Citi raises gold target price to $3,500/ounce for 0-3 months

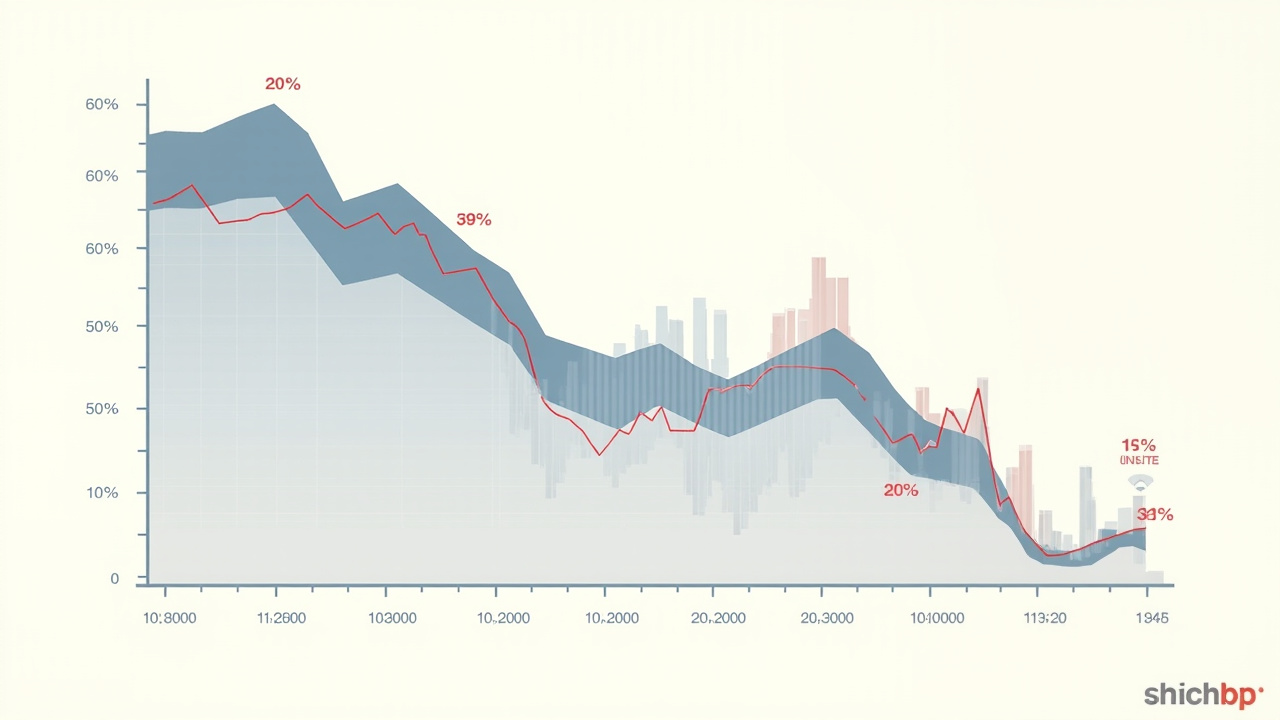

Citibank has made a significant revision to its gold price forecast, raising the target price to $3,500 per ounce for the next zero to three months. This adjustment comes amid a period of fluctuating prices, suggesting that investors can expect a consolidation phase between $3,100 and $3,500. Such an upward revision indicates both confidence in the precious metal's resilience and a pivotal moment for investors looking to capitalize on potential gains.

The implications of this adjusted target price are substantial. A price consolidation at this level could galvanize interest from both retail and institutional investors, turning gold into a more attractive asset amid ongoing economic uncertainties. With geopolitical tensions and inflationary pressures playing a prominent role in the markets, gold's status as a safe-haven investment is likely to be reinforced, making Citibank’s forecast a key point of consideration for market participants.

Read These Next

Chinese Economy Faces Decline in Q2 2025: Ongoing Downward Trend Revealed

China's economy faces pressure in Q2 2025, with falling consumer spending and investment, prompting calls for reforms.

China's Regulator Seeks Public Feedback on Draft Guidelines for Platform Fees

China's regulator is consulting on new guidelines to regulate online transaction fees, promoting fairness and consumer protection.

Battery-grade lithium carbonate price hits 61,950 yuan/ton

Battery-grade lithium carbonate price drops to 61,950 yuan/ton, affecting NEV industry amid supply-demand dynamics.