Navigating Shareholder Dynamics: 2025 Meeting Insights

The recent extraordinary shareholders' meeting of the company, convened for the fiscal year 2025, reflects a pivotal moment in the company's governance landscape, underscoring how corporate structures adapt to shareholder engagement in an evolving market. The hybrid voting format allowed both in-person and online participation, thereby enhancing inclusivity and transparency—a move that social distancing measures during the pandemic have made increasingly popular. As shareholder activism rises, the successful navigation of such gatherings marks a significant affirmation of management strategies and shareholder confidence in the current leadership.

A substantial 49.53% of share representation—917,728,788 shares, supported by 1,227 participants—demonstrates an engaged ownership eager to partake in shaping the future direction of the company. Shareholder support for the update to the accounting department reached a remarkable approval of 99.58%, signaling trust in the company’s financial governance and presenting a solid front against economic uncertainties. Moreover, the outlined three-year dividend distribution plan highlights financial resilience, suggesting the company's ability to maintain profitability and return value to shareholders despite the backdrop of evolving market conditions.

However, this shareholder enthusiasm does not come without its risks. The exclusion of preferred shareholders and the necessity to comply with regulatory frameworks could lead to dissatisfaction among affected groups—a consideration that management must be astutely aware of going forward. Notably, the legal validation provided during the meeting assures compliance but also raises a pivotal question: Are the interests of minority shareholders effectively represented in the long run? The abstentions and opposition votes, tallied at 5,269,677 against and 702,400 abstentions, could imply underlying dissent or concerns that require proactive management to ensure alignment with broader shareholder interests.

The trend of high approval rates—99.65% for the dividend plan among minority shareholders (98.19% overall approval)—draws attention to a critical junction where corporate governance strategies must evolve. With an increasing reliance on management-hosted proposals, the company must mitigate potential conflicts of interest while ensuring that minority shareholder voices are amplified. Observing how these dynamics unfold could serve as a bellwether for future corporate governance practices, particularly as we look to the past crises such as the 2008 financial collapse, where shareholder transparency and accountability became critical in restoring market trust.

In conclusion, the interaction between the company and its shareholders signals a robust approach to corporate governance and financial management amid turbulence. However, the potential pitfalls posed by discontent among minority stakeholders require vigilance from management. Nourished by proactive communication and responsive governance, the company stands to leverage its strong foundation into sustained growth and enhanced market positioning. As we move further into 2025, the challenge remains to harmonize diverse shareholder interests while maintaining a committed dividend policy—essentially, how can the company assure all stakeholders of its ongoing viability in an ever-complicated economic landscape?

Read These Next

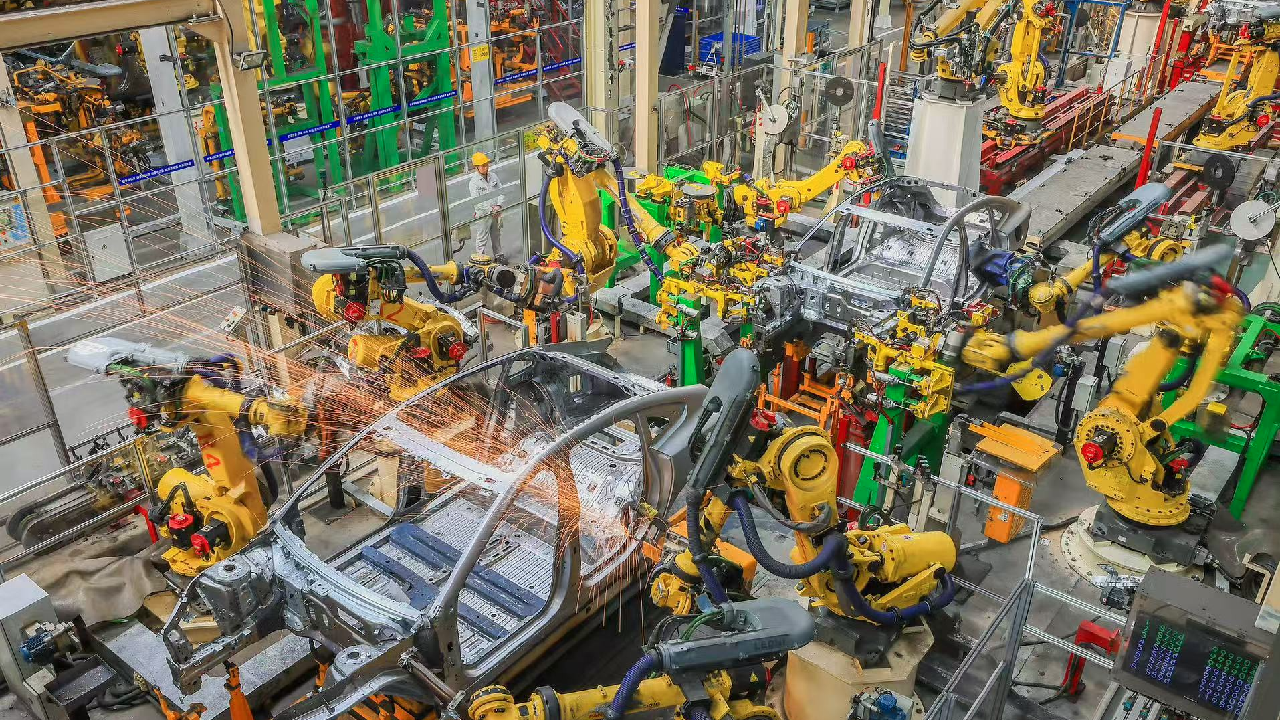

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.