Zhu Hai Hui Jin's New Audit System Enhances Governance

Zhu Hai Hui Jin Technology Co., Ltd.'s recent establishment of an internal audit system for its communication via the Interactive Easy platform marks a significant development in the company's corporate governance framework. This initiative not only formalizes the company’s commitment to transparency but also establishes a more structured approach to investor relations. As market participants continue to seek clarity and reassurance amid volatile conditions, such measures to enhance internal communication protocols cannot be overstated. In an environment where investor confidence is pivotal to enduring market success, Zhu Hai Hui Jin’s proactive steps may bridge the gap between ensuring accountability and fostering trust with stakeholders.

The decision to improve its corporate governance through rigorous internal audits directly correlates with broader trends across financial markets, where companies are increasingly prioritizing governance as a means to mitigate risks associated with information mismanagement. This initiative aligns with regulatory expectations set forth by the China Securities Regulatory Commission (CSRC) and the Shenzhen Stock Exchange, effectively positioning the company within a compliance framework that may yield positive long-term investor sentiment. However, one must question whether these governance improvements will adequately shield the company from potential market scrutiny or reputational damage. Historical precedents such as the 2008 financial crisis reveal that insufficient oversight can lead to dire consequences, ultimately spurring more stringent regulatory frameworks. In this regard, Zhu Hai Hui Jin's ambitious goal of optimizing investor communications is commendable, but they must remain vigilant against the cyclical nature of investor trust.

While these developments signal a burgeoning corporate culture focused on compliance, there are inherent risks that cannot be ignored. The company's obligations concerning the non-disclosure of sensitive information and the avoidance of misleading communications are paramount in safeguarding its financial integrity and market standing. Yet, could there be unintended consequences of this heightened focus on compliance? For instance, a misguided emphasis on strict communication may inadvertently stifle genuine engagement with investors. Additionally, there is the pressing need for the company to attract attention while being cautious not to trigger regulatory scrutiny. The dialogue between compliance and proactive investor relations is delicate; if mishandled, it could lead to a lose-lose scenario where neither regulatory bodies nor investors feel adequately informed.

Read These Next

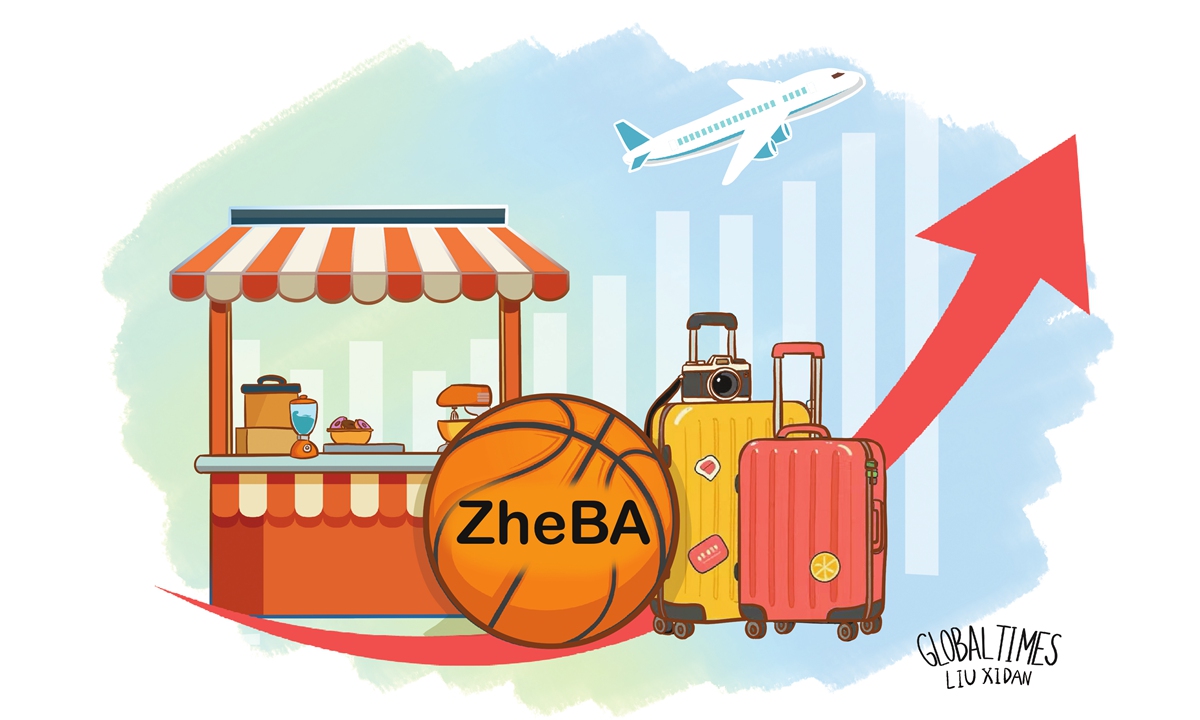

Grassroots Sports Surge Reflects Growth in Emerging Markets

Grassroots sports events like ZheBA are boosting local economies in China, increasing hotel stays, restaurant sales, and tourism.

Shanghai Private Enterprises Achieve Nearly One Trillion Yuan Trade

Shanghai's private enterprises' import/export value hit 982.38B yuan in Jan-Jul 2025, up 25.5% YoY. Exports rose 27%.

China Shipbuilding's Board Meeting: Governance and Financial Prudence

China Shipbuilding Industry Corporation's upcoming board meeting will discuss its half-year financial report for 2025, highlighting corporate governance and the importance of transparency.