Gold and Silver Prices Surge as Safe Haven Asset

The unprecedented rise in gold and silver prices over the past several weeks marks a significant moment for investors and economic stakeholders alike. On December 22, 2025, gold futures closed at $4,469.40 per ounce, already showing signs of a robust market after reporting a staggering 70% increase year-to-date. Silver, in a spectacular show of performance, soared to $68.98 per ounce, culminating in a 128% rise this year. This boom not only exemplifies heightened market volatility but also raises critical questions about the underlying economic conditions. What implications will these dynamic movements hold for the broader economic landscape, particularly regarding inflation and geopolitical tensions?

The ascendance of gold and silver prices can be cogently attributed to several intertwining factors, notably risk aversion among investors amidst escalating geopolitical instability and persistent economic uncertainty. The recently announced interest rate cuts by the Federal Reserve have exacerbated fears regarding future inflation and wobbly market conditions, propelling a flight towards safe-haven assets like gold. In a historical context, this anticipation mirrors behaviors seen during the 2008 financial crisis and periods during the dot-com bubble, when investors equally gravitated towards tangible assets following downturns and heightened uncertainties. The current climate reflects a re-emergence of gold's significance as a hedge against inflation, a role that some believe had been overshadowed by a longstanding bull market in equities.

However, it is critical to look beyond surface-level trends to consider the potential risks and unintended consequences of this gold rush. As analyst Jim Wyckoff highlighted, raw commodity markets are susceptible to cyclical boom and bust patterns. With gold and silver prices at record highs, new entrants into the market may face significant volatility and risk of loss should a correction occur. Moreover, a weakened U.S. dollar, which currently undermines traditional currency reserves, may lead to detrimental effects for international trade dynamics, as costs escalate for dollar-denominated commodities. Additionally, there is a growing concern regarding monetary policy coherence, particularly as political pressures mount for the Fed's leadership. The increasing fiscal deficits across major economies could exacerbate economic vulnerabilities, potentially thwarting any recovery should inflation breach target thresholds.

In conclusion, while the gold and silver surge in prices indicates a strong demand for tangible safety in uncertain times, it simultaneously highlights the fragility of economic recovery as we approach 2026. Institutional investors should closely scrutinize shifts in monetary policy as continued adaptation and uncertainty around fiscal prudence remain quintessential. The balance between risk and opportunity becomes increasingly fragile, calling for a judicious assessment of long-term investment strategies in precious metals. Will the current boom in gold and silver foster genuine stability or merely serve as a fleeting reaction to temporary instability? As investors and policymakers navigate this terrain, the intricate dance between market forces and economic cycles will be critical to shaping future trajectories.

Read These Next

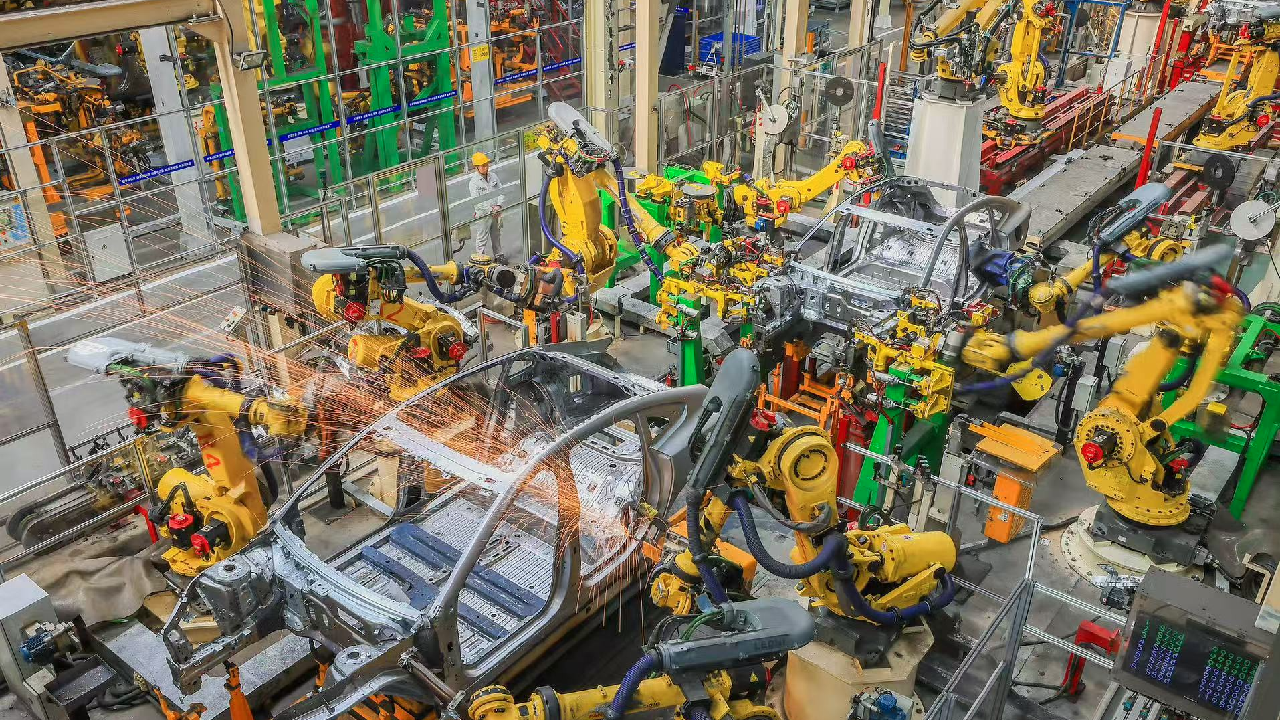

China's Industrial Profits Show Continued Growth in 2025

China's industrial profits stay positive despite a slight growth decline, indicating sector recovery and resilience.

Countries and Organizations Unite Against Israel's Somaliland Recognition

Several countries and organizations condemned Israel's recognition of Somaliland, citing threats to peace and breaches of international law.

Europe at a Crossroads: AI Competition vs. Climate Issues

Europe faces a pivotal choice of advancing in AI while meeting climate goals; existing regulations may hinder progress, leading to energy demands increasing rapidly, complicating their climate initiatives.