Public Fund Reform: Upgrading Assessment for Companies and Managers

In a significant stride toward enhancing the public fund landscape for nearly 800 million citizens, the recent reform initiative has ushered in the approval of 26 new floating rate products as of May 23. This moves aims not only to boost profitability but also to restore trust among investors in the public fund arena. The introduction of these innovative financial tools reflects a comprehensive effort to adapt to market conditions and respond to the needs of fund participants.

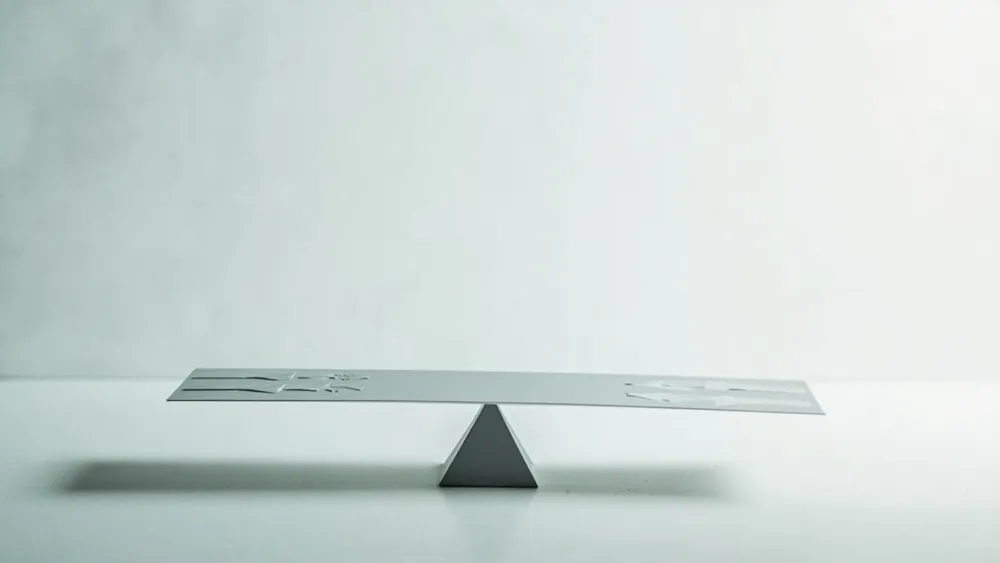

The reforms emphasize rigorous assessments of both companies and fund managers, focusing on improving performance metrics and accountability. By upgrading evaluation standards, the initiative aims to ensure that the interests of citizens are safeguarded, fostering greater transparency and efficiency in fund management. This pivotal change is expected to result in higher returns for investors while reinforcing confidence in public fund investments.

Read These Next

Goldman Sachs Launches New ETF for Downside Protection

Goldman Sachs' strategic acquisition of Innovator Capital Management signals a bold move into ETFs aimed at market downturn protection, tapping into growing investor demand for safety amid volatility. This commentary explores the implications and trends arising from their strategy.

Korean Air Sees Travel Surge to China with Shanghai Top Destination

Korean Air sees a rise in passengers to China, with Shanghai being popular due to China's visa exemption for South Koreans.

Fire at Wangxiangu Scenic Area in Jiangxi Shangrao Under Control

On Dec 13, 2025, a fire at Wangxiangu's scenic area in Jiangxi was controlled in 2 hours with no casualties; cause under investigation.