300,000 Student Loan Borrowers Face Denial After Court Ruling

The recent news regarding the denial of over 300,000 applications for income-driven repayment (IDR) plans by the U.S. Department of Education underscores a critical point in the ongoing student loan crisis in America. With more than 42 million Americans holding approximately $1.6 trillion in student debt, the repercussions of these denials extend beyond individual financial burdens; they raise significant questions about regulatory efficiency and borrower rights within the current administration's framework. Nearly half a million borrowers now face the dire prospect of hefty monthly payments that they might fail to afford, potentially exacerbating an already precarious situation for many.

The most striking aspect of this situation is the assertion by the Department of Education that the bulk of denials stem from "unexpected ambiguity" regarding which repayment plan should be chosen when multiple plans yield similar payments. In an environment where transparency is essential to financial policymaking, this arbitrariness may undermine public trust and further complicate matters for borrowers who are diligently trying to manage their debts. Given the Department's estimates of increasing defaults—potentially reaching 10 million borrowers soon—the stakes couldn't be higher. During a time when federal policy aims to relieve the burden of student debt, this predicament raises fundamental questions: could the existing framework lead to a backlash against reform initiatives? Moreover, this situation is reminiscent of the fallout from the 2008 financial crisis where misunderstandings and lack of clarity in lending practices led to widespread disillusionment and financial ruin. Borrowers today, similarly, may end up trapped in cycles of forbearance or high monthly payments—echoes of failures past. Consumer advocates have voiced their concerns, emphasizing the risk of borrowers missing out on qualifying months necessary for Public Service Loan Forgiveness programs, putting additional pressure on already strained borrowers. With wage garnishment set to resume in January, the urgency to address such barriers is paramount.

Interestingly, expert opinions provide both a critique of the Department's logic and suggest feasible paths forward for affected borrowers. Mark Kantrowitz noted that the reasoning behind the denials lacks robustness, a sentiment echoed by consumer rights advocates. The seemingly arbitrary nature of the denial process could inadvertently discourage borrowers from seeking assistance, limiting their potential for long-term financial stability. In light of this, is it not logical for the Department of Education to refine its processes to better serve borrowers? Moving forward, borrowers who were denied applications are advised to re-apply, but this may require further time and awareness from the borrowers themselves about the specifics of each repayment option available. This leads to another question: Are borrowers equipped with the financial literacy needed to navigate these complexities, or will they remain at the mercy of bureaucratic inefficiencies? Given these challenges, it's crucial to enhance educational resources that equip borrowers with the knowledge to make informed decisions.

In conclusion, the recent denials of IDR applications not only deepen the student loan crisis but also spotlight systemic inefficiencies within the Department of Education's approach to managing student debt. As the trajectory of borrower distress continues to unfold, it is essential for both policymakers and educational institutions to re-examine existing frameworks and implement reforms that prioritize clarity, accessibility, and support for borrowers. Investors and stakeholders in educational financing should closely observe these developments, as they are poised to influence long-term trends in consumer behavior and regulatory landscapes. The path ahead remains fraught with challenges, yet it also presents an opportunity for transformative change in how student debt is handled in the U.S.

Read These Next

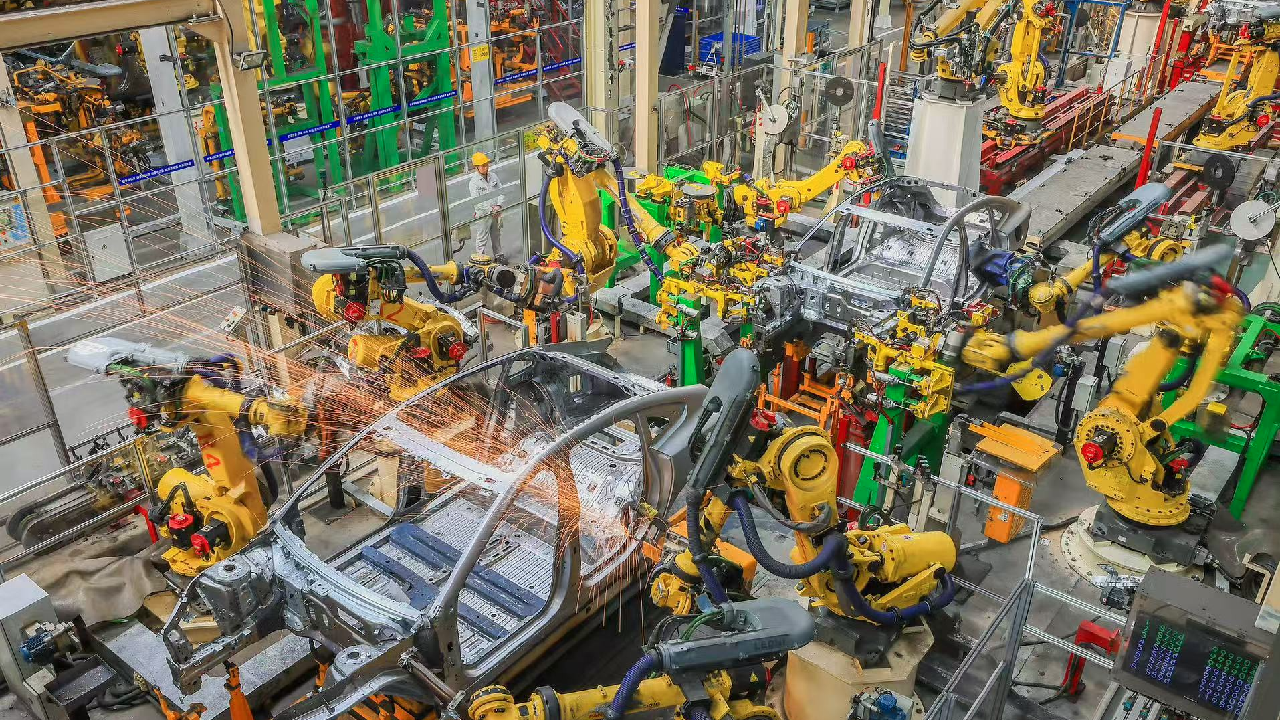

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.