Bawei Storage: Analyzing Planned Share Reduction and Financial Trends

### Overview Bawei Storage, a company involved in providing advanced data storage solutions, recently announced a significant change regarding its shareholders. This report focuses on their planned share reduction and its implications, as outlined in their October 2023 announcement regarding the planned share reduction between June 18, 2025, and September 17, 2025.

### Key Financials The planned share reduction is primarily driven by the financial strain faced by directors and senior executives who need funds to purchase restricted stocks from a stock incentive plan initiated in 2023. With the highest management holding a mere 0.0388% of the shares, the overall impact of this reduction on total share capital is expected to be minimal, demonstrating some confidence in the company’s future from its leadership.

### Management Commentary Management has stated that they will not sell any of their shares through the secondary market for the remainder of the year, which reflects their belief in the company's long-term prospects. Their tone appears cautious yet optimistic as they navigate current financial obligations.

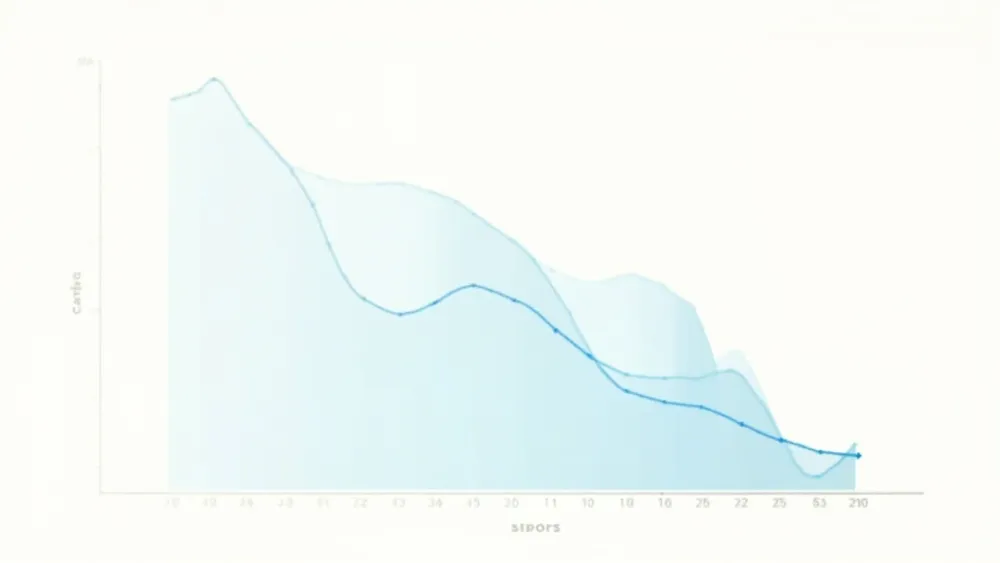

### Trends and Drivers The shared concern over financial liquidity is a predominant theme in this announcement. The planned reduction of shares due to financial pressure suggests that macroeconomic trends and internal cost pressures may be impacting the company's cash flow. However, the slight nature of the share reduction also indicates potential growth confidence among company executives.

### Risks and Outlook Several risks are associated with this development. Firstly, there is a risk of negative market reaction to the share reduction, although the scale is small. Ongoing liquidity issues could pose additional risks, as they may impact future growth opportunities. Moreover, any changes in share structure or capital fund management during the reduction period could necessitate revisions to the current plan, which would then affect market expectations.

### Conclusion In summary, while Bawei Storage's proposed share reduction is small in scale, it underscores an existing financial strain among management. Investors should remain vigilant regarding market reactions and continuous monitoring of the company’s financial health and operational strategies as it navigates these challenges.

Read These Next

Magnitude 6.0 Earthquake Hits Tonga Islands, Reports German Geoscience Research Center (GFZ)

A 6.0 magnitude earthquake struck the Tonga Islands on the 25th, at 12 km depth, urging research on disaster management and ecology.

Higlight Information Technology's Strategic Merger with Zhongke Shuguang: Financial Insights and Future Outlook

Analysis of Higlight Information Technology's significant asset restructuring plans with Zhongke Shuguang, highlighting key aspects and potential impacts.

Torrential rain to hit southern China starting September 27, heavy precipitation expected.

Cold weather in northeast and northwest China ends on 22nd; heavy rain expected in the south from 27th, raising concerns.