ShuiJingFang's Strategy Against Misinformation in Markets

The recent clarification from Sichuan ShuiJingFang Co., Ltd. regarding takeover rumors underscores a notable trend in corporate governance and investor relations amidst an increasingly volatile market landscape. In an environment where misinformation can spread rapidly, the company’s swift response signals a robust approach to safeguarding investor confidence, which is crucial given the dual pressures from market speculation and consumer sentiment. Such proactive measures reflect an overarching strategy to maintain not only market stability but also the integrity of the company’s valuation in the eyes of stakeholders.

This incident sheds light on deeper economic forces at play, especially in sectors that are sensitive to consumer perception and market narratives, such as the beverage industry. With the global markets battling various headwinds, from inflationary pressures—reflected in metrics such as the Consumer Price Index (CPI)—to tighter monetary policies that are navigating the equilibrium between growth and stability, companies like ShuiJingFang must navigate these complexities. The backdrop of quantitative tightening across many economies poses a risk that could magnify the volatility of stock prices, making it ever more critical for corporations to maintain open channels of communication with investors.

Historically, we can draw parallels to events like the dot-com bubble, where misinformation and irrational exuberance led to substantial market corrections. In such contexts, it becomes imperative for companies to differentiate between valid market dynamics and speculation that can alter public perception and investment decisions. The potential credibility of the rumors about a takeover could have far-reaching implications for ShuiJingFang, ranging from changes in its stock price to potential shifts in investor sentiment, all of which necessitate a nuanced understanding of market psychology. After all, why do misleading speculations gain traction, and how should companies counteract this risk effectively to protect their brand and financial standing?

Going forward, the potential risks and opportunities for Sichuan ShuiJingFang are multi-faceted. On one hand, the company must remain vigilant against market misinformation and shore up its investor relations framework; on the other hand, it could consider reevaluating its strategic positioning in the market to capitalize on consumer trends or potential partnerships—strategies that could ultimately enhance its EBITDA margins and long-term growth prospects. As we move through an uncertain economic climate, the companies that embrace transparent communication and strategic agility will be better positioned to thrive in the face of external pressures.

Read These Next

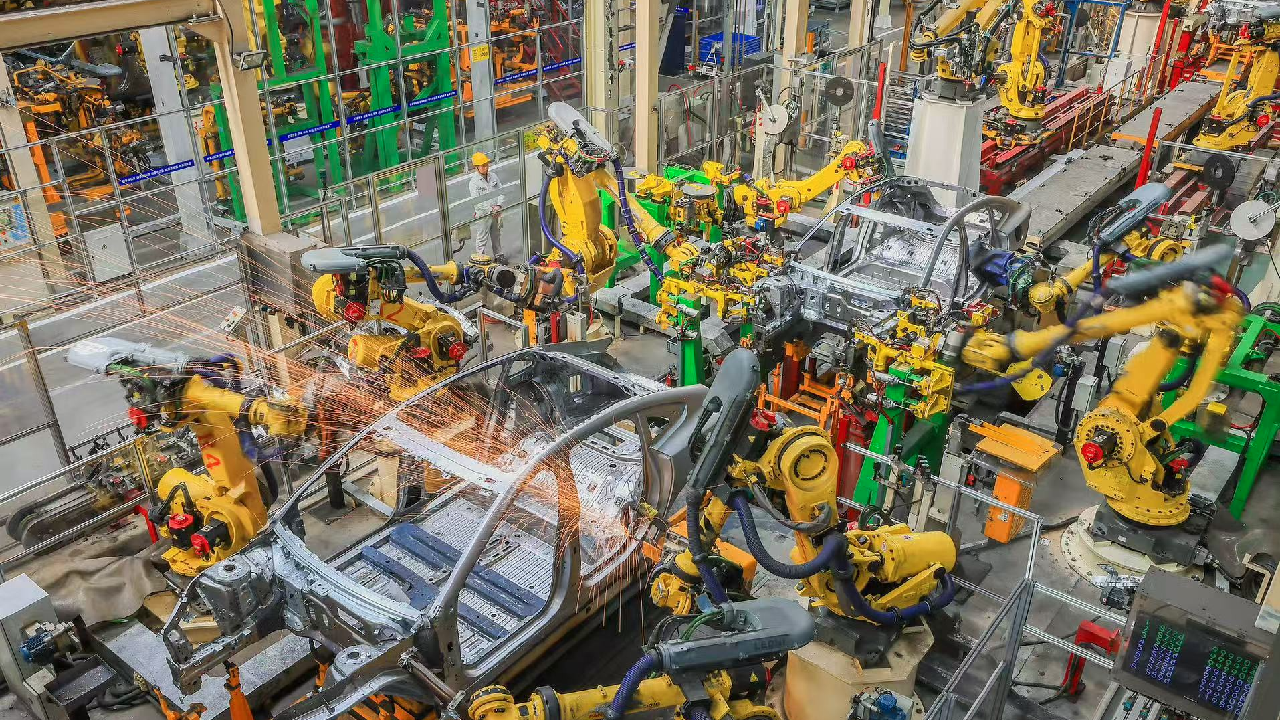

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.