5 Infrastructure Stocks That Tripled This Year Thanks to AI

The recent surge in stock prices of various infrastructure firms amidst the AI boom certainly signals a tectonic shift in the technology landscape. Nvidia, as the headline act, has captured investor attention with its astonishing thirteen-fold increase in value since the end of 2022, yet it is the equally momentous rise of subsidiary firms that deserves closer scrutiny. As companies funnel an estimated $380 billion into data center expansion this year, understanding which players will best capitalize on this burgeoning demand becomes crucial for investors seeking alpha.

For instance, Lumentum, known for its laser-based components, has seen its stock price skyrocket a staggering 372% in 2025. The company's pivot towards supplying optical connections designed for AI servers epitomizes a core trend: the increasing interdependence of AI computing and cutting-edge infrastructure. Beyond the current quarter's 58% revenue increase to $533 million, Lumentum's forward guidance does hint at a potential deceleration in growth rates to 32% and 15% in fiscal years 2026 and 2027, respectively. This slowdown invites a rhetorical inquiry: Do current valuations fully incorporate such potential headwinds?

Similarly, Western Digital, Micron, and Seagate have all recorded staggering increases in stock values—approaching 300% for Western Digital and 240% for Micron. However, the essential question remains: Is the market possibly inflating these stocks based on a trajectory that may not be sustainable? Western Digital's reliance on hard drives as a 'data fuel' for AI applications reveals both a market opportunity and the hazards of over-reliance. As seen in case studies such as the dot-com bubble, companies that failed to adapt to evolving technological demands often faced drastic corrections. In this context, while the near-term seems lucrative for these infrastructure plays, long-term assessments could potentially reveal vulnerabilities, especially in an environment characterized by volatile demand and rapid technological advancements.

Furthermore, these infrastructure firms share significant operating exposure to AI hardware demands yet face potential firsthand consequences of an overheated market. For stakeholders across the spectrum—investors, regulators, consumers—overestimating the ceiling of sustainable growth could be perilous. Furthermore, higher interest rates resulting from central banks' quantitative tightening measures may exacerbate funding challenges, potentially hindering companies' investments in R&D and innovation, which are vital for continued success.

In conclusion, while the current narrative surrounding infrastructure companies in the AI domain appears robust and enticing, it is imperative for investors to approach this segment with a discerning eye. A combination of healthy skepticism and analytical vigor can unearth underlying weaknesses in business models stemming from both internal and external pressures. As we look towards 2026 and beyond, the ability of these infrastructure players to adapt to slowing growth rates, alongside rising competition and potentially tightening monetary conditions, will ultimately dictate the sustainability of their phenomenal valuations.

Read These Next

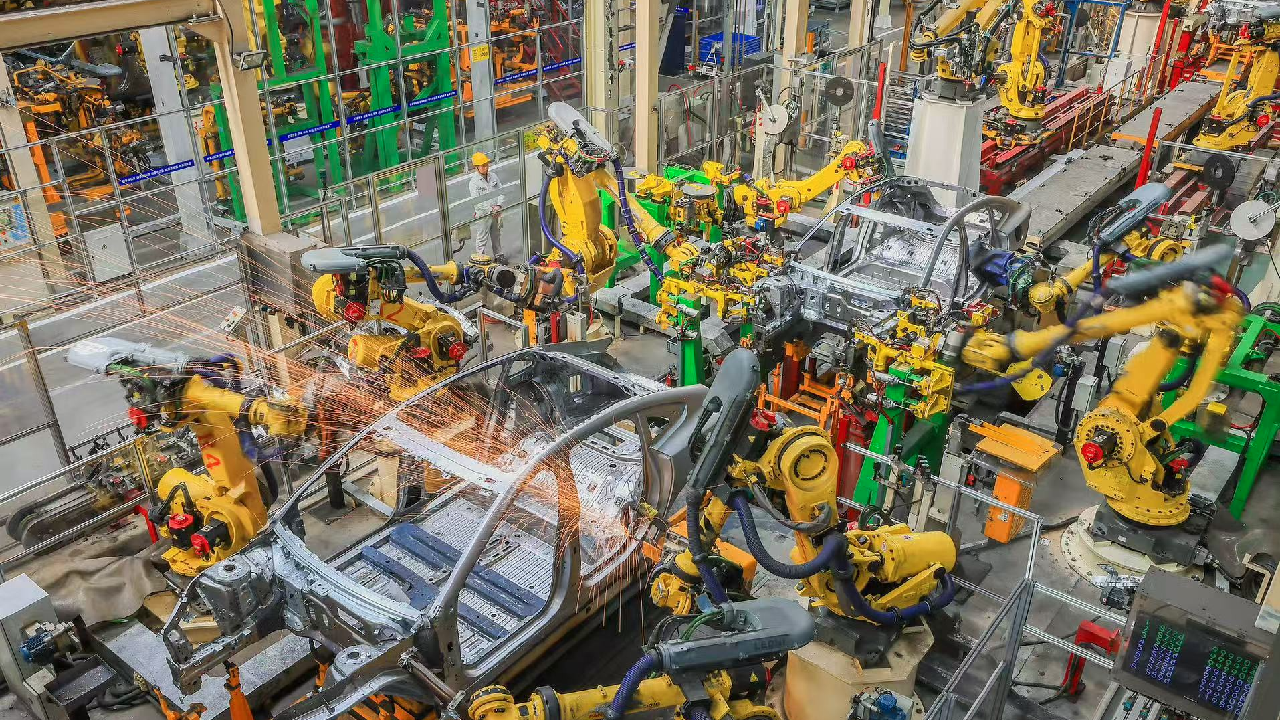

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.