Australia Q2 inflation hits lowest since March 2021

In a pivotal economic shift, Australia has reported its second-quarter inflation rate at 2.1%, the lowest level since March 2021. This drop has significant implications for monetary policy, particularly as it inches within the Reserve Bank of Australia’s (RBA) target band. The current setting presents a noteworthy backdrop against which the RBA may reconsider its interest rate strategy, creating an environment ripe for discussions on potential rate cuts, especially following two earlier reductions this year.

Analysis of the broader economic trends reveals a complex landscape. The lower inflation rate arrived at a time when global growth appears sluggish, evidenced by a GDP growth rate of just 1.3% year-over-year for Q1 2025, which failed to meet expectations. Among the drivers contributing to the favorable inflation data are modest rises in housing and food prices coupled with decreases in transport costs, which portray a delicate balance in spending habits. Moreover, the persistence of the unemployment rate at 4.3% raises concerns about labor market stability, creating a paradox for the RBA: the risk of tightening monetary policy amidst weak economic indicators could stifle any recovery.

The contrasting narratives woven into these economic indicators challenge the assumption that low inflation alone warrants a preemptive rate cut. Indeed, while analysts from institutions like Bank of America anticipate a cut based on the latest inflation data, they caution against underestimating the potential for global economic pressures to disrupt domestic recovery. A possible connection emerges between Australia's experienced inflation data and broader economic phenomena akin to the post-GFC periods of quantitative easing, where muted inflation was often a harbinger of future economic troubles. This juxtaposition brings to light the risks of complacency by both policymakers and investors, as unexpected global shifts could disrupt fragile gains in consumer and business confidence.

As we forecast the immediate economic horizon, it becomes critical for stakeholders to contemplate potential unintended consequences of policy shifts. While a cut in the policy rate might inject necessary liquidity into the market, it could also amplify asset bubbles or incentivize consumer debt in an already shaky economic environment. Herein lies an opportunity for institutional investors to evaluate the viability of sectors that traditionally withstand economic turbulence. In conclusion, while the RBA may lean toward a rate reduction in its next meeting, the implications of such a decision necessitate cautious scrutiny, taking into account not just domestic indicators, but also the lessons learned from historical economic cycles.

Read These Next

Hong Kong Court Freezes 1.8 Billion HSBC Account Amid Inheritance Dispute

Hong Kong High Court bars Zong Fuli from accessing $1.8B in HSBC account amid inheritance dispute with half-siblings.

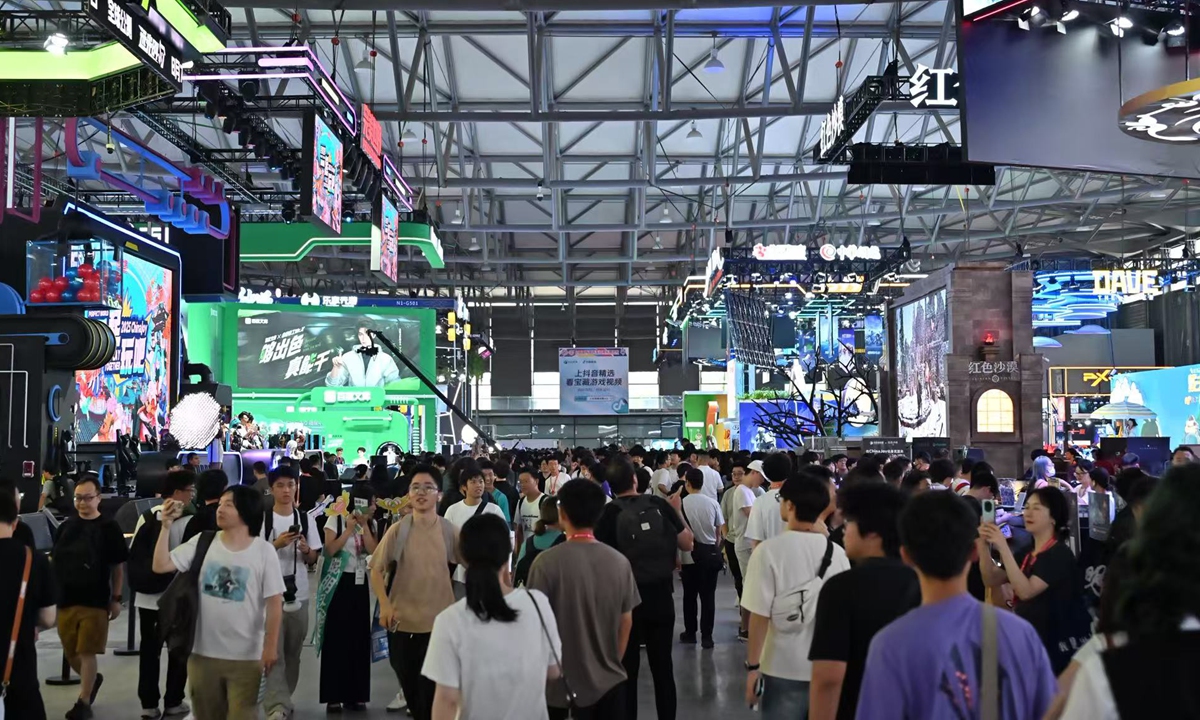

ChinaJoy Welcomes 700 Firms with Industry Vows to Explore Market

The 2025 ChinaJoy, Asia's biggest gaming convention, drew 700+ firms, showcasing recovery and optimism in gaming.

Acquisition Signals Growth Amid Economic Uncertainty

Commentary on the acquisition of Guangxi Zirconium Technology Co., Ltd. and its implications for corporate strategy and financial health.