Gold and Silver Rally: Future Prospects

The remarkable ascent of gold and silver prices has once again captured the attention of investment communities worldwide. With gold futures closing at $4,505.70 per ounce and also reaching record highs above $4,530.80, the performance has been nothing short of exceptional. Simultaneously, silver has risen dramatically, with spot prices surpassing the $70 mark for the first time—solidifying its status as a precious metal in high demand. The urgency of this rally is underscored by the pervasive sentiment of risk aversion, largely driven by fears about an inflated AI market and significant geopolitical uncertainties. As investors flock to these assets for protection against market volatility, awareness of these evolving dynamics will be essential.

Economic factors contributing to the surge are multifaceted. Firstly, persistent inflationary pressures have raised concerns over the devaluation of fiat currencies, motivating investors to pivot towards hard assets like gold and silver. Furthermore, as David Neuhauser, Investment Director at Livermore Partners, indicated, the current market is rife with apprehensions regarding escalating global debts, which add weight to the argument for holding precious metals. The commentary from Neuhauser serves as a reminder of the memories from past crises, where similar investor instincts materialized during high inflation periods, like those witnessed in the late 1970s and again during the 2008 financial crisis. The convergence of rising geopolitical tensions, such as the U.S. blockade of oil supplies and conflicts involving Ukraine, further amplifies the allure of these commodities.

From an investment standpoint, the current environment favors strategizing for portfolio diversification, particularly as gold and silver are perceived as robust hedges against inflation and economic instability. Investors might contemplate increasing their allocations to these metals, especially given economist forecasts. Neuhauser's remark on gold potentially reaching $6,000 per ounce illustrates the bullish sentiment prevalent among analysis circles, though it begs the question: will this possibility trigger speculative behavior akin to past market bubbles? Institutional investors should remain vigilant, linking micro-level movements in metal prices to macroeconomic trajectories. However, balancing optimism with caution is paramount, especially as the 2026 Federal Reserve leadership approaches—an event which could see monetary policies pivotal in shaping future market conditions.

Read These Next

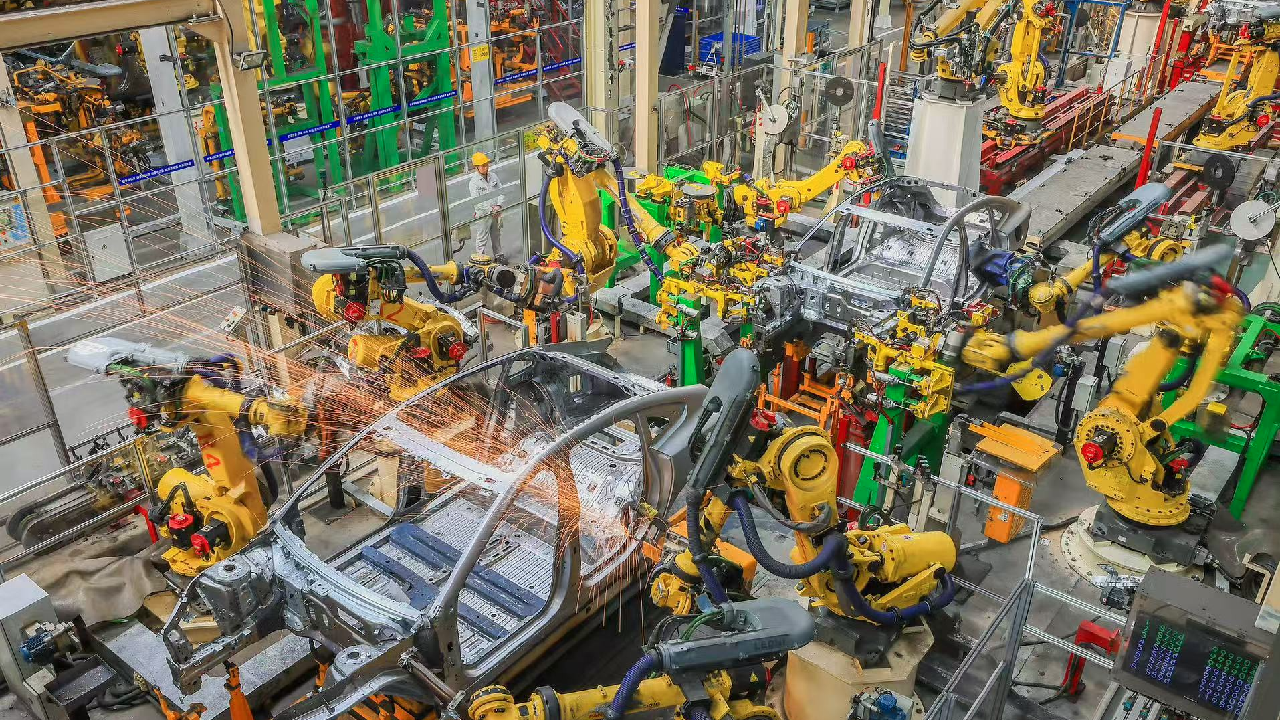

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.