Yunshou Partnership Revises Strategy Due to Financial Obligations

The recent developments within the 云寿合伙企业 (Yunshou Partnership Limited Liability Company) mark a significant turning point in how the organization approaches its business operations and financial commitments. The signing of a new memorandum aimed at correcting investment fund obligations is a strategic maneuver that not only provides the company with enhanced flexibility in managing its commitments but also has wider implications for the overall financial landscape. With the extension of the investment period from 2025 to 2033, there appears to be a conscious effort to mitigate short-term financial pressures, allowing the company to focus on longer-term growth strategies.

Financially, the company's landscape remains active, characterized by substantial obligations, including a notable 15 billion Yuan expended in 2022 just to address buyback commitments. This proactive stance on debt management may provide a cushion against adverse market conditions that could disrupt cash flows. However, one must question whether this is a sustainable approach in an environment where liquidity can suddenly tighten, as seen in past crises like the 2008 financial downturn. Furthermore, the company’s recent strategic transition—restructuring its management and partner responsibilities—can be interpreted both as a risk mitigation tactic and as an opportunity for streamlining operational effectiveness.

Despite these proactive measures, there is an array of potential risks looming over the horizon. The company's unfulfilled obligations towards Yunshou Partnership concerning buybacks must be resolved to avoid jeopardizing investor confidence and regulatory compliance. The warning for continuous monitoring of market conditions highlights an unavoidable complacency that can easily disrupt operations, reminiscent of past economic crises where enterprises struggled to adapt to rapid shifts. The company's emphasis on stakeholder communication is crucial to navigate these challenges effectively. In balancing the perspectives of investors seeking returns, regulators enforcing compliance, and consumers desiring stability, the organization faces a complex landscape. The fundamental question remains: Can this company effectively turn current challenges into opportunities without succumbing to the weight of unmet obligations?

In conclusion, the recent strategic realignments and active debt management efforts underscore a shift in 云寿合伙企业's operational strategy, aiming for long-term sustainability despite the associated risks. While the extended timeline for investment obligations offers some respite, the company must navigate the delicate balance of maintaining investor support and regulatory compliance. As the market continues to evolve, the path forward will undoubtedly require not only resilience but also agility in decision-making. Investors keeping a close watch on this unfolding situation should remain aware of both the potential for innovation and the ever-present risks that could impede growth.

Read These Next

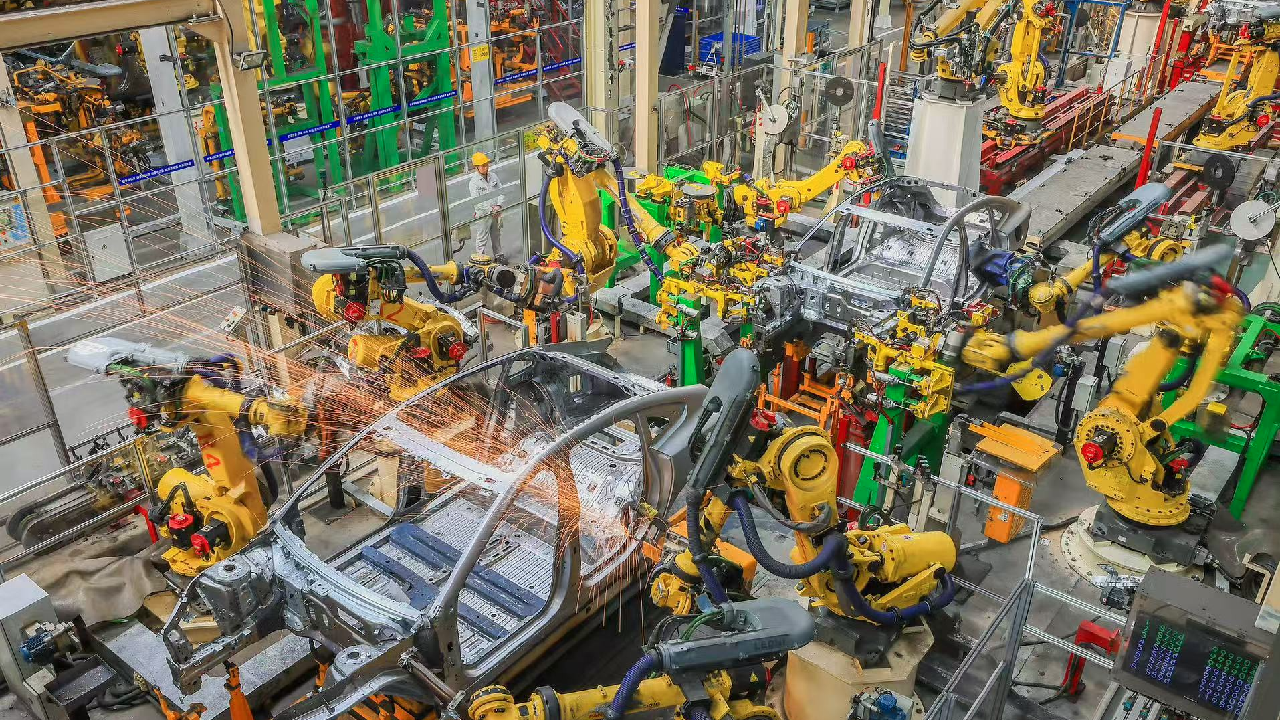

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.