Shanghai silver futures main contract jumps over 6% in night session

On December 27, the Shanghai silver market witnessed a significant uptick, with the main futures contract surging over 6% to close at 19,204 yuan per kilogram. This sharp increase reflects strong demand from investors alongside favorable market trends that have been supporting precious metal prices. Such movements typically attract attention from traders seeking to capitalize on the volatility inherent in commodity markets.

The rise in silver futures also underscores the broader trends within the commodities space, where heightened interest in safe-haven assets has propelled prices amid ongoing economic uncertainties. Analysts suggest that the uptick may continue as market participants monitor inflation rates and geopolitical developments. The Shanghai silver market, being a key player in the global commodities arena, remains sensitive to these macroeconomic factors.

Read These Next

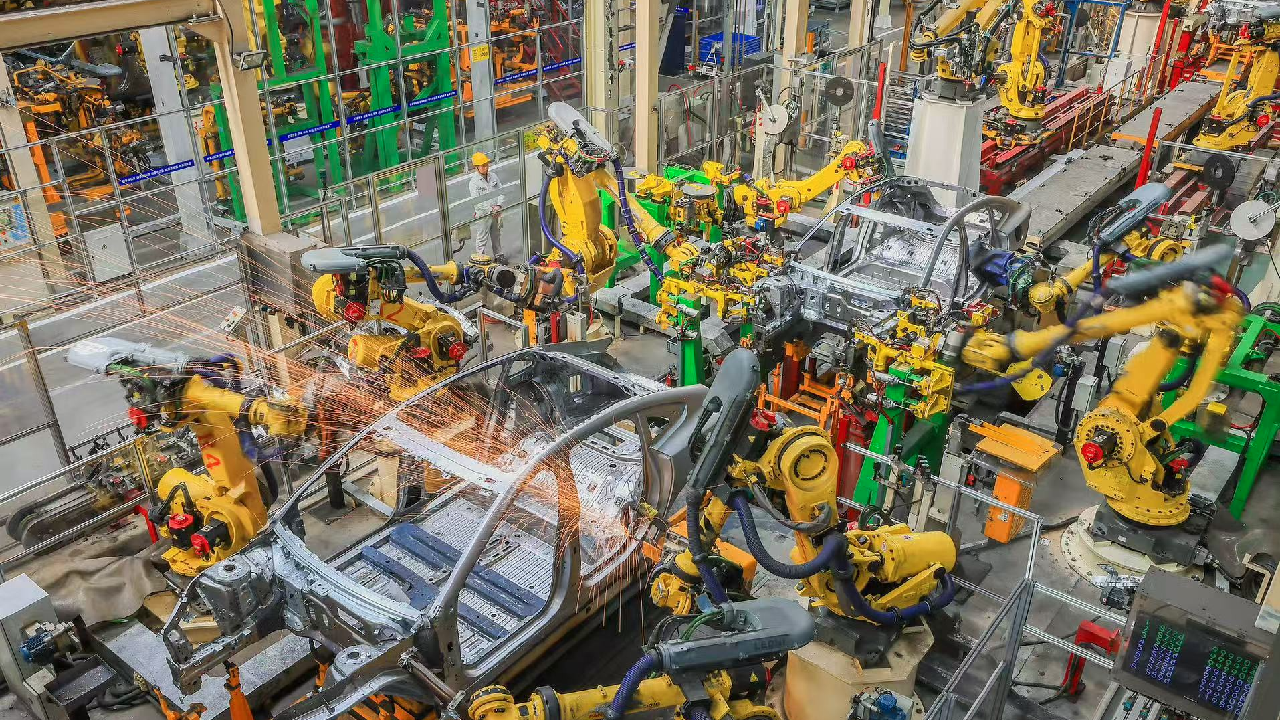

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.