Beijing Jinchengzi Technology's Strategic Shift Analysis

The recent developments at Beijing Jinchengzi Technology Co., Ltd. reflect a pivotal moment for the company as it navigates through a significant capital restructuring. The strategic decision to issue stocks while simultaneously making cash payments for asset acquisition encapsulates a dual approach to drive growth and solidify company valuation. With increasing global interest in tech-centric firms, this transaction underscores the company's ambition to bolster its market position—one that has broad implications for stakeholders including investors, employees, and regulators alike.

A noteworthy aspect of this transition is the approval of an employee stock ownership plan (ESOP). This initiative not only aligns employee interests with the company's overarching goals but also signifies a shift towards a more inclusive corporate governance model. Recent studies have shown that companies facilitating ESOPs tend to experience enhanced productivity, greater employee retention rates, and improved profitability, thereby affirming the growing trend of democratizing ownership within corporate structures. The 1,571,908 shares related to this plan reflect robust participation and commitment, signaling to investors a proactive approach to workforce engagement.

However, it is essential to assess the risks associated with this ambitious endeavor. The suspension of trading on July 31, 2025, for the purpose of restructuring poses potential short-term volatility that could unnerve investors. Furthermore, the market's reaction to the announced transaction—constituted by both stock issuance and cash payments—will be significantly influenced by perceptions of the company’s transparency and regulatory compliance. Despite no documented cases of insider trading, ongoing vigilance is crucial as missteps in regulatory aspects could lead to severe repercussions, risking both financial and reputational capital. Is the market prepared for the possibility that an overly ambitious growth strategy may overshadow the immediate benefits of compliance?

In looking forward, Beijing Jinchengzi Technology Co., Ltd. must weigh the benefits of capital inflow against potential market perceptions. The historical precedents of capital restructuring in tech firms often reveal a mixed bag of outcomes; for instance, the dot-com bubble illustrated how unfettered growth could swiftly turn into volatility when market expectations are not met. Thus, maintaining a balance between aggressive expansion and prudent financial management will be key in the upcoming quarters. Stakeholders must pursue a transparent dialogue to mitigate any risks of macroeconomic shifts affecting the company’s trajectory.

Read These Next

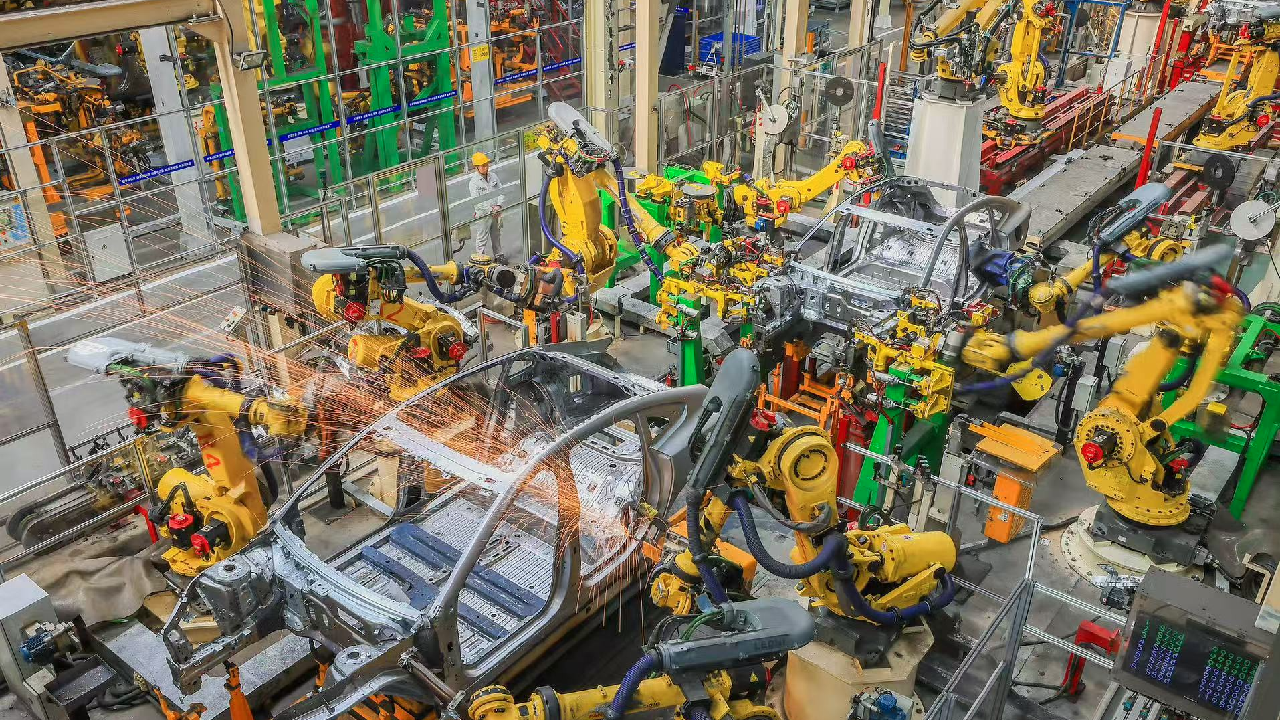

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.