Jintuo Co.'s Strategic Shift and Financial Outlook

The recent annual report from Jintuo Co. represents a crucial inflection point for the company, reflecting significant shifts in both strategy and financial health. As Jintuo pivots from a traditional business-oriented approach to a technology-centric framework, the implications of this transition extend well beyond the company's operational purview, potentially reshaping its standing in the competitive electronic thermal equipment sector. This change is particularly meaningful in an economic climate characterized by rapid technological advancements and a push towards more efficient production capabilities.

Analyzing Jintuo's financial trends, the notable 12.44% increase in revenue reaching 36.88 billion yuan for the first half of 2025 is impressive, especially considering the challenging global market conditions. Moreover, the staggering 49.01% rise in net profit at 5.34 billion yuan points to effective cost control alongside this revenue growth, a testament to enhanced profitability strategies—an important indicator for investors assessing long-term viability. Importantly, the operating cash flow of nearly 7.93 billion yuan, reflecting a remarkable increase of 60.91%, underscores Jintuo's strong cash generation capabilities, a crucial aspect for financing both its growth initiatives and ongoing operational needs. This robust financial performance enables Jintuo to strategically engage in further capacity expansion while investing in R&D for technology development.

However, the market dynamics that Jintuo faces cannot be ignored. While the dependency on high-value clients in overseas markets may augment revenue streams, it simultaneously presents a considerable risk if these clients’ needs are not met or if they shift their purchasing patterns. This situation mirrors the risks seen during the 2008 financial crisis, where reliance on a limited customer base led to vulnerabilities as market conditions tightened. Furthermore, the company's ambitious plans to establish new production and sales sites worldwide will necessitate astute operational management to avoid pitfalls related to execution inefficiencies or supply chain disruptions, aspects exacerbated by current geopolitical tensions.

In conclusion, Jintuo Co. is strategically positioned to harness the growing demand for advanced electronic equipment, yet remains exposed to inherent market risks and technological challenges. The company's efforts to expand overseas sales and initiate cutting-edge products signify an opportunity to strengthen its market position whilst addressing potential vulnerabilities through careful strategizing and execution. Investors must ponder: can Jintuo adapt swiftly enough to its technology-oriented aspirations, while maintaining operational excellence against a backdrop of evolving global market conditions? As the tech landscape continues to evolve, the future trajectory for Jintuo's corporate strategy will be crucial not just for the company itself but also for the stakeholders invested in its ongoing success.

Read These Next

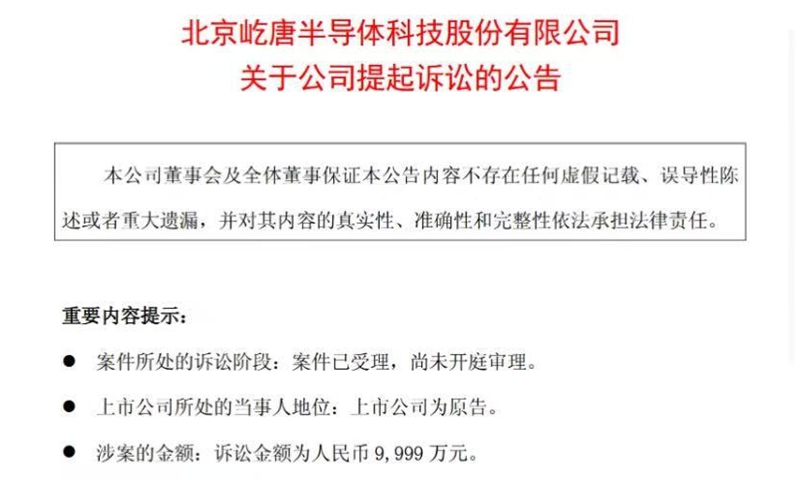

Beijing E-Town Sues US Firm Over Alleged Trade Secrets Leak

Beijing E-Town Semiconductor sues US's Applied Materials, claiming trade secret theft, impacting US-China trade and semiconductor industry.

Mining Truck Market Thrives on Electrification Automation Trends

The mining truck sector thrives on electrification, automation, and Chinese expansion, boosting R&D and attracting investors.

Victory Securities' Strategic Shift in Corporate Communication

Victory Securities (Holdings) Company Limited is shifting its corporate communication strategy to enhance accessibility for shareholders, particularly through electronic distribution of reports. However, the lack of detailed financial data raises concerns regarding transparency, while risks associated with non-registered shareholders potentially missing critical updates underscore the importance of effective communication strategies. The firm must ensure that both its communication policies and the information conveyed support investor confidence and engagement in an increasingly digital marketplace.