Biofuels: Strategic Transition Opportunities and Challenges

The recent transformation of a company from traditional environmental services to focusing on the biofuel sector highlights a significant shift within the global energy landscape. As the world continues to grapple with pressing climate change concerns and an increasing push towards renewable energy sources, this company's strategic pivot towards biogas and biofuels underscores broader economic trends shaping the industry. The urgency for cleaner alternatives is spurred by stringent regulations and shifting consumer preferences, making this transition both timely and critical in safeguarding the company's future prospects.

A notable economic force driving this shift is the substantial growth in the biofuel market, where demand for sustainable energy solutions is projected to surge. The establishment of partnerships, such as the recent collaboration with CNPC, will not only bolster the company's market position but also enhance its access to necessary capital and resources for innovation. Moreover, the projected adjustment mechanism for carbon borders (CBAM) set to take effect in January 2026 could offer significant competitive advantages for firms engaged in carbon emission reduction strategies. However, the unpredictability of carbon credit pricing and the ease of entry for competitors into this sector raises concerns about maintaining a sustainable competitive edge.

While the company has exhibited a strong project-based track record—culminating in over 400 projects related to filtrate treatments—the shift to biofuels also hinges on the viability of these initiatives amid fluctuating regulatory landscapes and economic uncertainty. With volatility being a core threat to profitability, particularly as regulations evolve, it raises critical questions about the timing and scope of investments in new biogas projects. Moreover, with increased competition within environmental services, there is a palpable risk that without innovation, growth could stagnate. Would the company’s careful approach to expanding its project portfolio and investment in energy efficiency solutions be sufficient to shield it from broader market fluctuations?

Investors should remain cautiously optimistic about the firm's future; while it is decentralized and adopting a diversified business model, the balance of risk and opportunity is delicate. The anticipated growth in energy efficiency solutions is promising, particularly as eco-friendly demands intensify. However, both regulatory dependence and the economic feasibility of new projects remain significant hurdles. The need for a robust political framework, ensuring supportive green subsidies, will be paramount for the company's long-term strategies. If these elements do not align, the impact on financial performance could be substantial.

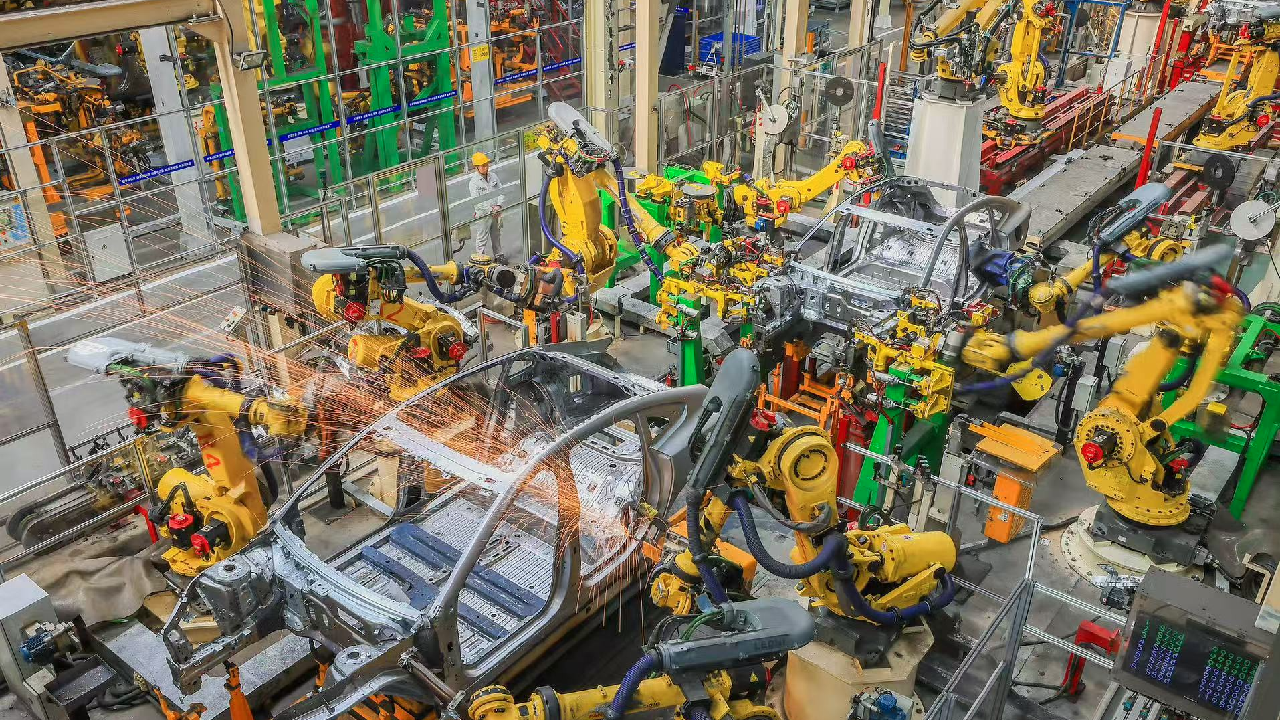

In conclusion, the company's proactive engagement in biogas and associated fields positions it well to capitalize on emerging market trends. This ambition to diversify into liquid cooling and robotics, coupled with strong partnerships, indicates an awareness of the multidimensional nature of growth in the energy sector. Nevertheless, the ability to navigate through volatile market dynamics and evolving regulatory environments will ultimately determine its success in reaping the opportunities that lie ahead. Stakeholders—be they investors, regulators, or consumers—must all be cognizant of this evolving landscape and prepared to adapt to the promising yet uncertain future of renewable energy.

Read These Next

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.