Saudi CMA Issues License to ASAS GULF

On May 25, the Saudi Capital Market Authority (CMA) granted a license to ASAS GULF, a significant move aimed at strengthening the framework of arrangements and consulting within the Saudi financial market. This licensing decision is part of a broader strategy by the CMA to enhance market regulation, fostering transparency and stability in financial operations. By allowing ASAS GULF to operate in this capacity, the CMA is not only upgrading the standards of consulting services available but also setting a precedent for improved governance in financial affairs.

Furthermore, this initiative is expected to attract increased foreign investment into the Kingdom. As ASAS GULF begins its operations, it is likely to present new opportunities for international investors looking to navigate the complexities of the Saudi market. The CMA's proactive stance illustrates its commitment to creating an inviting environment for foreign capital, potentially leading to a revitalized economic landscape. This move underscores Saudi Arabia's ongoing efforts to diversify its economy and reduce its dependence on oil revenues, aligning with its Vision 2030 objectives.

Read These Next

China's First Large-Scale Lithium-Sodium Hybrid Energy Storage Station Launches, 98% Green Energy

China has launched its first large-scale lithium-sodium hybrid energy storage station to advance green energy solutions.

“Mission Impossible 8: Final Liquidation” grosses $190M globally.

"Mission Impossible 8" has grossed $190M globally, showing strong marketing power and cultural impact in today's film market.

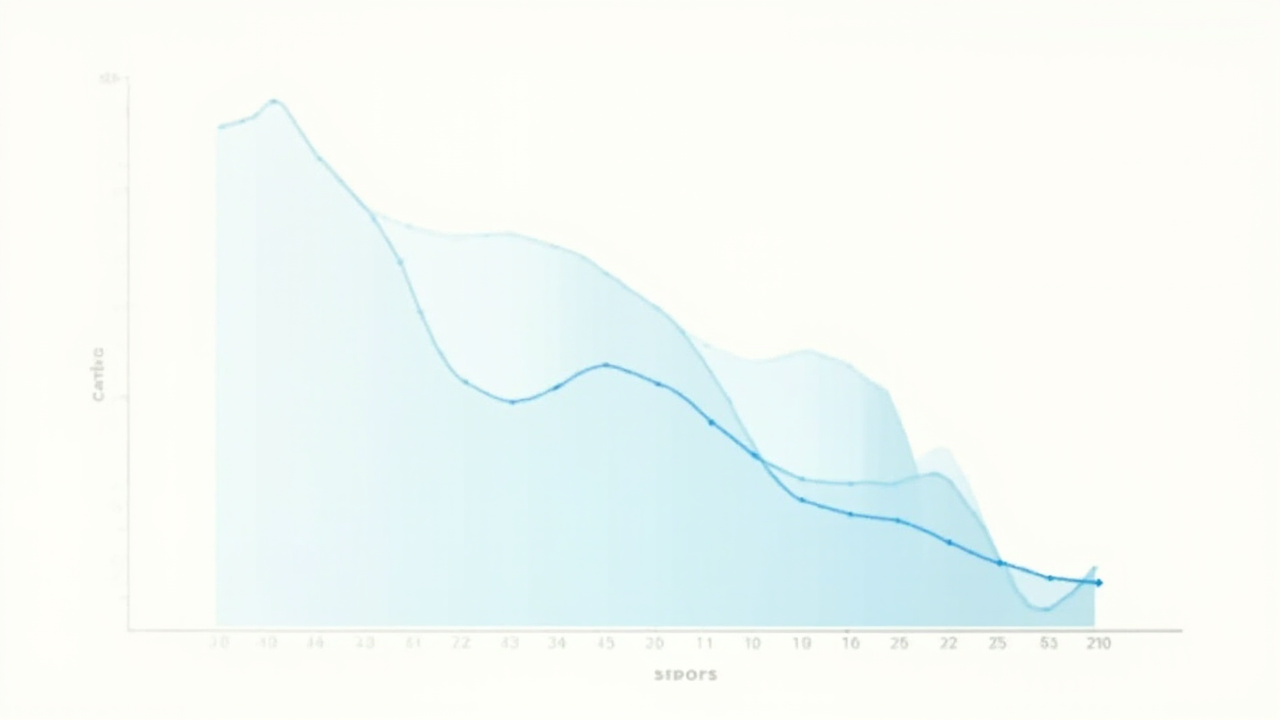

Bawei Storage: Analyzing Planned Share Reduction and Financial Trends

Analysis of Bawei Storage's recent plans for share reduction amidst financial pressures, highlighting key financials, management perspectives, and potential risks.