Navigating Growth and Governance Risks in Corporations

The recent board decisions reflect a pivotal moment in the company’s governance and operational strategy, especially as it plans for a more dynamic business environment ahead. The board's approval of external guarantees for 2026 symbolizes not only an anticipated growth trajectory but also underscores a significant shift in risk management practices. In today's market landscape, where external uncertainties abound, such proactive measures can potentially buffer the company against volatility, thus enhancing investor confidence and positioning it favorably against peers. Moreover, the resignation of independent director Zhu Changlin followed by the nomination of Ye Meiping signifies a critical adjustment in leadership. Independent directors play an essential role in ensuring board independence and maintaining stakeholder trust, so this transition invites a closer examination of potential implications for corporate governance. Will this shake-up lead to a more robust oversight mechanism or incite concerns about the continuity of strategic objectives? This question looms large as the company embarks on restructuring its boardroom dynamics. In conjunction with these changes, the proposed compensation system for directors and upper management indicates a strong commitment to aligning management incentives with performance goals. By fostering higher motivation levels, the company could enhance operational efficiency, which historically correlates with improved EBITDA margins. Given the backdrop of a competitive market, the alignment of executive rewards with strategic milestones could be a formidable tool for driving better financial outcomes.

However, it is crucial to evaluate this from multiple angles. Notably, the absence of dissent during the board's recent decisions may suggest a well-aligned management team; however, it could also imply a lack of robust debate that is essential for challenging the status quo. Companies that echo a singular voice in board decisions may encounter the risk of stagnation, which can lead to missed opportunities for innovation. Looking back at the dot-com bubble of the late 1990s, we note that periods of unchecked optimism and consensus often precede significant market corrections. While the immediate outlook for the company appears robust, the reliance on newly proposed guarantees poses operational risks should the underlying subsidiaries falter financially. Such dependencies could ripple through to the parent company and negatively impact its overall financial health, echoing the pitfalls witnessed during the 2008 financial crisis when interconnected risks were underestimated. Investors should remain cautious yet optimistic; this reflects the duality of the current opportunities veiled by precarious risks. Stakeholders will need to closely monitor the board’s composition and the outcomes of the proposed compensation system. A balanced approach that weighs the benefits of strategic growth against the potential hazards of management transitions will be paramount for sustaining stakeholder trust and achieving long-term success.

Read These Next

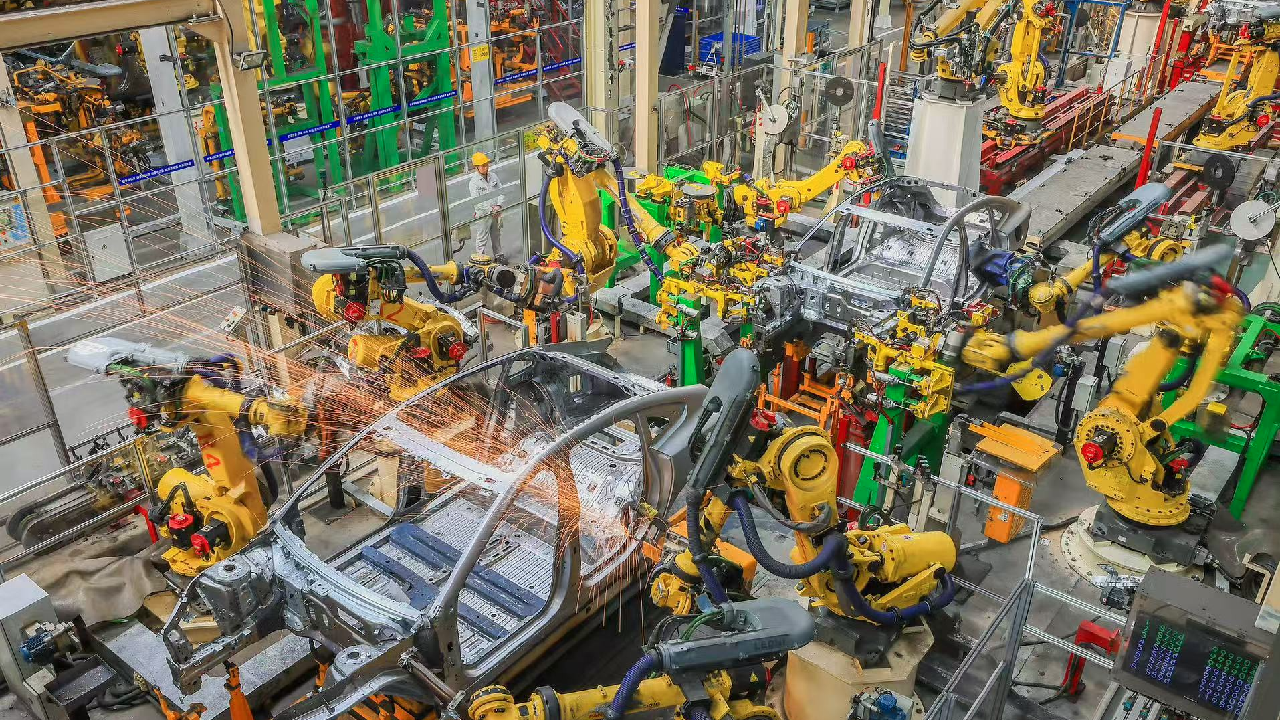

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.