Public Fund Reform: Upgrading Assessment for Companies and Managers

In a significant stride toward enhancing the public fund landscape for nearly 800 million citizens, the recent reform initiative has ushered in the approval of 26 new floating rate products as of May 23. This moves aims not only to boost profitability but also to restore trust among investors in the public fund arena. The introduction of these innovative financial tools reflects a comprehensive effort to adapt to market conditions and respond to the needs of fund participants.

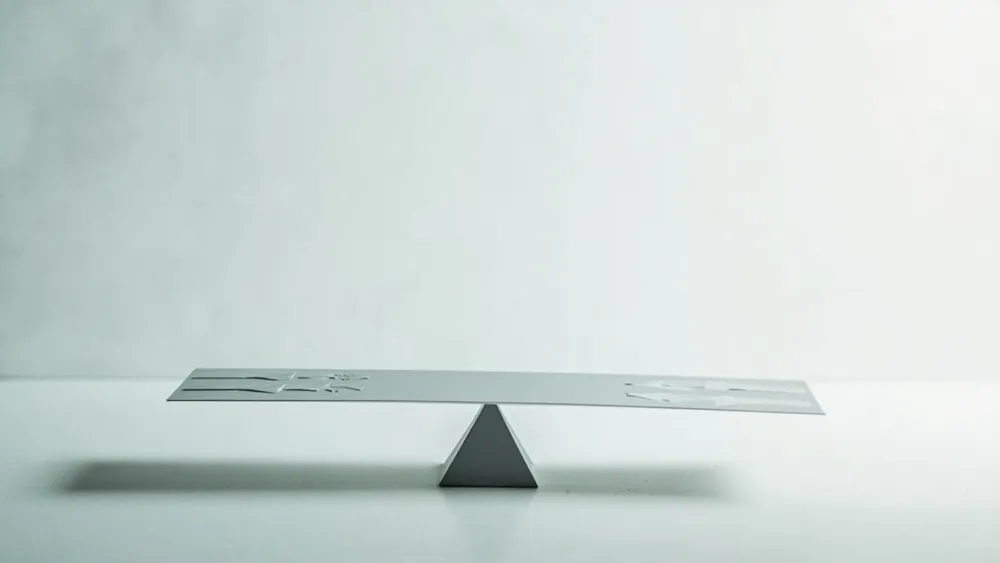

The reforms emphasize rigorous assessments of both companies and fund managers, focusing on improving performance metrics and accountability. By upgrading evaluation standards, the initiative aims to ensure that the interests of citizens are safeguarded, fostering greater transparency and efficiency in fund management. This pivotal change is expected to result in higher returns for investors while reinforcing confidence in public fund investments.

Read These Next

Impact of House GOP Bill's Historic Medicaid and SNAP Cuts on Benefits

Analysis of the implications of the House GOP tax bill, focusing on significant cuts to Medicaid and SNAP, their economic impact, and broader fiscal considerations.

Boeing, Justice Department reach deal to avoid prosecution over 737 Max crashes

Boeing's recent non-prosecution agreement with the Justice Department concerning its 737 Max crashes raises questions about corporate accountability, regulatory scrutiny, and the implications for aviation safety. This commentary delves into the operational, economic, and ethical ramifications of the deal, considering the perspectives of various stakeholders and the historical context of corporate governance failures.

State Internet Information Office to rectify online financial information chaos.

China is clamping down on false online financial info to protect investors and maintain market order, boosting investment safety awareness.