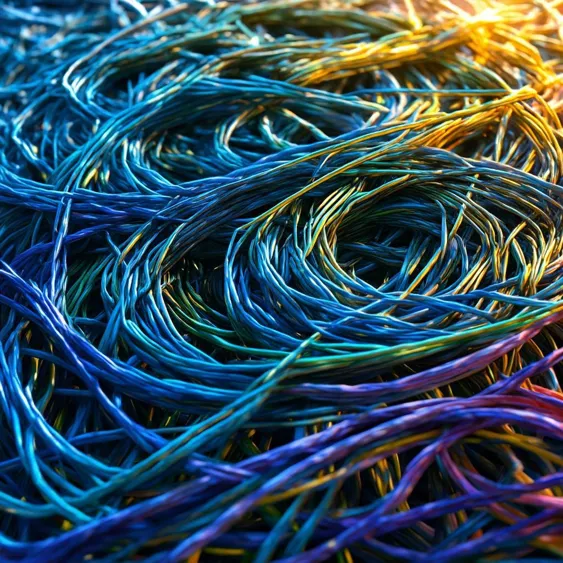

Strategic Realignment in Threads and Cables Sector

In a noteworthy shift, an unnamed company has announced significant changes to both its business scope and registered capital, signaling a strategic pivot aimed at bolstering its operational focus within the competitive landscape of threads and cables. The decision to streamline its business model comes at a time when industries globally are scrutinizing their capital allocations and operational efficiencies in the wake of fluctuating market demand and economic uncertainties. This article analyzes the implications of these changes, their alignment with broader economic trends, and the potential risks and opportunities inherent in this transition.

The reduction in registered capital from 1,014,289,836 RMB to 1,011,075,446 RMB, attributed to the repurchase and cancellation of restricted shares, is emblematic of a strategic effort to optimize the company's capital structure. The move can be interpreted as a response to pressures within the market that demand a more focused allocation of resources. By reducing the registered capital, the company is potentially signaling to investors a prioritization of shareholder value, inspired by similar strategies seen during the 2008 financial crisis when firms aimed to preserve liquidity and enhance operational efficiencies amidst market volatilities. The impending share buyback adds a layer of confidence for investors, as it reflects a proactive approach to managing capital, potentially enhancing EBITDA margins over time.

However, as with any significant operational shift, there are notable risks and uncertainties that stakeholders must navigate. The need for regulatory approval from the Zhejiang Provincial Market Supervision Administration introduces a layer of fragility. Any delays or rejections could stall the anticipated operational changes, potentially affecting market perceptions and investor confidence. Furthermore, the company's realignment may not necessarily guarantee a perfect match with market needs; should there be an unforeseen downturn in demand for threads and cables, the risks of underperformance loom large. The changes also necessitate careful communication with shareholders to minimize backlash and enhance transparency. How will the company manage investor expectations amidst a reshaping of its fundamental business strategy?

In conclusion, while the company's strategic pivot towards a more concentrated business focus and capital optimization appears promising, it is fraught with risks that need careful management. Engaging stakeholders transparently and preparing for potential market adjustments will be critical as the company embarks on this transformative path. As the manufacturing landscape continues to evolve, the ability to adapt to and anticipate market shifts will be the key to sustaining shareholder value. Future success will hinge not just on operational execution but also on the company's agility in navigating regulatory landscapes and market demands.

Read These Next

HK strengthens position as super-connector in global trade

Hong Kong's Financial Secretary cites its role as a 'super-connector' for trade amid global shifts and geopolitical tensions.

Market Shifts Amid Geopolitical Tensions and Inflation

Analysis of current market sentiment reflecting changes in geopolitical tensions and inflation, emphasizing corporate strategy adjustments and risk management approaches in light of evolving economic conditions.

AG600 Kunlong Amphibious Aircraft Completes Production Test Flights

The AG600 Kunlong amphibious aircraft completed test flights, advancing delivery and enhancing China's emergency response capabilities.