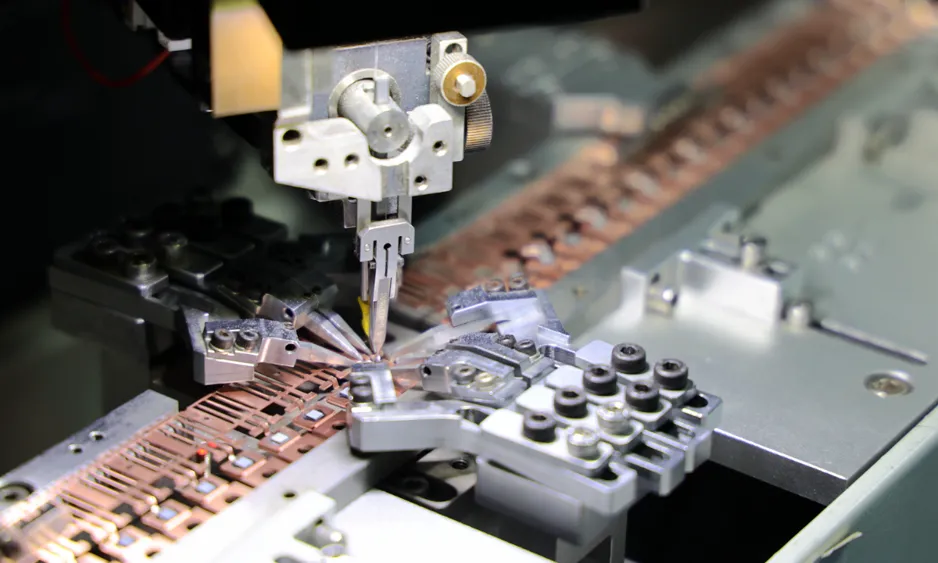

In response to the complexities of the current environment, Chinese semiconductor firms are advancing their independent research and development efforts, achieving notable progress. Leading domestic enterprises are providing essential technology support for local AI chip production, and several publicly traded companies are actively engaging in building the domestic ecosystem, buoyed by supportive government policies enhancing the semiconductor industry's growth.

The semiconductor sector is currently on an upward trajectory, fueled largely by the accelerated growth of AI applications. Analysts anticipate that AI will serve as the primary catalyst for expansion in the semiconductor market, driven by sustained demand for cloud-based AI services alongside rapid advancements in terminal AI technologies.

Recent reports indicate a strong performance among semiconductor firms, with August marking the semi-annual reporting period. Many players within the industry have reported robust results for the first half of 2025, attributed to the increasing demand for AI and domestic substitution, leading to significant growth in both revenues and net profits.

As a testament to the semiconductor industry's strength, the World Semiconductor Trade Statistics reported that the global semiconductor market reached a staggering $346 billion, reflecting an 18.9 percent year-on-year growth. This robust growth underscores the momentum sustaining the sector amidst a complex economic backdrop.

In the first half of the year, nearly 40 A-share semiconductor companies disclosed their earnings, with only three reporting a year-on-year decline in net profit. The majority exhibited profit growth, reduced losses, or turned previous losses into gains, highlighting the sector's resilience and positive trajectory.

Furthermore, the electronics and information manufacturing sector has shown remarkable performance, with an added value increase of 11.1 percent year-on-year, outpacing the overall industrial growth. Integrated circuit production also rose significantly, reaching 239.5 billion units, marking an 8.7 percent increase from the previous year.

Overall, the A-share market has displayed vigorous growth, with the Shanghai Composite Index recently surpassing the significant threshold of 3,700 points for the first time since December 2021. As of the close on Thursday, the index stood at 3,666.44, reflecting its new phase high. Despite external pressures and a slowdown in domestic growth, the dynamic growth across various Chinese industries continues to signify a robust economic performance.

Read These Next

Non-Bank Financial Sector Surges with Great Wall and Tianfeng Hitting Limits

Non-bank financial sector thrived in afternoon trading; Great Wall & Tianfeng hit limits, Dongfang up 8%, signaling investor confidence.

Strategic Transformation in Battery Production

This commentary analyzes a company's strategic transformation focusing on lithium battery production and energy storage. It highlights financial trends, risks, and insights on market dynamics, urging stakeholders to consider the implications of innovation in a competitive landscape.

Apple Watch to redesign blood oxygen feature after dispute

Apple's announcement about the redesigned blood oxygen monitoring feature for Apple Watch users reflects a significant shift in its corporate strategy following a legal battle with Masimo. This update not only restates Apple's commitment to health technology but also highlights the complex interplay between innovation and regulation in the health tech sector. As public curiosity intensifies in health monitoring solutions, this development is timely, exemplifying the need for adaptive corporate strategies in a competitive market.