Shenglong Jinxiu International's Share Repurchase Strategy: Financial Insights and Future Outlook

### Overview This report covers the recent share repurchase activity of Shenglong Jinxiu International as of May 23, 2025. The company repurchased 500,000 shares at a price of HKD 0.495 per share. This transaction reflects a strategic move aimed at optimizing its capital management amid a defined market landscape.

### Key Financials The total amount paid for the repurchased shares was HKD 248,028.91. After the buyback, the total issued shares will decrease from 490,420,000 to 448,155,000, reflecting a reduction of the actual shares in circulation. The repurchased shares account for 0.41% of the company's total issued shares on the transaction date. This disciplined approach to share repurchase aligns with current liquidity strategies and demonstrates the company's commitment to maximizing shareholder value.

### Management Commentary Management's tone surrounding the buyback initiative appears to be cautiously optimistic. The approval for share repurchase was awarded on April 25, 2025, allowing for the potential buyback of up to 45,000,000 shares. The company has emphasized that all repurchases have been executed according to Hong Kong Securities Listing Rules, assuring stakeholders of its compliance and operational integrity.

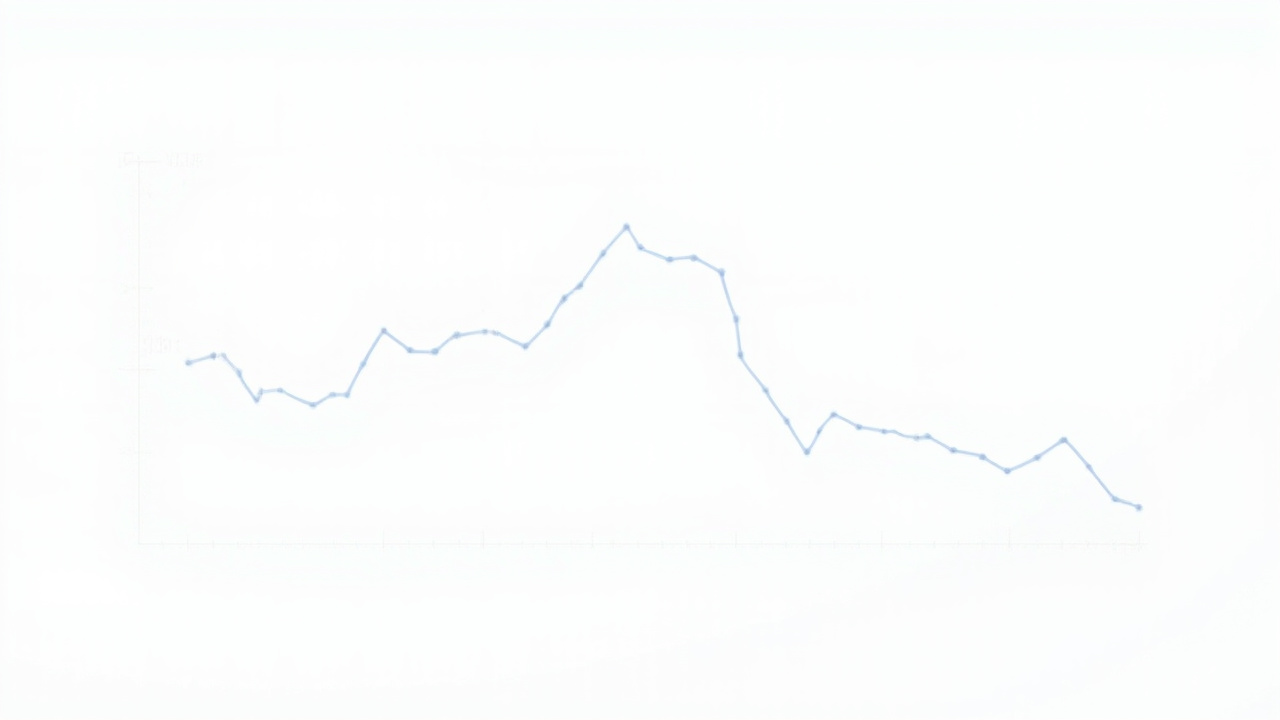

### Trends and Drivers The decision to conduct a share buyback indicates management's confidence in the company's long-term growth prospects despite current market oscillations. However, the limitation imposed on new stock issuance within 30 days of the buyback could affect potential funding strategies. The market dynamics that pressure stock prices could also influence the effectiveness of the buyback in translating to improved financial performance.

### Risks and Outlook Potential risks for Shenglong Jinxiu International include maintaining compliance with regulatory stipulations regarding share issuance and buyback processes. Any violations could lead to regulatory penalties or a loss of investor confidence. Additionally, market volatility poses a risk as it can undermine the impact of the buyback on the company’s stock performance. The coming quarters will be essential to monitor how management navigates these challenges and the overall financial health of the company.

### Conclusion In conclusion, Shenglong Jinxiu International's recent share buyback highlights a strategic maneuver within its capital management framework. While the company is committed to enhancing shareholder value through these actions, prudent oversight of regulatory compliance and market conditions will be critical in sustaining its growth trajectory and financial stability moving forward.

Read These Next

Hefei Company Unveils 'Air Expressway' to Accelerate Delivery of Goods and Medical Supplies

Hefei company boosts logistics efficiency with extensive drone delivery routes for consumer and medical supplies.

Manganese silicon futures contract intraday decline widens to 3%

Manganese silicon futures fell 3%, signaling potential market trend changes and industry impact.

Shenzhen Kedali: Navigating Growth Amid Market Pressures

An analytical overview of Shenzhen Kedali's recent developments, financial trends, and future outlook based on their latest earnings report.