Japanese 40-Year Treasury Bond Yield Rises 8 Basis Points Ahead of Auction

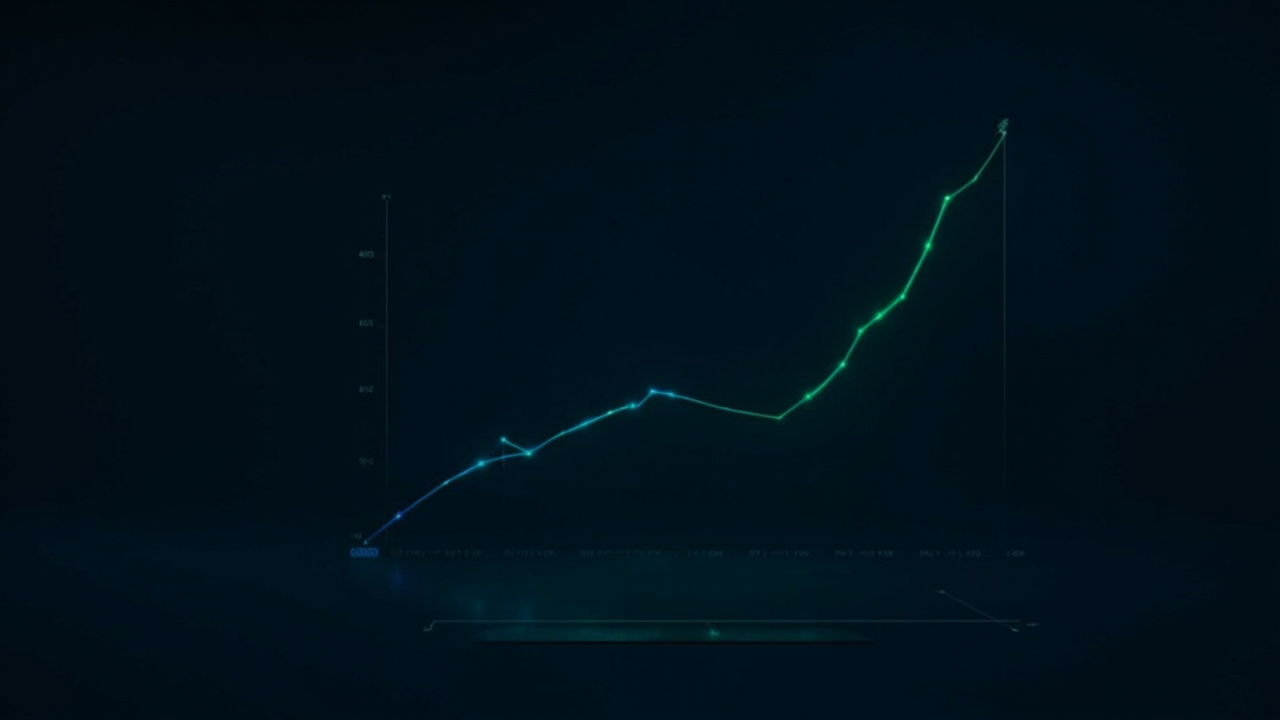

In a notable movement within the Japanese bond market, the yield on the 40-year treasury bond increased by 8 basis points just ahead of the upcoming auction. This rise is indicative of shifting investor sentiments, particularly in the context of prevailing global economic uncertainty. The bond auction, which typically garners significant attention from both domestic and international investors, will serve as a crucial indicator of demand for long-term Japanese government debt.

The uptick in yields suggests that investors may be reassessing their risk perceptions as they navigate through a climate marked by geopolitical tensions and fluctuating economic conditions. With yields responding to these external pressures, market analysts will be closely monitoring how the bond auction plays out and its implications for Japan's monetary policy. This auction will not only reflect current market sentiment but could also shape future investment strategies as global uncertainties continue to unfold.

Read These Next

China's Growth Momentum Affirmed by Agency

Economists are optimistic about China's growth, citing effective policies stabilizing markets despite external pressures.

Zhou Dasheng Jewelry Co., Ltd.: Navigating Transformation and Growth in the Jewelry Market

This article analyzes Zhou Dasheng Jewelry Co., Ltd.'s recent investor relations highlights, covering its brand transformation, financial outlook, and associated risks.

April Profit Rise for Major Industrial Firms, Reports NBS

China's major industrial companies see profit growth, especially in high-tech, signaling economic recovery and government support.