Examining Recent Trends in Share Buybacks

The recent share buyback program initiated by the company marks a significant strategic move, demonstrating management's confidence in the firm’s financial health and its commitment to enhancing shareholder value. Approved on May 19, 2025, the program, which commenced on February 20, 2026, involves repurchasing 130,000 shares, accounting for a mere 0.0107% of the total issued shares. This conservative approach to share repurchases seems aligned with the management’s view on the company’s undervaluation in current market conditions, particularly considering the average buyback price of HKD 1.5088 per share—significantly lower than the authorized maximum of HKD 196.140.

Analyzing this move within the broader economic landscape reveals a cautious optimism. As companies globally navigate supply chain disruptions and inflationary pressures, the decision to embark on a buyback signifies a belief in stable cash flows despite potential external headwinds. Factors such as Gross Domestic Product (GDP) fluctuations and Consumer Price Index (CPI) changes will inevitably influence investor sentiment; hence, this program could be seen as a hedge against perceived volatility. Furthermore, the restriction on issuing new shares for a lock-up period until March 22, 2026, underscores a strategic pivot intending to support share price stabilization while potential market conditions remain unpredictable.

However, it is essential to critically assess the associated risks. By decreasing the pool of available shares without issuing new equity, the company could face liquidity pressure should its operational metrics falter. For instance, why might the company opt for a buyback now rather than reinvest in growth initiatives or return capital to shareholders through dividends? Maintaining a long-term perspective is vital amidst these maneuvers; a more aggressive strategy could yield higher returns than share repurchases, particularly in innovation-driven sectors. Therefore, while current market conditions may favor buybacks, the opportunity costs could be substantial if underlying growth remains subdued.

In conclusion, the company’s recent buyback program illustrates a strategic maneuver that reflects both confidence and caution. As the firm navigates these changes, stakeholders—ranging from institutional investors to regulators—will need to closely monitor upcoming financial disclosures. Going forward, the ability to balance shareholder returns with sustainable growth initiatives will be crucial. Stakeholders must ponder: does this buyback position the company for resilience against future economic shocks, or does it expose it to greater risks down the line? Such inquiry will shape investment strategies in an evolving market landscape.

Read These Next

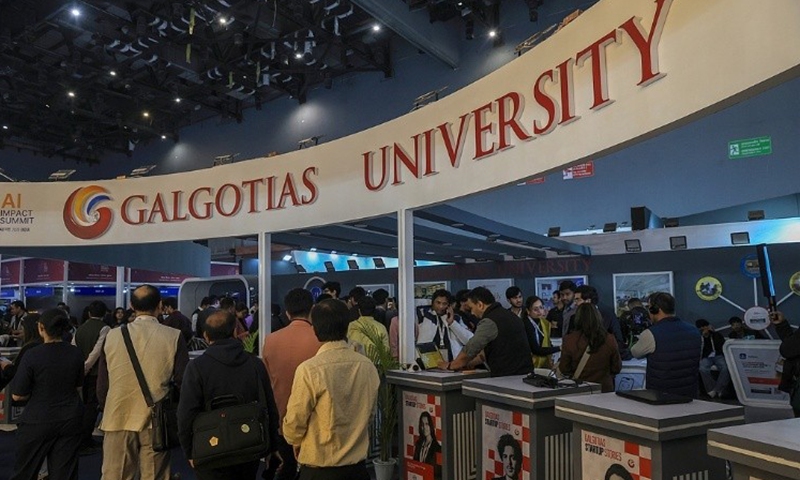

International Media Reacts to Indian University Robodog Claim

Galgotias University faces scrutiny for alleged dishonesty on tech origins at an AI summit, raising concerns over academic integrity.

FTSE Singapore Straits Times Index Hits New High at 5017.60 Points

On February 20, 2026, the FTSE Singapore Straits Times Index hit a record high of 5,017.60, up 0.3%, showing investor confidence.

HKC International Holdings' Strategic Shifts and Engagement

A critical commentary on recent developments at HKC International Holdings Limited, focusing on their property transfer announcement, communication strategies with shareholders, and implications for financial performance and risk management.