Nvidia Acquires Groq: Opportunities and Challenges Ahead

In a significant development for the artificial intelligence (AI) sector, Nvidia has reached an agreement to acquire the assets of Groq, a startup focused on developing high-performance chips for AI acceleration, in a deal valued at $20 billion in cash. This acquisition, the largest in Nvidia’s history, highlights the ongoing race to dominate the burgeoning AI market, a race intensified by global demand for advanced computing technologies. As Nvidia's CEO Jensen Huang stated, the integration of Groq’s technologies into their existing architecture aims to broaden their offerings and enhance capabilities in AI inference and real-time applications.

The context surrounding this acquisition is steeped in the rapidly evolving landscape of AI technology, where companies like Nvidia, Meta, and Google vie for supremacy by snapping up talent and innovations. The deal comes shortly after Groq successfully raised $750 million in a funding round, reaching a valuation of approximately $6.9 billion. Investors such as BlackRock and Cisco played pivotal roles in supporting Groq, yet it is worth noting that Nvidia's swift move to acquire the startup may indicate a strategic push to solidify its lead in an industry experiencing exponential growth. The company reported $57 billion in revenue for the third quarter of 2025, showcasing robust demand and operational efficiency, as they navigate a competitive environment characterized by surging sales in AI hardware.

However, the acquisition raises important questions about the sustainability of such rapid growth in the tech sector. Historically, acquisitions of this magnitude can lead to integration challenges and cultural clashes, potentially straining operational coherence. It brings to mind the 2008 financial crisis, during which rapid consolidation in the banking sector led to systemic vulnerabilities. Investors must consider whether Nvidia’s aggressive acquisition strategy could place it in a precarious position should economic headwinds arise—especially as corporations reduce spending amid fears of inflation and potential economic downturns. Furthermore, as Nvidia bolsters its position in AI, it also invites scrutiny from regulators concerned about monopolistic behaviors in tech industries. How will Nvidia balance innovation while adhering to potential regulatory pressures?

Yet, the strategic acquisition of Groq also presents significant opportunities. With projected revenues of $500 million for Groq amid increasing demand for chips optimized for AI workloads, Nvidia stands to benefit substantially as it enhances its portfolio of cutting-edge technologies. Moreover, aligning with Groq’s expertise may pave the way for advancements in sectors ranging from cloud computing to autonomous systems, catalyzing substantial growth opportunities across the tech ecosystem.

Looking ahead, Nvidia seems well-positioned to continue evolving at the forefront of AI technology advancements. As it integrates Groq's assets and cultivates innovation, stakeholders, including investors and consumers, must remain vigilant about both the risks and rewards associated with this deal. The industry could witness a paradigm shift in how AI computing power is leveraged, as Nvidia pushes the envelope on innovation. Will this acquisition be the catalyst for new breakthrough technologies, or could it precipitate unforeseen challenges akin to those seen in previous tech booms? Time will reveal the answer.

Read These Next

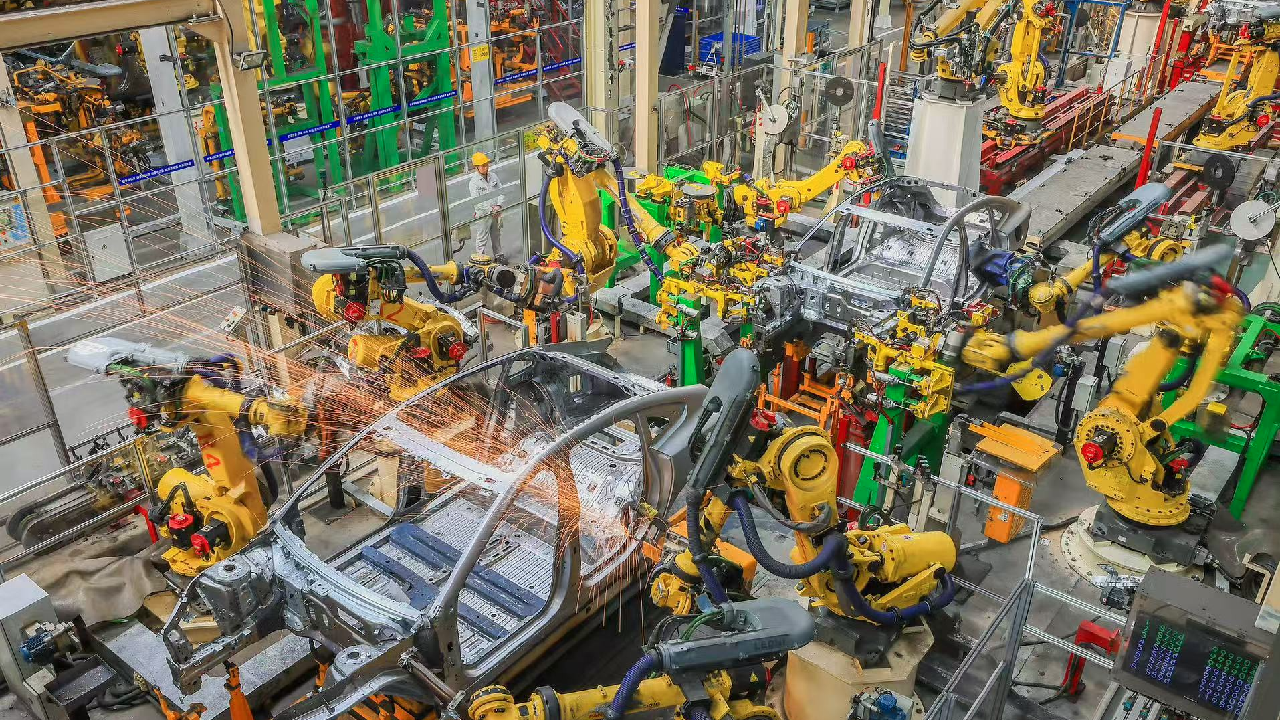

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.