Fuling Zhuacai's Strategy Amid Market Challenges

In an era defined by fast-paced changes and competitive pressures, the recent disclosures from Chongqing Fuling Zhuacai Group Co., Ltd. (Fuling Zhuacai) present significant insights into the company’s strategic ambitions and the dynamic landscape of the food production sector. The company’s initiatives, particularly its move to explore the acquisition of Weizimei, a mixed spices manufacturer, signal a deliberate pivot toward diversifying product offerings in response to consumer demand for variety and quality. This acquisition, if successful, could prove to be a pivotal moment not only for Fuling Zhuacai’s profitability but also for its overall market positioning.

From a financial perspective, the company is currently positioning its non-cabbage-based products in the mid-price range, indicating a clear strategy to become a formidable player in the quality food market, distinct from its competitors that primarily engage in price wars. This approach is further complemented by Fuling Zhuacai's efforts in forming new distribution partnerships with significant platforms like Hema and Sam's Club, which is likely to enhance brand visibility and customer reach. However, as the company navigates these new channels, it must remain vigilant about maintaining EBITDA margins in a fiercely competitive environment. What repercussions could the increasing costs associated with brand promotion and product innovation have on these margins?

Moreover, the strategic investments into international markets serve as a testament to Fuling Zhuacai's long-term vision of becoming a global player. The establishment of a dedicated international department focused on regions such as the USA and Europe represents not just an expansion of market opportunities but also diversifies revenue streams, potentially offsetting domestic competition risks. However, the company's aspirations are not without their risks. Price volatility of agricultural raw materials can lead to increased operational costs, and while the company’s strategy to bolster inventory is prudent, it begs the question of whether it is equipped to handle the fluctuations inherent in global supply chains. The anticipated price wars in the industry compound this uncertainty, raising concerns over profit margins in a market that seems destined to prioritize low costs over quality.

In conclusion, while Chongqing Fuling Zhuacai Group Co., Ltd. is making commendable strides toward achieving operational diversification and market expansion, the path forward is fraught with challenges. The ongoing pressure from price competition and raw material costs will require the company to adopt agile strategies that balance quality with fiscal responsibility. The proactive approach of financial management and innovative product positioning could serve as a crucial lever in mitigating risks, yet stakeholders must remain acutely aware of the transformative changes in consumer behavior and competitive dynamics. As such, the future alignment of Fuling Zhuacai’s offerings with evolving market demands will determine its ability to thrive in an increasingly complex financial ecosystem.

Read These Next

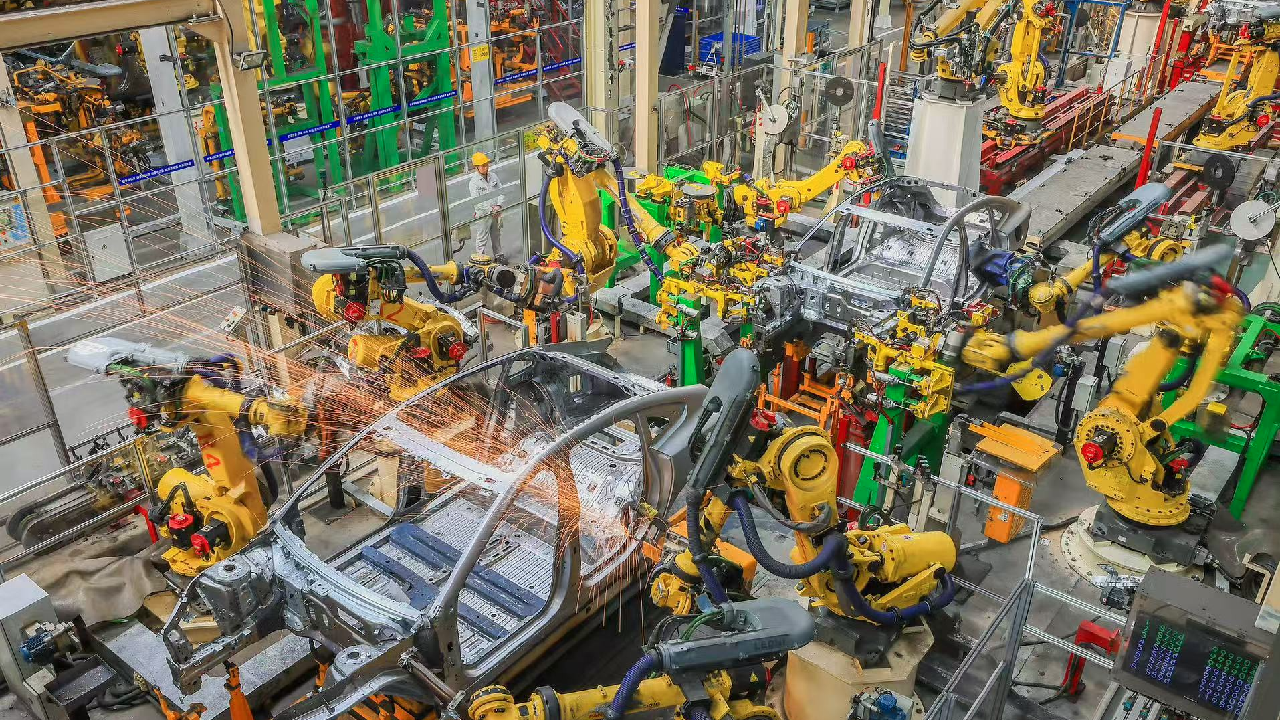

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.