Trump's Tip Tax Deduction: A Blow to Low-Income Workers?

The ongoing tax debate in the United States has recently illuminated significant intricacies tied to President Donald Trump's tax deduction focused on what has been termed the "necessity of tax-free tips." This provision, which allows certain workers to deduct up to $25,000 worth of qualified tips on their federal tax returns from 2025 to 2028, has been positioned as a tax break for working-class families. However, experts are raising critical questions regarding the actual beneficiaries of this policy, particularly concerning low-income households that constitute a sizeable portion of the workforce reliant on tipping.

The deduction's design restricts benefits to workers whose modified adjusted gross income surpasses $150,000 for single filers or $300,000 for couples. Such delineations inherently exclude many low-earning individuals from reaping any tangible benefits. Elena Patel of the Urban-Brookings Tax Policy Center starkly highlights this anomaly by pointing out, "Poorer households do not benefit from the tax-free tips because they do not pay federal income tax anyway." Given that over a third of tipped employees owed no taxes in 2021 due to their income levels, there is a palpable irony that a tax relief measure fails to address the needs of the very workers it purports to assist. This raises an essential question: Are we truly addressing income inequality, or merely offering a facade of support?

The implications of this tax policy become even more convoluted when the classification of who qualifies comes into play. Specific professions, particularly those identified as specified service trades or businesses (SSTB), may also find themselves ineligible for the tip deduction. As the Treasury Department and IRS compel further rule finalization, uncertainty prevails, leaving many workers in limbo about their eligibility status. For example, individuals in healthcare, performing arts, or financial services repeatedly receive tips but might not access this deduction. Such exclusions highlight potential unintended consequences that policymakers appear to overlook.

Historically, tax reforms have incited significant market adjustments, as seen in the aftermath of the 2008 financial crisis and the dot-com bubble, where tax implications and regulatory changes created turbulent conditions. Evaluating the current tax measure through this lens unveils deeper ramifications that could disrupt the equilibrium in the labor market in forthcoming years. If unaddressed, such policies risk exacerbating societal divisions while benefitting the already affluent.

Investors, businesses, and policymakers must remain attuned to these developments, as misunderstanding the demographic effects of such measures can lead to misguided strategies. As we look forward, the landscape of wage-earning and taxation may continue to evolve, and it would be judicious for all stakeholders to advocate for reforms that genuinely address income disparities across the board.

Read These Next

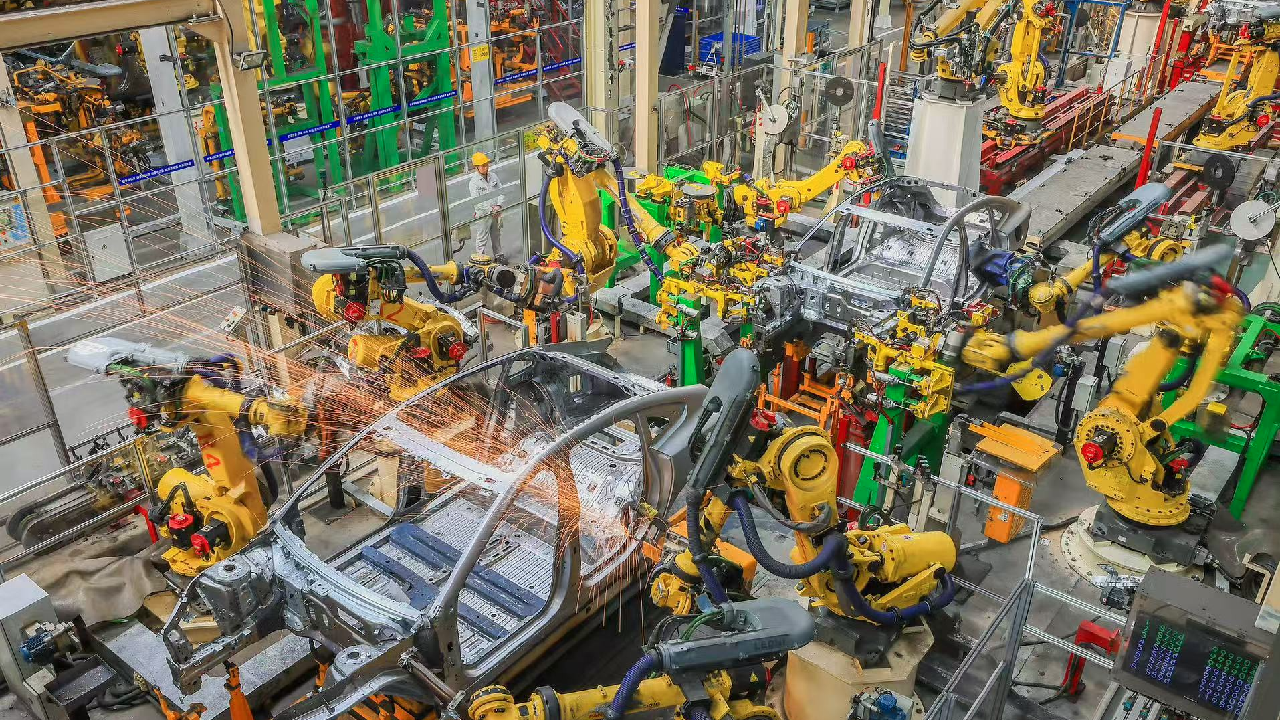

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.