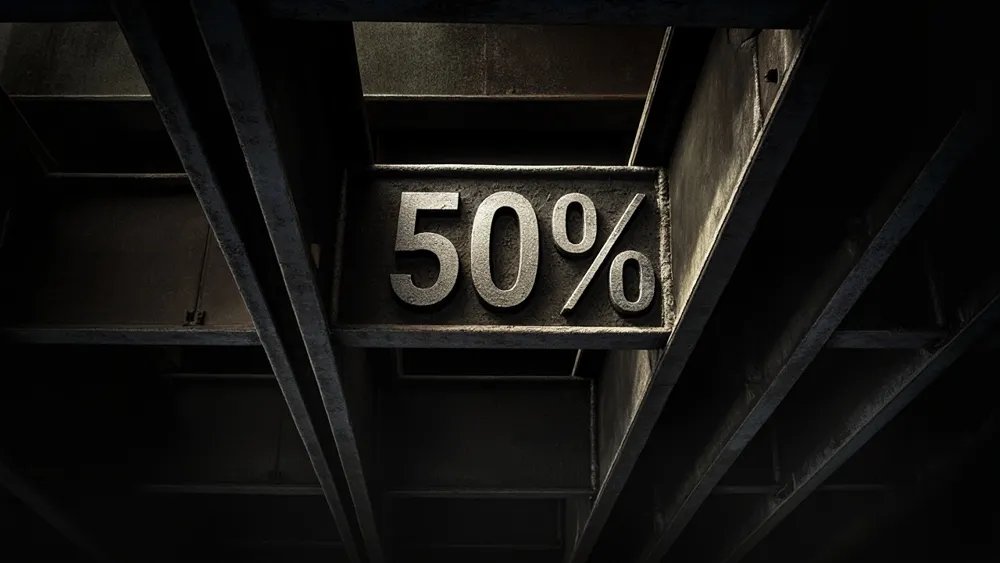

Trump Raises Steel Tariffs to 50%

In a significant move to bolster the domestic manufacturing sector, President Trump has announced an increase in tariffs on imported steel to 50%, effective June 4. This decision is aimed at protecting U.S. steel producers from foreign competition, particularly as concerns regarding market fairness and international trade practices continue to rise. By imposing these elevated tariffs, the administration seeks to stimulate local industry and safeguard jobs in a sector that has faced challenges from cheaper steel imports.

The implications of this tariff hike are multifaceted, potentially impacting various stakeholders in the economy. Domestic steel producers may benefit from reduced competition, allowing them to increase production and potentially expand their workforce. However, higher tariffs could lead to increased costs for industries reliant on steel, such as construction and automotive manufacturing. Consumers might also feel the effects through higher prices for products that require steel, thereby creating a ripple effect across the economy that warrants close monitoring.

Read These Next

Federal Reserve Officials Express Optimism About Monetary Policy

Fed's Mary Daly finds price recovery comforting but acknowledges complexities; stresses timely monetary policy for economic boost.

China's April auto product import and export volume reaches US$23.09 billion

In April 2025, China's auto import/export volume hit $23.09B, up 6.8%, signaling recovery amid market competition and demand.

U.S. foreign tax bill sparks jitters on Wall Street

The article discusses the implications of President Trump's proposed "One Big Beautiful Bill Act" which could significantly alter the U.S. tax treatment of foreign capital, potentially escalating trade conflicts into a capital war and impacting international investments.