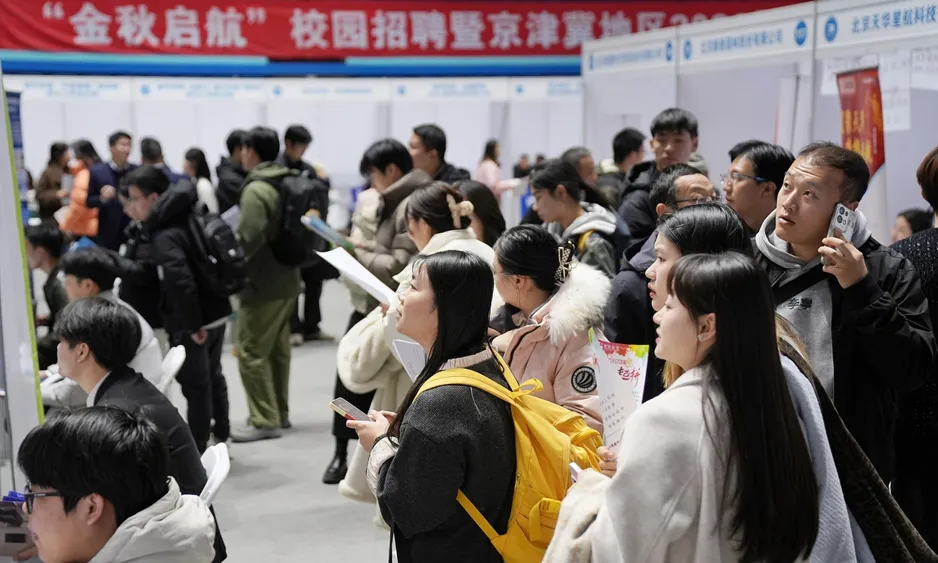

China Launches Guidelines to Boost Employment and Support Entrepreneurship

China's Ministry of Finance, in collaboration with three other departments, has issued new guidelines aimed at enhancing employment through increased entrepreneurship and financial support, with a strong focus on small businesses and job creation. The initiative underscores a strategic push towards utilizing the job creation potential within various demographic sectors.

The guidelines highlight the necessity of strengthening financing guarantees for private enterprises, thereby fostering a reinforcing relationship between business development and job growth. This move serves as a reaffirmation of the nation’s commitment to prioritizing employment as fundamental to enhancing the well-being of its citizens.

This recently issued notice, developed alongside the Ministry of Human Resources and Social Security, the People's Bank of China, and the National Financial Regulatory Administration, delineates five critical areas intended to optimize the government-backed financing guarantees to better support both employment and entrepreneurship.

Central to the guidelines is the emphasis on adopting an employment-first strategy which encourages a harmonious alignment between fiscal, financial, and employment policies. The guidelines advocate initiatives to expand job opportunities, spur entrepreneurship in priority demographics, and leverage financial resources to maximize job creation potential.

Moreover, the document stresses the importance of integrating real economy support with employment promotion, particularly through government-backed finance that focuses on small businesses and agriculture. It aims to assist micro and small enterprises that considerably contribute to job creation, helping to stabilize and expand employment as these firms increase production and investment.

Economic experts have highlighted that prioritizing labor-intensive businesses with substantial job-creation abilities will mitigate financing barriers while stabilizing business outlooks. This alignment of financial support with real economy needs is geared toward enhancing the employment elasticity associated with economic growth.

The guidelines also advocate for a more systemic approach to employment stabilization characterized by coordinated fiscal, labor, and financial policies. This integrated framework aims to provide a stronger foundation for private companies, especially micro and small enterprises, aiding in stabilizing business expectations.

Furthermore, the policies emphasize aligning government directives with market-driven operations to optimize resource allocation. Financial institutions are encouraged to independently select service recipients based on market principles, adhering to regulatory frameworks while ensuring efficient service delivery.

As part of these efforts, the guidelines underline the need for a careful balance between innovation and risk management. Banks and institutions are urged to create new financial products while enhancing technology use to offer more inclusive financing solutions for smaller enterprises.

Recent statistics underscore the significant role of the private sector in driving job creation, with reports indicating that it accounts for over 90 percent of newly generated urban employment. This further strengthens the argument for increased support targeted at private enterprises and individuals.

Looking ahead, experts stress that the key challenge lies in not just boosting short-term employment numbers, but also ensuring the quality and sustainability of jobs. This includes addressing issues like hidden unemployment and skill mismatches to foster resilient job opportunities.

Read These Next

AI and Climate Change: Navigating Europe's Critical Crossroads

Analysis of Europe's dilemma between advancing AI technology and adhering to climate goals amidst growing energy demands and regulatory challenges.

Hubei Lab Achieves World Record with 800 km/h Maglev Breakthrough

Hubei researchers set a world record by accelerating a maglev rail model to 800 km/h, showcasing China's transport advancements.

Strong 66 Magnitude Earthquake Hits Waters off Taiwan

A magnitude 6.6 earthquake hit off Yilan County, Taiwan, on Dec 27, 2025, raising alerts and discussions on disaster preparedness.