Analyzing Company Diversification and Growth Strategies

In the ever-evolving landscape of technology and market demands, the recent developments of this company represent a significant pivot towards innovation and diversification. As businesses adapt to new consumer needs and technological advancements, the company's foray into the animal husbandry sector serves as a signal of its commitment to leveraging its core competencies in RFID technology. This strategy not only addresses a burgeoning market but also aligns with global trends towards smart agriculture, highlighting the importance of agility in corporate strategy.

Financially, the company reported a commendable revenue growth of 11.16% in the first three quarters of 2025, with total revenues reaching approximately 417.7 million Yuan. This increase reflects a robust demand for RFID solutions across various sectors, and particularly underscores the potential growth trajectory in smart agriculture and animal husbandry. However, while these numbers paint a picture of health, analysts must consider the underlying economic forces at play. Currently, various sectors are experiencing inflationary pressures that could influence future earnings, as consumer price index (CPI) fluctuations impact spending behavior. Furthermore, as the company embarks on its investment strategy—characterized by both organic growth and potential acquisitions—investors should weigh the anticipated return on investment against the backdrop of economic uncertainty.

The risks associated with such a diversification strategy cannot be overlooked. Entering the animal husbandry market, still in its infancy, presents operational risks that could translate into short-term profitability challenges. The competitive landscape in both this new segment and existing markets remains intense, necessitating a strong focus on innovation and differentiation to secure market position. Additionally, concerns regarding the security of RFID data have been raised; while the company commits to addressing these vulnerabilities, stakeholders must remain vigilant. What steps are being taken to ensure comprehensive data protection? Ensuring the integrity of data not only adheres to regulatory requirements but also fortifies consumer trust—an increasingly salient factor in today's market.

Looking ahead, the strategic choices made by the company will serve as a critical indicator of its long-term success. While the current trajectory suggests an optimistic outlook bolstered by growth in smart sectors, the challenge will lie in navigating operational risks and market competition. Moreover, potential unintended consequences of a rushed market entry into sensitive sectors could jeopardize brand equity if not managed prudently. In light of these factors, investors must maintain a balanced perspective—recognizing both the opportunities presented by innovation and the pragmatic realities of today's economic environment. As the game of corporate chess unfolds, stakeholders should prepare for a landscape marked by both volatility and opportunity as this company transitions into a promising new era.

Read These Next

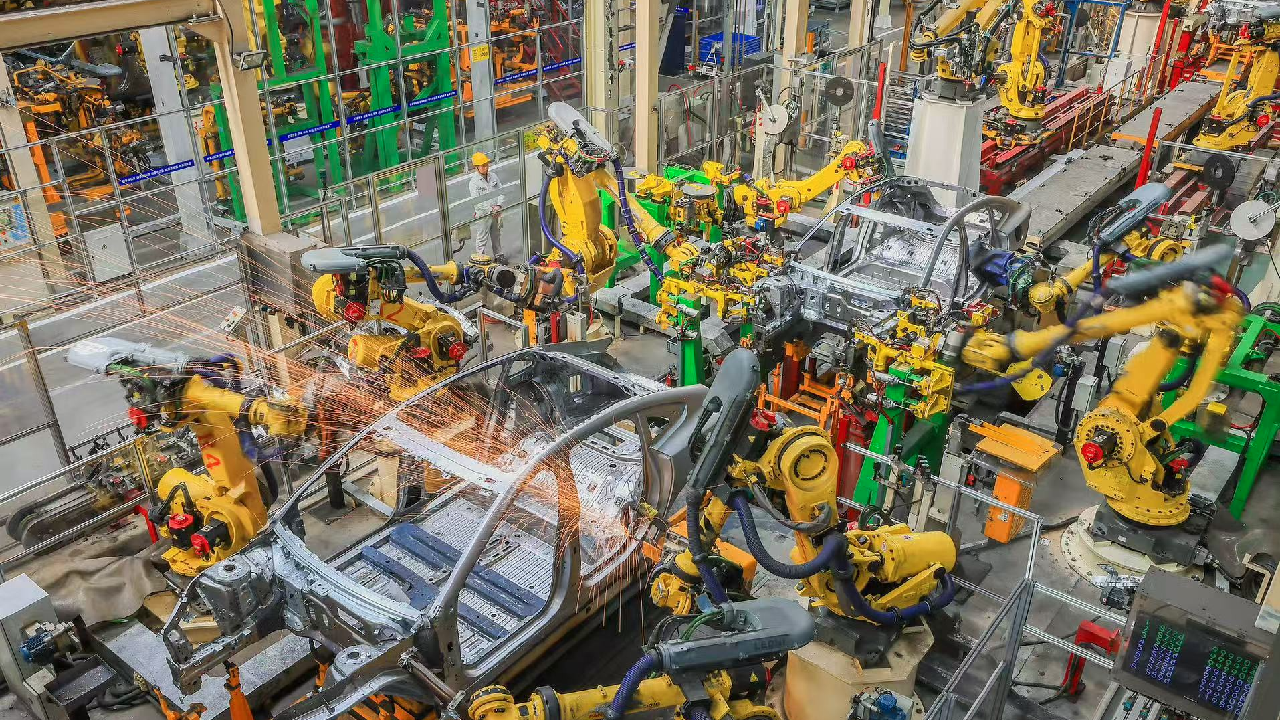

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.