Altman aims to invest post-GPT-5 launch despite losses

The recent launch of OpenAI's GPT-5 marks a pivotal moment in the artificial intelligence landscape, underscoring both the rapid advances in AI technology and a bold financial strategy from the organization’s leadership. In an unveiling that has captured the attention of industry leaders and investors alike, CEO Sam Altman articulated a steadfast commitment to growth over immediate profitability. This departure from traditional corporate strategy, where profit is typically prioritized, raises critical questions about the sustainability of such an approach in the rapidly evolving tech sector.

In the fiscal context, OpenAI's revenue trajectory is impressive, with annual recurring revenue projected to surpass $20 billion this year, despite previous estimates forecasting losses of approximately $5 billion on revenues of $3.7 billion. The dichotomy between revenue growth and ongoing losses is illustrative of a broader trend observed in the tech sector, reminiscent of the dot-com bubble in the late 1990s, where growth superseded immediate profitability. However, unlike many companies during the dot-com era, OpenAI operates with a different foundational premise: it remains private and can prioritize long-term technological advancements without succumbing to quarterly pressure from public investors.

Altman’s willingness to ‘run the loss’ signals a forward-looking vision that many investors currently endorse, as this strategy aligns with their expectations of future viability and dominance in a competitive AI market. Moreover, the release of open-weight models encourages extensive application development and customization, potentially expanding OpenAI's ecosystem and market penetration. However, potential risks remain, including the possibility of unforeseen market corrections or regulatory hurdles that could change investor sentiment. What happens if OpenAI's growth trajectory falters as it scales? The company must balance these aggressive expansion efforts with prudent financial stewardship, even as it seeks out new sources of investment at an astonishing valuation of around $500 billion.

Read These Next

Chinese Hospitals Embrace AI Transforming Health Care Fast

United Imaging Intelligence partners with Zhongshan Hospital to enhance diagnoses with AI in clinical settings, improving patient care.

US Claims Ukraine Used Drones to Strike Russian Drone Facility

On August 9, Ukraine used drones to strike a logistics hub in Tatarstan, Russia, causing an explosion and fire.

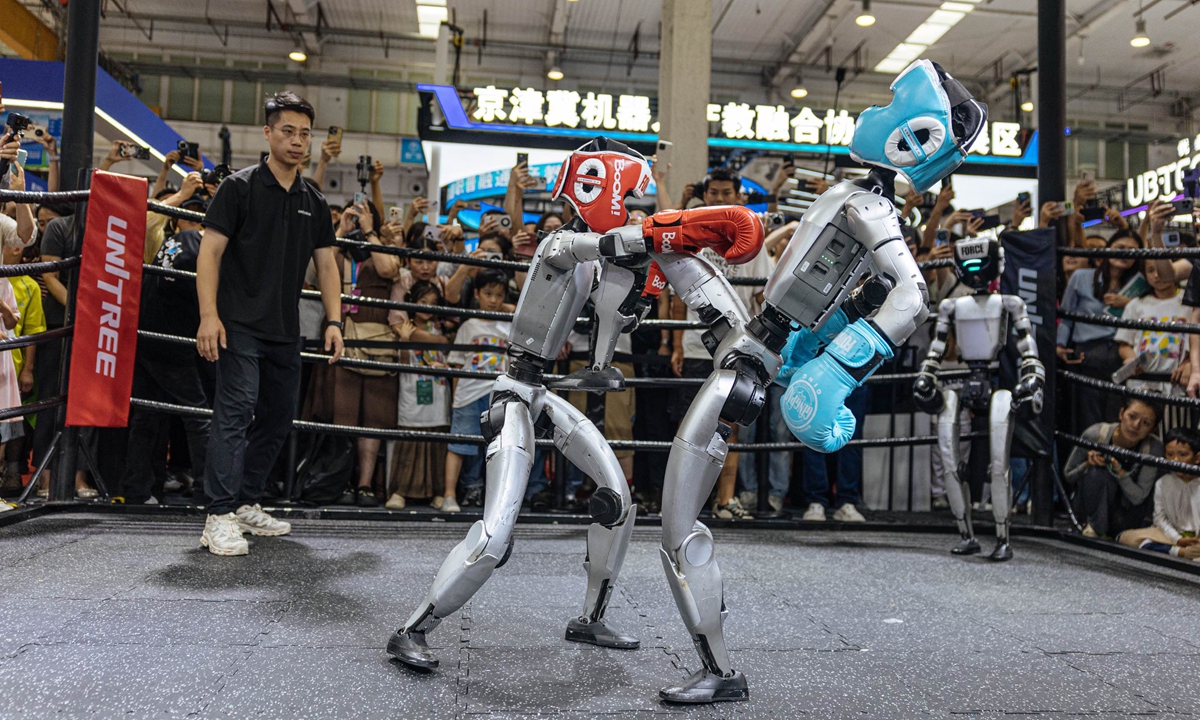

10th World Robot Conference Begins in Beijing

The 2025 World Robot Conference in Beijing showcases 1,500 products from 200 companies, marking a 25% rise in participation.