JPMorgan expands into crypto with stablecoin-like token JPMD

JPMorgan Chase's recent foray into the cryptocurrency sector with its stablecoin-like token, JPMD, marks a pivotal moment in the evolving landscape of digital assets. This move not only signifies the banking giant's commitment to integrating blockchain technology into their traditional offerings but also represents a broader shift among institutional investors toward recognizing cryptocurrencies as legitimate financial instruments. The introduction of JPMD is particularly significant as it blends characteristics of conventional banking practices with the innovative features of digital currencies, suggesting a possible new paradigm in how financial services may operate.

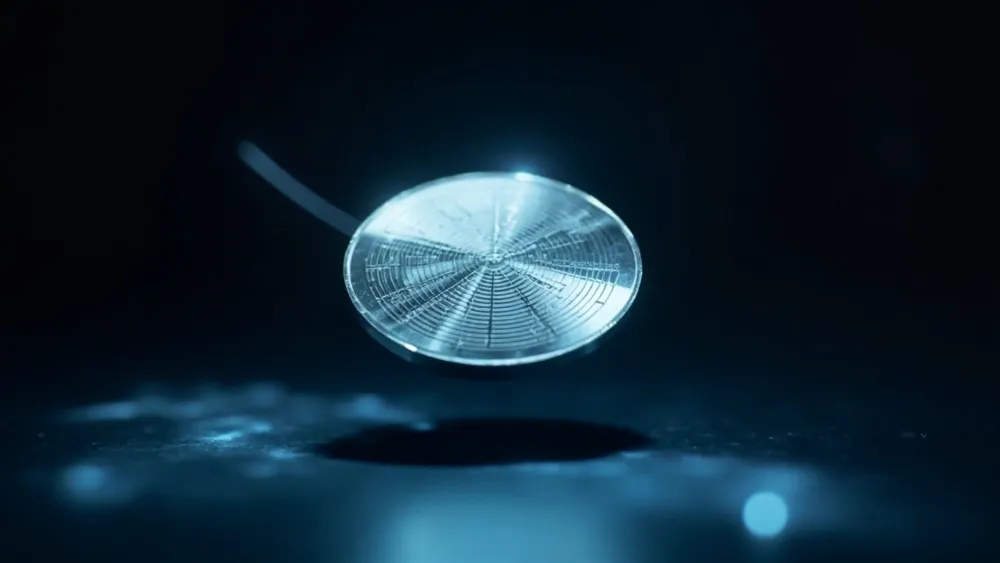

On a structural level, JPMorgan’s JPMD will serve as a deposit token on the Coinbase blockchain, thus allowing for 24/7 transactions that can facilitate real-time settlements. This is particularly relevant considering ongoing discussions around stablecoins and their regulatory landscape—currently worth approximately $262 billion. Comparatively, JPMD's permissioned model exclusively caters to JPMorgan's institutional clients could create an alternative dynamic in the market, diverging from widely available stablecoins like Tether and USDC. Given the recent preemption of regulatory frameworks, including the anticipated GENIUS Act in the U.S. and the MiCA regulation in the EU, JPMorgan's initiative could potentially position it favorably in a space that will soon face stricter scrutiny.

However, one must examine the potential risks associated with this venture. While JPMD's design assures institutional users of compliance and security, it may inadvertently bolster concerns regarding the centralization of power within the cryptocurrency ecosystem. This raises a vital question: can blockchain technology coalesce with centralized banking practices without losing the core ethos of decentralization that initially propelled cryptocurrencies into the financial spotlight? Furthermore, while JPMorgan's established reputation could lead to wider adoption among institutions seeking holistic digital asset solutions, it also creates a reliance on a single entity that might stifle competition and innovation in the long run. Investors should remain vigilant, understanding that the serve-and-protect mentality that larger institutions embody might not always align with the inherently disruptive nature of fintech.

In conclusion, JPMorgan's strategic entry into the cryptocurrency market through the launch of JPMD holds significant implications not only for the bank but for the entire financial ecosystem. While it provides an avenue for institutional clients to engage with blockchain technology in a compliant manner, it concurrently poses risks by shifting the balance of power toward established financial institutions. Moving forward, institutional investors should keep a close watch on both the performance of JPMD and the evolving regulatory landscape to ascertain whether the emerging synergy between traditional finance and blockchain technology will lead to opportunities or unintended consequences.

Read These Next

AWS' custom chip strategy cuts into Nvidia's AI dominance

AWS is making strides in chip technology with the new Graviton4 chip, positioning itself against Nvidia in the AI infrastructure space. This is significant for institutional investors and the semiconductor market amid rising AI demand.

Labubu's Global Craze: Decoding the Blind Box Phenomenon

Labubu's rise shows China's shift from a manufacturing hub to a creator of original cultural products influencing global trends.

Insights into Recent Board Election and Its Implications for Company Stability

Analysis of the company's recent board election and its implications for governance and financial stability.