US Economy Grows 4.3% in Q3, Surpassing Expectations

The recent release of the third-quarter Gross Domestic Product (GDP) data from the U.S. Commerce Department has sent ripples through the financial markets, revealing a remarkable annualized growth rate of 4.3%. This figure not only surpasses the expectations set by economists, who predicted a growth of approximately 3.2%, but also confirms a resilient economic recovery post-pandemic. Understanding the implications of this growth is critical for investors, consumers, and policymakers as the data reflects the evolving dynamics of the U.S. economy amid continued uncertainties.

The catalyst for this impressive 4.3% growth can primarily be traced back to robust consumer spending, which increased by 3.5% during the third quarter, up from 2.5% in the prior quarter. This surge in consumer activity underscores a significant rebound in household confidence, but it also raises questions about sustainability going forward. However, it is important to note that while overall growth appears strong, a slight decline in private investment could signal underlying weaknesses in business sentiment. As we have seen in previous economic cycles, such as the dot-com bubble, a dip in investment can foreshadow a slowdown if not addressed.

Furthermore, the report indicated that exports and government spending also played a role in contributing to this growth. With global demand showing signs of recovery, the uptick in exports by 8.8% is a notable highlight, suggesting a renewed competitiveness of U.S. goods in the international market. But as we analyze this data, one must ponder, is this growth sustainable in the face of rising inflationary pressures? The PCE price index increased by 2.8% from the previous quarter, with core inflation metrics also elevating beyond the Federal Reserve's targets. This volatility in inflation could compel policymakers to calibrate interest rates, thus affecting borrowing costs and investment decisions.

The implications of this growth extend into future economic indicators. If consumer spending continues to drive economic momentum, one can expect a moderate shift in monetary policy as the Federal Reserve weighs its options to either contain inflation or support growth. The mixed market response—with stock futures mildly declining—highlights a cautious sentiment among investors, suggesting that while growth is good, the specter of inflation and its possible impact on consumer spending cannot be ignored.

In conclusion, the 4.3% growth in the third quarter is undoubtedly a bright spot for the U.S. economy, signaling resilience and potential opportunities for investors. However, as history suggests, sustainable economic health requires more than just short-term growth; it necessitates an equilibrium between growth and inflation, proper investment levels, and consumer confidence across socio-economic divides. Investors must remain vigilant and prepared to adapt to the evolving landscape, keeping a keen eye on inflation indicators and consumer confidence levels that will dictate the economic trajectory moving forward.

Read These Next

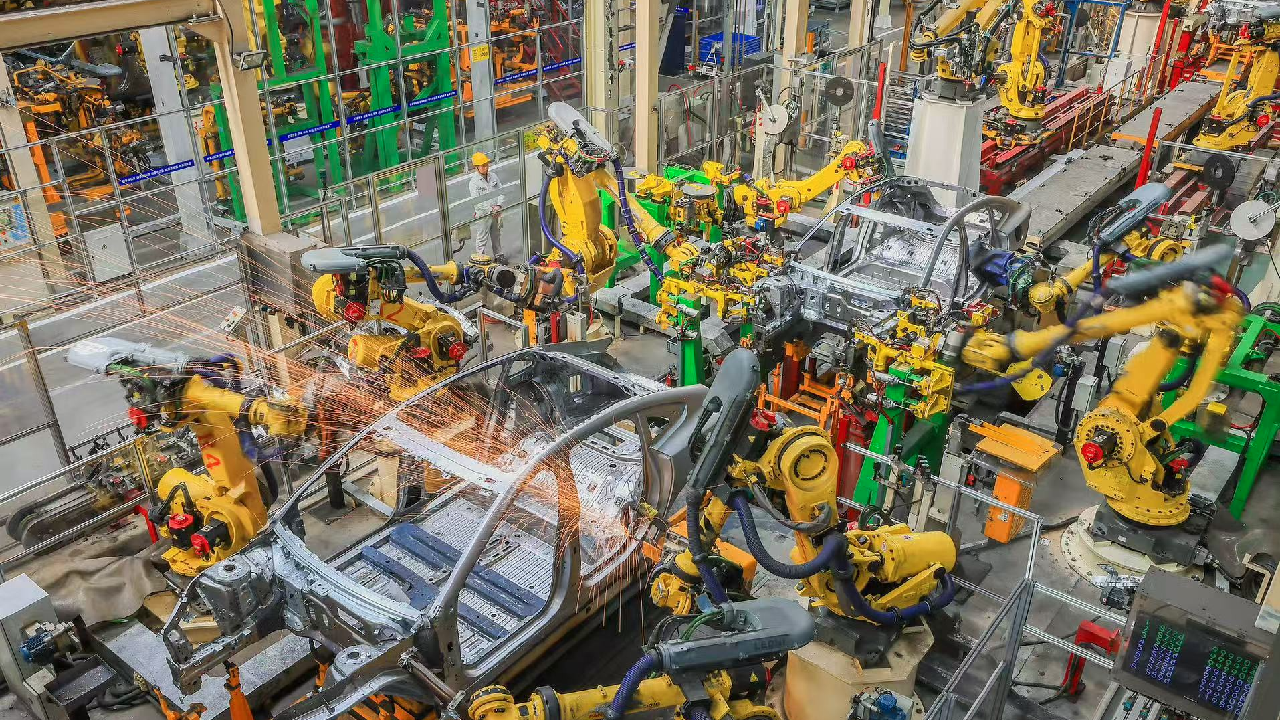

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.