Four Key Pillars Expected to Drive RMB Appreciation by 2026

Analysts are anticipating a favorable trajectory for the Chinese yuan, driven by four significant factors that are expected to support its appreciation by 2026. The projected elements include persistent trade surpluses, stable trade relations, low inflation rates, and a continued weakness in the US dollar.

Shen Jianguang, the chief economist of JD Group, notes that the RMB has seen a reversal in its depreciation trend since April this year, recently surpassing the 7 RMB to 1 USD mark. He attributes this rebound to a combination of a robust current account surplus, the mitigation of trade conflicts, the undervaluation of the RMB’s purchasing power, and potential further depreciation of the US dollar. These dynamics are anticipated to strengthen into 2026.

The first pillar supporting RMB appreciation is the substantial increase in China's goods trade surplus, which exceeded $1 trillion for the first time by November 2025. Simultaneously, the decrease in the service trade deficit during the first half of the year indicates that China's current account surplus may reach a record high in 2025. This increase in the current account surplus generally correlates with heightened demand for the RMB, further reinforcing the balance of payments and enhancing the RMB exchange rate.

Another critical factor is the resilience of China's exports in the face of escalating US-China trade tensions in 2025. While exports to the United States experienced a significant decline, demand from other global markets stabilized China's overall demand and employment, showcasing the strength of its supply chain. The conclusion of several high-level negotiations and anticipated mutual diplomatic visits in 2026 bode well for stabilizing trade relations, potentially creating a more favorable external environment for the RMB.

Additionally, China's comparatively low inflation rates are expected to bolster the RMB’s purchasing power, contributing to nominal exchange rate appreciation against the US dollar. In contrast, the United States has experienced persistent inflationary pressures, indicated by rising GDP deflator rates over recent years. This inflation gap, coupled with the undervalued real effective exchange rate of the RMB, suggests ongoing correction is likely, further propelling RMB appreciation through 2026.

The anticipated depreciation of the US dollar in 2026 adds another dimension to the expected strengthening of the RMB. Recently, signs of weakness have emerged in the US job market, and the valuation of US stocks has raised investor concerns. Following three interest rate cuts by the Federal Reserve since September, market consensus points toward further easing, which could exacerbate the US dollar's decline. Additionally, questions surrounding the sustainability of US fiscal policies and Federal Reserve independence could undermine the dollar's credibility.

In conclusion, the synergy of the four identified factors is expected to continue fostering RMB appreciation through 2026. Should the US dollar remain weak and international commodity prices rise, any moderate appreciation of the RMB could offset the economic impact of increasing raw material costs. Furthermore, a stronger RMB would elevate the international purchasing power of Chinese residents, potentially leading to an uptick in overseas travel.

However, it is important to note that domestic demand recovery remains uncertain, and maintaining export competitiveness is essential. Given these dynamics, significant room for RMB appreciation against the US dollar appears limited, with moderate and sustained growth towards 6.8 serving as a likely trend for the RMB exchange rate in the coming year.

Read These Next

Saudi Arabia Strikes Southern Transitional Council Targets in Yemen

On Dec 27, Saudi warplanes struck targets in Yemen's Hadhramaut, aiming to strengthen regional influence amid ongoing turmoil.

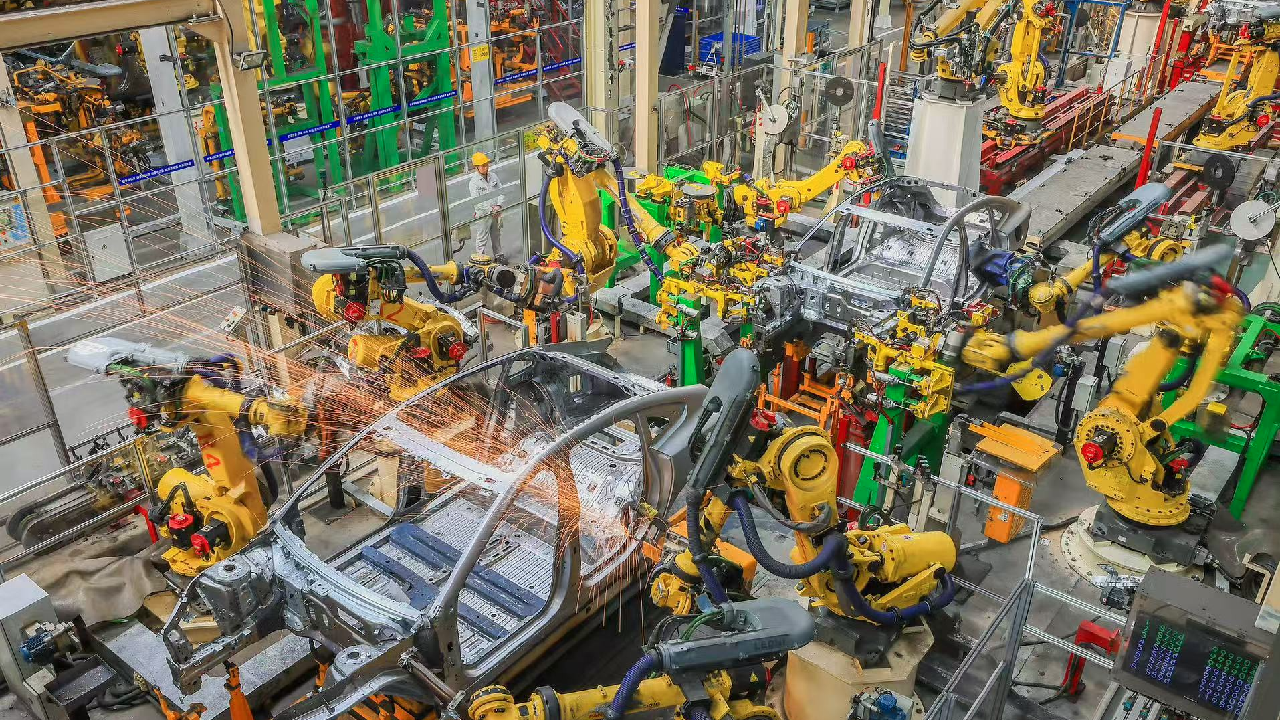

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.